Is Celanese (CE) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

As value-focused investors continually seek stocks priced below their intrinsic value, Celanese Corp (NYSE:CE) has emerged as a potential candidate. With a current price of 121.54, the stock recorded a gain of 2.82% in a day and a 3-month increase of 13.81%. However, its GF Value is estimated at $198.69, indicating a possible undervaluation.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock, derived from a unique method that takes into account historical multiples, GuruFocus adjustment factor, and future business performance estimates. It provides an overview of the fair value that the stock should be traded at. However, if the stock price significantly deviates from the GF Value Line, it may indicate overvaluation or undervaluation, affecting its future return.

Assessing the Risks: Celanese's Low Altman Z-Score

While Celanese (NYSE:CE) appears to be an attractive investment based on its GF Value, it's essential to consider its associated risks. These risks are primarily reflected through its low Altman Z-score of 1.69. This score suggests that Celanese, despite its apparent undervaluation, might be a potential value trap, emphasizing the importance of thorough due diligence in investment decision-making.

Decoding the Altman Z-Score

The Altman Z-score is a financial model predicting the probability of a company entering bankruptcy within a two-year time frame. It combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Company Snapshot: Celanese Corp (NYSE:CE)

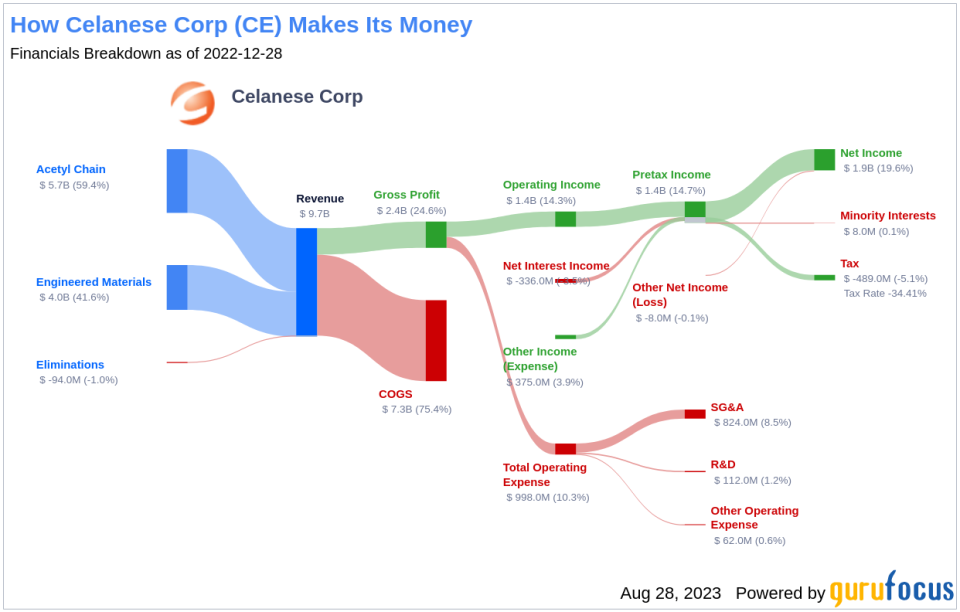

Celanese is one of the world's largest producers of acetic acid and its downstream derivative chemicals, which are used in various end markets, including coatings and adhesives. The company also produces specialty polymers used in the automotive, electronics, medical, and consumer end markets as well as cellulose derivatives used in cigarette filters. Despite its robust business operations, the company's stock price is still below its estimated GF Value.

Dissecting Celanese's Low Altman Z-Score

An analysis of Celanese's Altman Z-score reveals potential financial distress. The EBIT to Total Assets ratio, a crucial barometer of a company's operational effectiveness, has shown a decreasing trend over the years (2021: 0.27; 2022: 0.20; 2023: 0.05). This decrease suggests that Celanese might not be utilizing its assets to generate operational profits, negatively affecting its overall Z-score.

Conclusion: Navigating the Value Trap

In conclusion, despite its seemingly attractive price, Celanese (NYSE:CE) presents potential risks that could classify it as a value trap. It's essential for investors to conduct a thorough analysis beyond the GF Value, considering factors like the Altman Z-Score. GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .

This article first appeared on GuruFocus.