CenterPoint Energy Inc's Dividend Analysis

Assessing the Sustainability and Growth of CNP's Dividends

CenterPoint Energy Inc (NYSE:CNP) recently announced a dividend of $0.20 per share, payable on 2024-03-14, with the ex-dividend date set for 2024-02-14. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into CenterPoint Energy Inc's dividend performance and assess its sustainability.

Understanding CenterPoint Energy Inc's Business

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

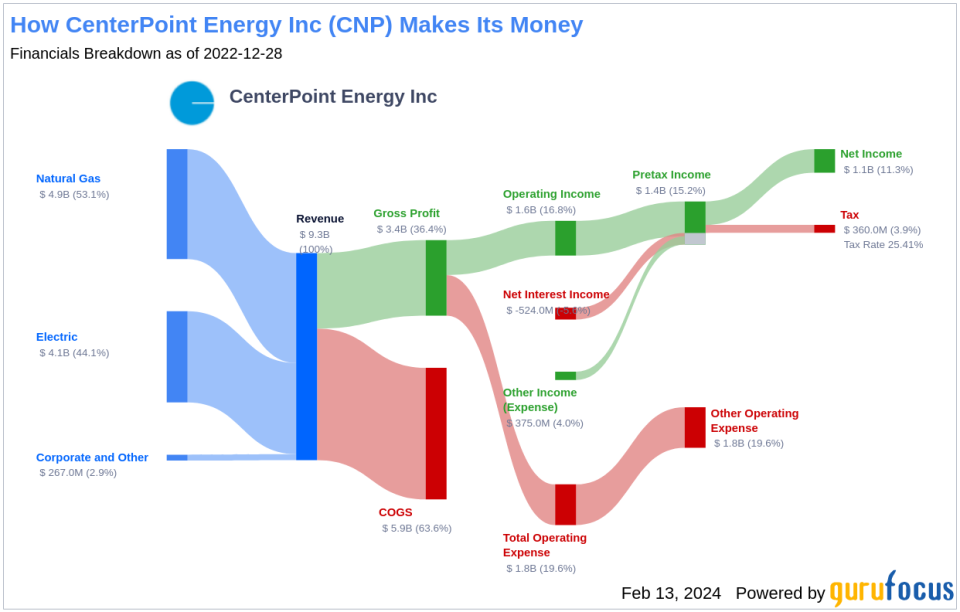

CenterPoint Energy Inc operates within the utility sector, managing a portfolio of businesses that deliver essential energy services. The company's regulated electric utilities cater to over 2.5 million customers in diverse regions including the Houston area, southern Indiana, and west central Ohio. Additionally, CenterPoint Energy Inc's natural gas distribution systems extend across six states, serving around 4 million customers, marking its significant presence in the energy distribution landscape.

CenterPoint Energy Inc's Dividend Track Record

CenterPoint Energy Inc has upheld a steadfast commitment to shareholder returns, maintaining a continuous dividend payment streak since 1986. The dividends are dispensed quarterly, reflecting the company's stable financial position and dedication to returning value to its investors. Below is a chart showing the annual Dividends Per Share to track historical trends, which is crucial for investors to gauge the company's long-term dividend policy.

Dividend Yield and Growth Insights

CenterPoint Energy Inc boasts a 12-month trailing dividend yield of 2.80% and a 12-month forward dividend yield of 2.91%. This forward-looking metric indicates an anticipated uptick in dividend disbursements over the upcoming year. However, the company's dividend growth has seen fluctuations with a three-year annual dividend growth rate of -15.30%, a five-year rate of -11.20%, and a ten-year growth rate of -1.90%. The 5-year yield on cost stands at approximately 1.55% as of today, providing a long-term perspective on the yield investors might expect.

Evaluating Dividend Sustainability

The sustainability of CenterPoint Energy Inc's dividends can be scrutinized through its dividend payout ratio, which currently stands at 0.60 as of 2023-09-30. This ratio indicates that the company is distributing a moderate portion of its earnings as dividends, retaining a substantial part for future growth and resilience against downturns. Additionally, CenterPoint Energy Inc's profitability rank of 6 out of 10 reflects fair profitability, supported by the company's consistent net profit generation over the past decade.

CenterPoint Energy Inc's Growth Prospects

For dividend sustainability, robust growth metrics are imperative. CenterPoint Energy Inc's growth rank of 6 out of 10 suggests fair future growth prospects. However, the company's revenue and earnings growth rates have been mixed. The revenue per share and 3-year revenue growth rate have underperformed 83.02% of global competitors, while the 3-year EPS growth rate has exceeded those of 32.56% of global competitors. The 5-year EBITDA growth rate has also underperformed, which could be a concern for long-term dividend sustainability.

Concluding Thoughts on CenterPoint Energy Inc's Dividends

In conclusion, while CenterPoint Energy Inc's dividend payments reflect a history of shareholder returns, the mixed growth rates and underperformance in certain metrics warrant careful consideration. The payout ratio and profitability rank provide some reassurance; however, investors should closely monitor the company's ability to sustain and grow its dividends in the context of its overall financial health. For those seeking high-dividend yield stocks, GuruFocus Premium offers a valuable tool with the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.