Centene (CNC) Unveils its 2024 Projections: Key Takeaways

Centene Corporation CNC revealed its 2024 outlook at an investor event, reaffirming its 2023 guidance. Emphasizing improving profitability, the company expressed its intent to enhance the repurchase program. The stock surged 2.8% yesterday following the better-than-expected bottom-line guidance.

2023 Guidance Reaffirmed

The company continues to expect premium and service revenues within $137.5-$139.5 billion, up from the 2022 figure of $135.5 billion. Adjusted EPS is projected to be at least $6.60, suggesting a significant improvement from the 2022 reported figure of $5.78. The Zacks Consensus Estimate for the same is currently pegged at $6.66 per share. The company also reiterated its HBR guidance in the band of 87.1-87.7%.

2024 Outlook

Centene expects total revenues within $142.5-$145.5 billion, lower than the 2023 expected figure of $149-$151 billion. The company estimates premium and service revenues to be in the $132-$135 billion range, also lower than the 2023 guided range. Factors contributing to the year-over-year decline may include Medicaid redeterminations and the reduction of specific Medicare Advantage products. This decline will be partially offset by certain contract wins.

Centene's 2024 adjusted EPS is projected to exceed $6.70, indicating growth from 2023 estimates despite a decline in revenues. This underscores positive operational momentum. The 2024 adjusted EPS guidance surpasses the Zacks Consensus Estimate of $6.68 per share. CEO Sarah London expects adjusted profit to achieve an average annual growth of 12-15% over the long term, as reported by Reuters.

Centene expects the health benefits ratio to be within 87.3-87.9% in 2024, signaling a deterioration from the 2023 estimated range. The company also estimates the adjusted SG&A expense ratio to be in the 8.4-9% range. It projects the adjusted effective tax rate to be within 24.1-25.1%.

Diluted shares outstanding for 2024 are expected at 522.2-525.2 million. The board has authorized a new $4 billion additional fund for the share buyback program, which had around $1.2 billion left.

Price Performance

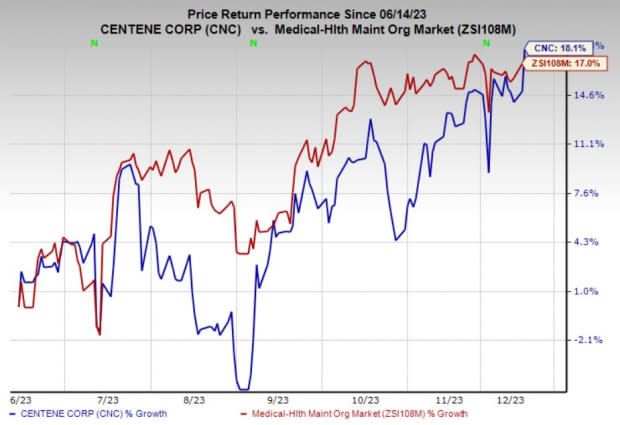

Centene’s shares have gained 18.1% in the past six months compared with the industry’s 17% rise.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Centene currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the broader medical space are HealthEquity, Inc. HQY, Enovis Corporation ENOV and Motus GI Holdings, Inc. MOTS, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for HealthEquity’s current-year earnings is pegged at $2.8 per share, indicating 52.9% year-over-year growth. HQY has witnessed four upward estimate revisions in the past week against none in the opposite direction. It beat earnings estimates in all the past four quarters, with an average surprise of 16.5%.

The Zacks Consensus Estimate for Enovis’ current-year earnings implies a 4.9% increase from the year-ago reported figure. The consensus mark for its current-year revenues is pegged at $1.7 billion. ENOV beat earnings estimates in all the last four quarters, with an average surprise of 11%.

The Zacks Consensus Estimate for Motus GI’s 2023 bottom line suggests a 67.2% year-over-year improvement. MOTS has witnessed one upward estimate revision over the past 30 days against no movement in the opposite direction. It beat earnings estimates in all the last four quarters, with an average surprise of 40.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Centene Corporation (CNC) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Motus GI Holdings, Inc. (MOTS) : Free Stock Analysis Report

Enovis Corporation (ENOV) : Free Stock Analysis Report