Centene (CNC), Pearl Health Unite to Enhance Value-Based Care

Centene Corporation’s CNC Medicare brand, Wellcare, recently announced its partnership with a startup, Pearl Health, to enhance value-based care services. This multi-year partnership will enable financial risk sharing, thereby allowing both companies to collaborate on innovative initiatives such as value-based care models.

This move bodes well for Centene’s Medicare Advantage members, as overall healthcare costs will be reduced as a result of this collaboration. Pearl Health’s provider enablement technology, coupled with CNC’s care delivery model, will make it easier for clinical teams to offer the customized treatment needed in value-based care. Pearl Health will offer financial tools, data insights and a plethora of value-based care services to improve the quality of value-based care. This program is currently live in South Carolina, and Centene aims to expand this service worldwide in the future. This will aid primary care physicians looking to transition more members to value-based care arrangements.

Although Medicare Advantage represents only a $16 billion revenue stream for CNC, it represents a big opportunity for margin expansion. Centene aims to leverage from duals expansion, improvement in star ratings and network synergies. CNC expects Medicare to grow at a CAGR of 7% by 2033. Moreover, people aged 65+ will grow in population in the coming years, thus benefiting this business. Centene aims to expand its Medicare business with a focus on quality. Thus, this partnership is a time opportune move.

In February 2024, the U.S. Centers for Medicare and Medicaid Services (“CMS”) proposed a 2.3% decline in reimbursement rate against 5% growth in 2023. Moreover, CMS also cut star rating for CNC’s Medicare Advantage plans. Hence, CNC’s aim to control costs and improve its star rating should help it revive its Medicare Advantage business in the coming days.

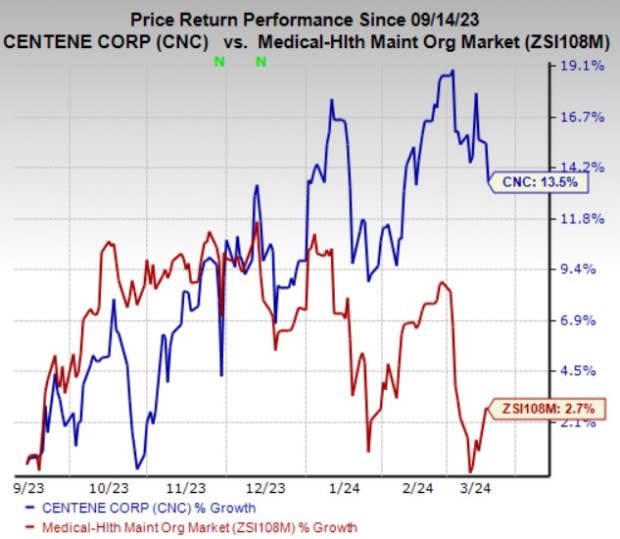

Shares of Centene have rallied 13.5% in the past six months compared with the industry’s 2.7% growth. CNC currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Medical space are Organon & Co. OGN, The Ensign Group, Inc. ENSG and Chemed Corporation CHE. While Organon currently sports a Zacks Rank #1 (Strong Buy), Ensign Group and Chemed carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Organon’s earnings surpassed the Zacks Consensus Estimate in two of the last four quarters and missed the mark twice, the average surprise being 5%. The Zacks Consensus Estimate for OGN’s earnings indicates a rise of 3.6%, while the consensus mark for revenues suggests an improvement of 1% from the corresponding year-ago reported figures.

The consensus estimate for OGN’s 2024 earnings has moved 2.1% north in the past 30 days. Shares of Organon have gained 26.7% year to date.

Ensign Group’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 1.7%. The Zacks Consensus Estimate for ENSG’s 2024 earnings indicates a rise of 12.2% from the year-ago reported figure. The consensus mark for revenues indicates growth of 11.2% from the year-ago reported figure.

The consensus estimate for ENSG’s 2024 earnings has moved 0.6% north in the past thirty days. Shares of Ensign Group have gained 11.1% year to date.

Chemed’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed the mark twice, the average surprise being 1.1%. The Zacks Consensus Estimate for CHE’s 2024 earnings indicates a rise of 15.1%, while the consensus mark for revenues suggests an improvement of 5.2% from the corresponding year-ago reported figures.

The Zacks Consensus Estimate for CHE’s 2024 earnings has moved 1.9% north in the past 30 days. Shares of Chemed have rallied 10.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Centene Corporation (CNC) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

Organon & Co. (OGN) : Free Stock Analysis Report