CenterPoint Energy Inc (CNP) Reports Strong Earnings Growth and Capital Investment Plans

Q4 Earnings: CNP reported $0.30 per diluted share, a significant increase from $0.19 in the same quarter of 2022.

Full-Year Earnings: Full-year earnings were $1.37 per diluted share, with non-GAAP EPS at $1.50, marking a 9% increase over 2022.

Capital Investment: CNP increased its 10-year capital plan to $44.5 billion, aiming to invest an additional $600 million through 2030.

2024 Guidance: The company reiterated its 2024 non-GAAP EPS guidance range of $1.61-$1.63, projecting 8% growth over 2023.

Regulatory Recovery: Growth and regulatory recovery contributed to the favorable earnings, alongside a one-time tax benefit.

On February 20, 2024, CenterPoint Energy Inc (NYSE:CNP) released its 8-K filing, detailing robust financial results for the fourth quarter and the full year of 2023. The company, which owns a portfolio of businesses including regulated electric utilities and natural gas distribution systems, serves over 7 million customers across several states.

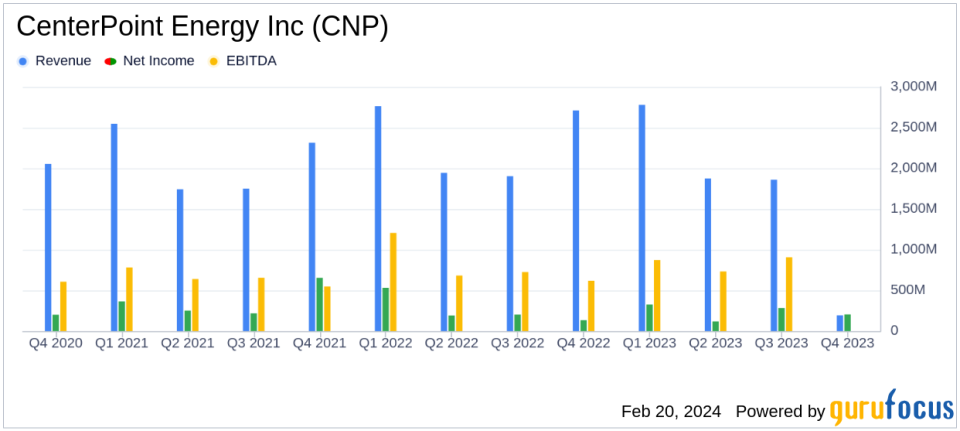

For the fourth quarter of 2023, CNP reported GAAP earnings of $0.30 per diluted share, a notable increase from $0.19 per diluted share in the previous year's comparable period. The full-year earnings stood at $1.37 per diluted share, compared to $1.59 per diluted share for the year ended December 31, 2022. On a non-GAAP basis, the earnings per diluted share (EPS) for Q4 2023 was $0.32, representing a 14% increase over the same quarter in 2022, and $1.50 for the full year, a 9% increase over the previous year's non-GAAP EPS of $1.38.

The company's CEO, Jason Wells, expressed confidence in the company's strategy and execution, which has led to three consecutive years of 9% non-GAAP EPS growth. The positive results were primarily driven by growth and regulatory recovery, contributing $0.05 per share of favorability, and a one-time tax benefit contributing another $0.06 per share. These were partially offset by an increased interest expense over the comparable quarter of 2022, which had an unfavorable variance of $0.05 per share.

CenterPoint Energy also increased its 10-year capital investment plan through 2030 to $44.5 billion, reflecting an increase of $600 million. This includes $100 million already deployed in 2023, with the remaining $500 million to be invested over the remainder of the decade. The company reiterated its 2024 non-GAAP EPS guidance range of $1.61-$1.63, indicating an 8% growth over the full-year 2023 non-GAAP EPS and maintaining non-GAAP EPS growth targets of 8% for 2024 and the mid-to-high end of 6%-8% annually thereafter.

Financial Performance and Outlook

The company's financial achievements are significant in the Utilities - Regulated industry, where consistent earnings growth and capital investments are critical for long-term success. The increased capital plan underscores CNP's commitment to infrastructure development and operational efficiency, which are vital for maintaining service quality and meeting regulatory requirements.

CenterPoint Energy's non-GAAP financial measures, such as non-GAAP income and non-GAAP diluted earnings per share, are used by management to evaluate the company's financial performance. These measures exclude items that are not indicative of the company's core business performance, providing investors with a clearer picture of the company's operational results.

The reconciliation of GAAP to non-GAAP financial measures for both the quarter and year-end highlights the adjustments made for ZENS-related mark-to-market gains and losses, as well as impacts associated with mergers and divestitures. These adjustments are crucial for investors to understand the underlying business performance without the noise of non-recurring or variable items.

CenterPoint Energy's strong financial performance, increased capital investment plan, and positive earnings outlook reflect the company's strategic positioning and operational efficiency. As the company continues to navigate industry headwinds and capitalize on growth opportunities, it remains a potentially attractive option for value investors seeking stable and growing returns in the regulated utilities sector.

For more detailed information, investors are encouraged to review CenterPoint Energy's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, available on the company's website.

CenterPoint Energy's management will host an earnings conference call to discuss the results and provide additional insights into the company's performance and outlook.

For further details and to stay updated on CenterPoint Energy's developments, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from CenterPoint Energy Inc for further details.

This article first appeared on GuruFocus.