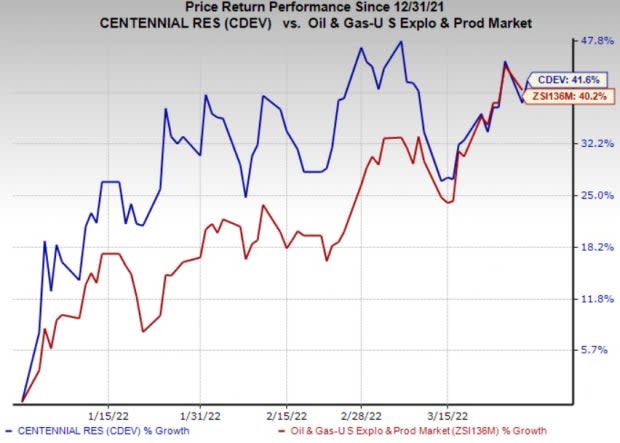

Centennial (CDEV) Stock Jumps 41.6% YTD: More Room to Run?

Shares of Centennial Resource Development, Inc. CDEV have jumped 41.6% year to date (YTD) compared with the industry’s 40.2% growth. In 2022 and 2023, the Zacks Rank #2 (Buy) stock is likely to see year-over-year earnings growth of 98.6% and 2.9%, respectively.

Image Source: Zacks Investment Research

Let’s delve into the factors behind the stock’s price appreciation.

What’s Favoring the Stock?

The price of West Texas Intermediate crude, which is trading above $100 per barrel, has improved drastically in the past year. The commodity price shot up, primarily due to the escalation of Russian attacks on Ukraine.

High oil price is beneficial for Centennial Resource since the company is a leading oil producer having a strong footprint in the Delaware Basin – a sub-basin of Permian (the most prolific basin in the United States). In the Delaware Basin, Centennial Resource’s operations spread across roughly 73,500 net acres, having roughly 15 years of economic drilling inventory. This reflects Centennial Resource’s strong production outlook.

Centennial Resource is focused on strengthening its balance sheet and returning capital to shareholders. Centennial Resource anticipates a further reduction in its reliability on debt capital this year. Moreover, Centennial Resource has received authorization from its board of directors to repurchase $350 million worth of shares over a span of two years.

It seems the outlook for CDEV’s upstream business is bright and there is plenty of room for further price appreciation.

Other Stocks to Consider

Other prospective players in the energy space are Devon Energy Corporation DVN, Viper Energy Partners LP VNOM and Matador Resources Company MTDR. While Devon Energy and Viper Energy Partners sport a Zacks Rank #1 (Strong Buy), Matador Resources carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the United States, Devon Energy is a leading upstream player with a strong footprint in the prolific Delaware Basin. Devon Energy is also focused on returning capital to shareholders.

In the past seven days, Devon Energy has witnessed upward earnings estimate revisions for 2022.

In the prolific Permian and Eagle Ford shale play, Viper Energy has a net of 27,027 royalty acres. Operations in those undeveloped assets require zero capital requirement. This secures sustainable free cashflow for Viper Energy.

In the past seven days, Viper Energy has witnessed upward earnings estimate revisions for 2022.

Rising oil prices are a boon for Matador’s upstream operations. This is because Matador has a strong footprint in the prolific Delaware Basin.

In the past 30 days, Matador has witnessed upward earnings estimate revisions for 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Viper Energy Partners LP (VNOM) : Free Stock Analysis Report

Centennial Resource Development (CDEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research