CenterPoint Energy (CNP) Q2 Earnings Miss, Revenues Down Y/Y

CenterPoint Energy, Inc. CNP reported second-quarter 2023 adjusted earnings of 28 cents per share, which lagged the Zacks Consensus Estimate of 29 cents by 3.4%. The bottom line also declined 10.7% from the year-ago quarter’s figure of 31 cents.

The company registered GAAP earnings of 17 cents per share compared with 28 cents in the prior-year quarter.

Q2 Revenues

CNP generated revenues of $1,875 million, down 3.5% from the year-ago figure. The top line missed the Zacks Consensus Estimate of $1,922.8 million by 2.5%.

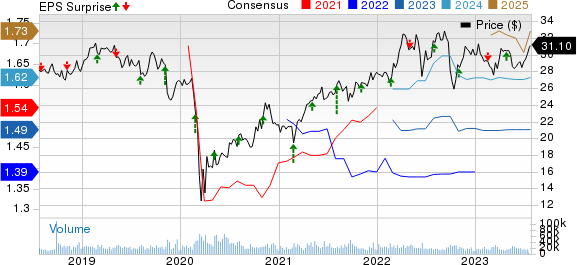

CenterPoint Energy, Inc. Price, Consensus and EPS Surprise

CenterPoint Energy, Inc. price-consensus-eps-surprise-chart | CenterPoint Energy, Inc. Quote

Operational Results

Total expenses during the reported quarter decreased 6.2% to $2,238 million.

The operating income increased 8.3% year over year to $380 million.

Interest expenses and other finance charges totaled $165 million, up 55.7% from $106 million in the year-ago quarter.

Financial Condition

As of Jun 30, 2023, CenterPoint Energy had cash and cash equivalents of $214 million compared with $74 million as of Dec 31, 2022.

The total long-term debt was $16,032 million as of Jun 30, 2023, compared with $14,836 million as of Dec 31, 2022.

Net cash flow from operating activities was $2,482 million as of Jun 30, 2023, compared with $978 million in the year-ago period.

The total capital expenditure was $2,259 million compared with $1,880 million in the prior-year quarter.

2023 Guidance

CenterPoint Energy reaffirmed its 2023 earnings guidance. It expects adjusted earnings per share in the range of $1.48-$1.50. The Zacks Consensus Estimate for 2023 earnings is pegged at $1.49 per share, in line with the midpoint of the company’s guided range.

Zacks Rank

CenterPoint Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

NextEra Energy, Inc. NEE released second-quarter 2023 adjusted earnings of 88 cents per share, which beat the Zacks Consensus Estimate of 83 cents by 6%. The bottom line was also up 8.6% from the prior-year quarter. The year-over-year improvement was due to the solid performances of Florida Power & Light Company and NextEra Energy Resources.

For the second quarter, NextEra’s operating revenues were $7,349 million, which surpassed the Zacks Consensus Estimate of $6,681 million by 10%. The top line improved 41.8% year over year.

PG&E Corporation’s PCG adjusted earnings per share (EPS) of 23 cents in the second quarter of 2023 lagged the Zacks Consensus Estimate of 27 cents by 14.8%. The bottom line decreased 8% from the year-ago quarter’s reported figure.

In the second quarter, PCG reported total revenues of $5,290 million compared with $5,118 million in the year-ago period. Operating revenues missed the Zacks Consensus Estimate of $5,608.6 million by 5.7%.

American Electric Power Company, Inc. AEP reported second-quarter 2023 operating earnings per share (EPS) of $1.13, which lagged the Zacks Consensus Estimate of $1.14 by 0.9%. The bottom line also declined by 5.8% from $1.20 in the year-ago quarter.

American Electric’s second-quarter operating revenues of $4,372.5 million lagged the Zacks Consensus Estimate of $4,686.7 million by 6.7%. The reported figure also decreased 5.8% from the year-ago quarter’s $4,639.7 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report