Celanese (CE) to Report Q3 Earnings: What's in the Offing?

Celanese Corporation CE is set to release third-quarter 2023 results after the bell on Nov 6.

The company missed the Zacks Consensus Estimate for earnings in three of the last four quarters and beat once. It has a trailing four-quarter earnings surprise of around 0.2% on average. It posted a negative earnings surprise of 11.8% in the last reported quarter.

In the third quarter, Celanese might have encountered challenges due to weak demand and consumer destocking. However, the company is expected to have benefited from its cost and pricing actions and the positive impact of its acquisitions.

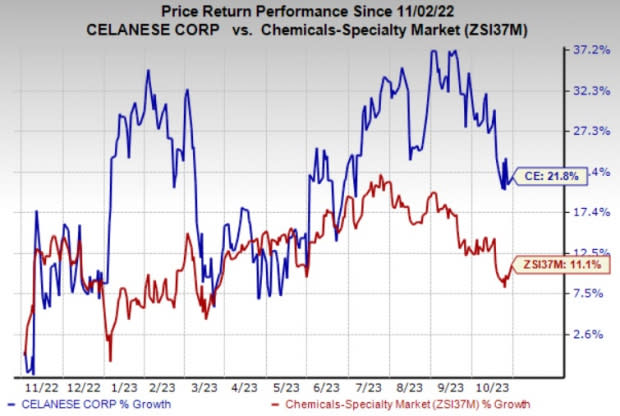

Celanese’s shares have gained 21.8% in a year compared with its industry’s 11.1% rise.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for this announcement.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter sales is currently pegged at $2,757.1 million, which suggests a rise of 19.8% from the year-ago reported number.

Our estimate for CE's Engineered Materials segment net sales stands at $1,461.6 million for the third quarter, indicating a year-over-year increase of 57.3%. The same for the Acetyl Chain segment is pegged at $1,278.3 million, suggesting a decline of 8.5% year over year.

Some Factors at Play

Celanese is expected to have benefited from its cost and productivity initiatives, strategic investments in high-return organic projects and the synergies derived from acquisitions in the third quarter.

The company continues to actively pursue acquisitions, which are providing opportunities for additional growth, investment and synergies. The benefits of acquisitions are expected to reflect on its third-quarter performance. The M&M acquisition is expected to have contributed to the company’s operating EBITDA. CE’s price increase actions are also likely to have supported margins in the quarter.

Moreover, Celanese is proactively implementing strategic initiatives recognizing the volatility and unpredictability of the current market landscape and competitive environment. These actions involve strengthening its commercial teams, aligning production and inventory levels with prevailing demand, implementing cost-saving measures, and optimizing cash flow. The benefits of these actions are expected to reflect on the company’s third-quarter results.

However, the company is likely to have faced headwinds from demand softness and customer destocking in certain end markets in the quarter to be reported. It witnessed weak demand in several end markets and continued customer destocking in the second quarter of 2023.

Soft demand has led to inventory reduction and deferral of orders by the company’s customers. Celanese is seeing weaker demand in industrial and electrical & electronics end markets. Weaker demand recovery globally and destocking are likely to continue to have weighed on the company’s volumes in the third quarter.

Celanese Corporation Price and EPS Surprise

Celanese Corporation price-eps-surprise | Celanese Corporation Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for Celanese this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Celanese is -0.21%. The Zacks Consensus Estimate for earnings for the third quarter is currently pegged at $2.20. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Celanese currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

IAMGOLD Corporation IAG, which is scheduled to release earnings on Nov 9, has an Earnings ESP of +10.71% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for IAG for the third quarter is currently pegged at a loss of 3 cents.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +2.96%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 10 cents. KGC currently carries a Zacks Rank #3.

Innospec Inc. IOSP, scheduled to release earnings on Nov 7, has an Earnings ESP of +1.73% and carries a Zacks Rank #3.

The consensus estimate for IOSP’s earnings for the third quarter is currently pegged at $1.45.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Iamgold Corporation (IAG) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report