CenterPoint (CNP) Rewards Shareholders With a 5.3% Dividend Hike

CenterPoint Energy, Inc. CNP recently announced that its board of directors has approved a hike in its quarterly dividend to 20 cents per share, reflecting an increase of 5.3% from the prior payout.

With the current hike, the company will now pay out an annual dividend of 80 cents per share. This represents an annual dividend yield of 2.99% based on its share price worth $26.70 as of Sep 28, 2023. CNP’s current annualized dividend yield is less than the industry’s yield of 3.74% but higher than the Zacks S&P 500 composite’s yield of 1.50%.

This signifies CenterPoint’s strength in the business to generate enough cash flow to reward shareholders with improved dividend payouts.

Can CenterPoint Sustain Dividend Hikes?

Dividend hikes are backed by a company’s financial strength and ability to generate enough cash to reward shareholders with impressive returns. CenterPoint had cash and cash equivalents of $214 million as of Jun 30, 2023, up from $74 million on Dec 31, 2022.

In the days ahead, the company expects to generate adjusted EPS in the range of $1.48-$1.50 in 2023, which implies growth of 7.2%-8.7% from the prior-year reported figure. CenterPoint also projects the long-term EPS growth rate in the range of 6-8% through 2030, which reinforces the company’s financial prowess through strong earnings and its ability for enhanced dividend disbursements.

A company’s planned capital expenditure to improve the business outcome and enhance operational efficiency assists it in generating healthy returns. In this regard, CenterPoint currently anticipates spending capital worth $43.4 billion over the next decade, which should amplify its business strength and improve its earnings. This should enable CNP to sustain dividend hikes, like the latest one.

Peer Moves

Stability in cash flows allows utilities to consistently pay as well as increase dividends for investors to maintain a consistent dividend growth policy. Apart from CenterPoint, other utility stocks that can be a good choice for income-seeking investors due to their impressive dividend yields are as follows:

CMS Energy Corporation CMS: In February 2023, CMS Energy approved a hike in its quarterly dividend to 48.75 cents per share, reflecting an increase of 6% from the prior payout.

CMS Energy boasts a long-term earnings growth rate of 7.8%. The Zacks Consensus Estimate for 2023 earnings implies a growth rate of 7.3% from the prior-year reported figure.

Ameren Corporation’s AEE: In February 2023, Ameren announced that its board of directors approved a hike in its quarterly dividend to 63 cents per share, reflecting an increase of 7% from the prior payout.

AEE has a long-term earnings growth rate of 6.4%. The Zacks Consensus Estimate for 2023 earnings calls for a growth rate of 5.6% from the prior-year reported figure.

Duke Energy Corporation DUK: In July 2023, Duke Energy announced that its board of directors approved a hike in its quarterly dividend to $1.025 per share, reflecting an increase of 2% from the prior payout.

DUK’s long-term earnings growth rate is projected at 6.1%. The estimated figure for Duke Energy’s 2023 earnings suggests a growth rate of 6.3% from the prior-year reported figure.

Price Movement

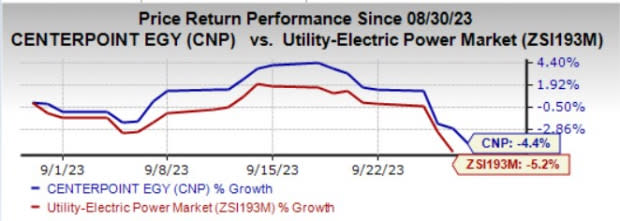

In the past month, shares of CenterPoint Energy have dropped 4.4% compared with the industry’s decline of 5.2%.

Image Source: Zacks Investment Research

Zacks Rank

CenterPoint Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report