Celsius Holdings Has Upside Potential Following Meteoric Share Price Rise

Celsius Holdings Inc. (NASDAQ:CELH) has emerged as one of the U.S. stock market's top performers over the past decade. Its share price has soared from 26 cents in February 2014 to $64.50 at the time of writing, generating an impressive return of nearly 21,910% or an annualized compounded return of 72.3% over the last 10 years.

Despite the recent rapid increase in its share price, I maintain an optimistic outlook for Celsius' long-term potential upside. This optimism is based on the company's high growth potential and its ability to improve its operating profitability going forward.

Business overview

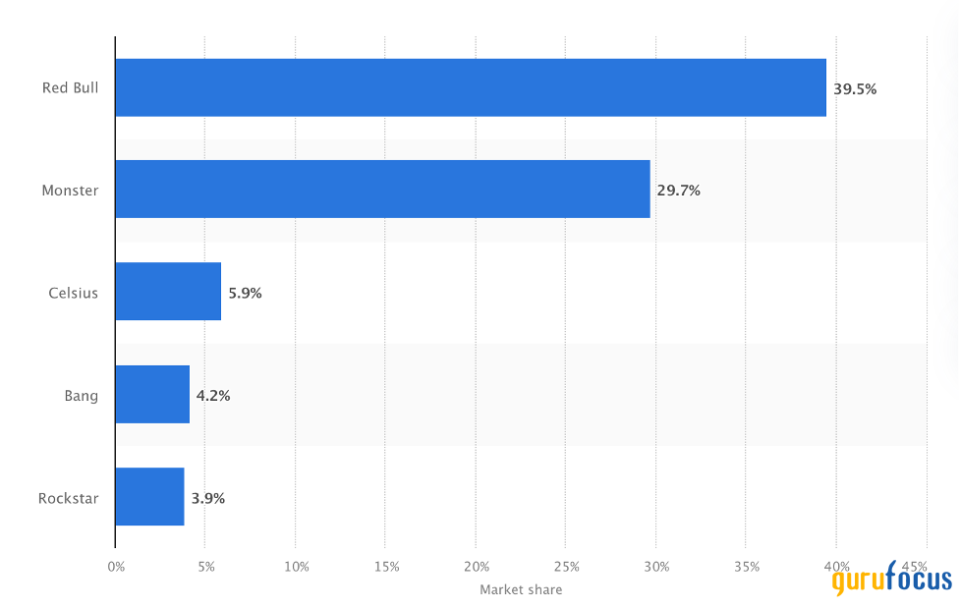

Celsius is the manufacturer and distributor of functional energy drinks and protein bars. Its flagship product, CELSIUS, an energy drink that provides energy while burning calories and body fat. The company's products are distributed through various channels, including convenience stores, mass market, fitness and e-commerce. Celsius ranks as the third-largest player in the U.S. energy drink market, holding a 5.90% market share. It follows Red Bull and Monster (NASDAQ:MNST), which hold market shares of 39.50% and 29.70%.

Source: Statista

Celsius derives its revenue from three main customers. PepsiCo (NASDAQ:PEP) is the largest one, accounting for 22% of the total revenue in 2022. Costco (NASDAQ:COST) ranked second, representing 16.7% of total sales. Amazon (NASDAQ:AMZN) stood in third place with 8.80% of the revenue. These leading customers are main distributors of Celsius' products, giving consumers considerable confidence in the brand.

Notably, PepsiCo has become the primary distributor for Celsius products in the U.S since August 2022. It also invested $550 million in Celsius' convertible preferred stock, further strengthening the bond between the two companies. I consider the agreement with PepsiCo as a game changer. As PepsiCo is the globally recognized brand with world-wide distribution channels, the deal with PepsiCo opens the door for Celsius to unlimited growth opportunities in both U.S. and international markets.

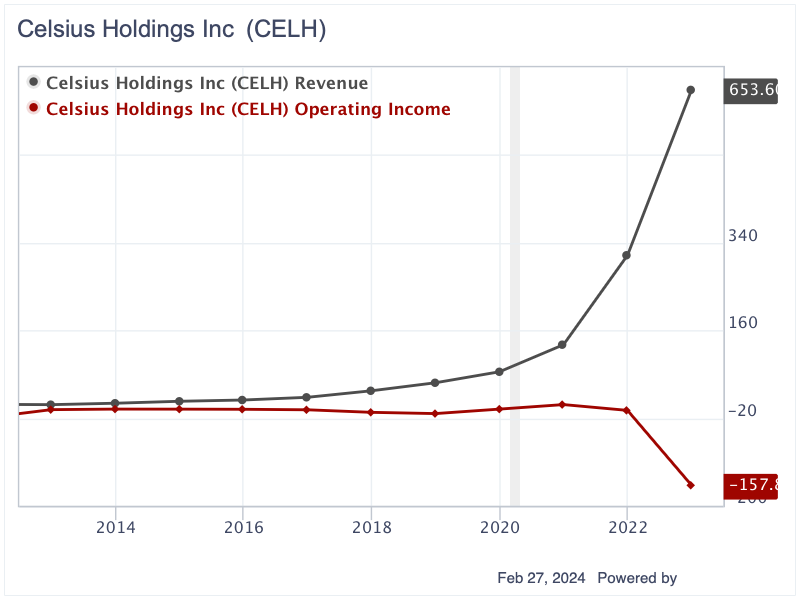

Superb revenue growth with dismal operating profitability

Celsius has managed to grow its revenue every single year for the past 10 years. Remarkably, its revenue soared 85-fold, climbing from $7.68 million in 2012 to $653.60 million in 2022. This growth translates to an impressive annual compounded growth rate of 56%. Despite this substantial revenue growth, the company recorded operating losses in nine out of the last 10 years. The only profitable year was 2020, where it posted operating profits of $7.83 million. In 2022, its operating income plummeted to a loss of nearly $158 million.

The significant operating losses in 2022 can be attributed to a substantial rise in selling and marketing expenses. While revenue more than doubled from $314.30 million in 2021 to $653.60 million in 2022, selling and marketing expenses surged nearly fivefold from $74 million to $353 million in just one year.

A closer examination reveals the selling and marketing expenses for 2022 included $194 million in termination fees paid to previous distributors as part of transitioning to Pepsi to become its primary distributor in the U.S. This expense is one-time, not recurring. After adjusting for these termination expenses, the adjusted selling and marketing costs would be $159 million only.

It is positive that Celsius has achieved significant operating profits during the first nine months of 2023. During this period, the company reported revenue of $970.60 million and operating profits of $207.40 million, resulting in a substantial operating margin of 21.40%.

Debt-free balance sheet

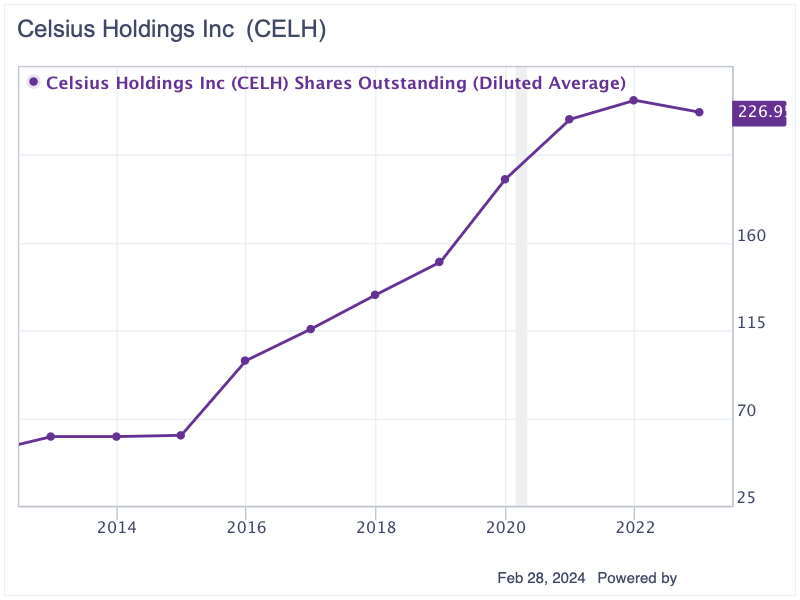

Celsius has a debt-free balance sheet. As of September, the company holds $760 million in cash and has a shareholders' equity of $213.40 million, with no interest-bearing debt at all. This strong financial position allows Celsius significant flexibility to invest in future growth and expand into international markets. However, maintaining a debt-free balance sheet has come at a cost, specifically in the form of an increasing share count, which leads to the dilution of shareholders' equity. The total number of diluted shares has increased from 60.55 million in 2012 to nearly 227 million in 2022.

Potential upside

From 2018 to mid-2020, the company's enterprise value-to-revenue ratio consistently remained lower than its larger competitor, Monster Beverage. However, since August 2020, its sales multiples has risen rapidly. At the time of writing, Celsius is trading at 12.40 times its sales, while Monster Beverage is trading at 8 times revenue.

The higher valuation of Celsius can be justified by its significantly higher revenue growth compared to Monster Beverage. Since 2020, Celsius has experienced annual revenue growth ranging from 50% to 130%, much higher than Monster Beverage's, which experienced sales increase in the range of only 12% to 20%.

Assuming Celsius maintains its historical revenue growth rate of 56% over the next five years, its revenue is projected to reach $12 billion by 2028. If Celsius' operating margin stays at 21%, its operating earnings will be $2.52 billion in 2028. With an earnings multiple of 30, Celsius' enterprise value will be $75.6 billion by 2028. Using a 10% discount rate, the estimated value of Celsius stands at $47 billion. Assuming the company issues 50% more shares over the next five years to fund for its business expansion and acquisitions, the total diluted share count is expected to reach 340 million. Thus, Celsius should be worth $138 per share, 114% higher than its current share price.

Conclusion

Celsius Holdings showcases phenomenal business growth, evidenced by its substantial revenue growth and a strong, debt-free balance sheet, emphasizing its financial health. The company's strategic partnership with PepsiCo for the U.S. and international expansion highlights the business' immense potential. Combined with an improving operating margin, Celsius represents a compelling investment opportunity with solid fundamentals and substantial potential upside.

This article first appeared on GuruFocus.