SITE Centers (SITC) Q3 OFFO & Revenues Beat, View Up

SITE Centers Corp. SITC reported third-quarter 2022 operating funds from operations (OFFO) per share of 29 cents, beating the Zacks Consensus Estimate by a cent. The figure was in line with the prior-year quarter’s FFO per share.

Results reflect healthy leasing activity and a year-over-year improvement in annualized base rent. Reflecting positive sentiments, shares of the company gained 4.3% on Oct 25 normal trading session on the NYSE.

SITE Centers generated revenues of $136.2 million in the reported quarter, outpacing the Zacks Consensus Estimate of $133.6 million. Moreover, the top line improved 12.5% year over year.

According to David R. Lukes, president and chief executive officer, “Third quarter results reflect a continuation of year-to-date trends with excellent operational and leasing performance, continued capital recycling and investments in our Convenience thesis, and further strengthening of our balance sheet.”

Quarter in Detail

SITC reported a leased rate of 95% as of Sep 30, 2022, which compared favorably with the prior-year quarter’s 92.3% on a pro-rata basis. The rise was attributable to the 520-basis point increase in small-shop (less than 10,000 square feet) leasing activity on a pro-rata basis.

The annualized base rent per occupied square foot was $19.11 on a pro-rata basis as of Sep 30, 2022, compared with $18.44 in the year-ago quarter.

SITE Centers, on a pro-rata basis, generated new and renewal leasing spreads of 10.8% and 7.1%, respectively, in the third quarter.

Moreover, the same-store net operating income (NOI) improved 1.1% on a pro-rata basis in the reported quarter, inclusive of redevelopment, from the prior-year quarter.

SITE Centers exited the third quarter with $20.9 million of cash, down from $38.5 million as of Jun 30, 2022.

Portfolio Activity

In the third quarter, SITC acquired five convenience shopping centers for a total price of $31.4 million. This included Parkwood Shops in Atlanta, GA, for $8.4 million and a four-property portfolio in Phoenix, AZ, for $23.0 million.

SITE Centers disposed of 15 shopping centers for $450.6 million ($118.1 million at company share). This was inclusive of the company’s 20% interest in the DDRM Joint Venture Pool A based on a gross asset value of $387.6 million (at 100%).

2022 Outlook Raised

SITE Centers raised its OFFO per share guidance for 2022.

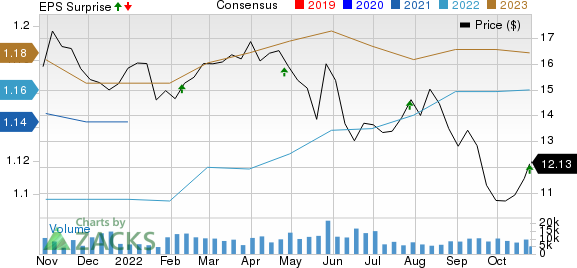

It expects it to lie in the range of $1.16-$1.17, up from the prior guidance of $1.13-$1.16. The Zacks Consensus Estimate for the same is pegged at $1.16.

Growth in same-store NOI (adjusted for 2021 uncollectible revenue impact) has been retained in the band of 3.50-4.75%.

SITE Centers currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SITE CENTERS CORP. Price, Consensus and EPS Surprise

SITE CENTERS CORP. price-consensus-eps-surprise-chart | SITE CENTERS CORP. Quote

Upcoming Earnings Releases

We now look forward to the earnings releases of other retail REITs like Kimco Realty KIM, Realty Income O and Federal Realty Trust FRT, scheduled to release on Oct 27, Nov 2 and Nov 3, respectively.

The Zacks Consensus Estimate for Kimco Realty’s third-quarter 2022 FFO per share is pegged at 39 cents, suggesting a year-over-year increase of 21.9%. KIM currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for Realty Income’s third-quarter 2022 FFO per share is pegged at 97 cents, implying a year-over-year increase of 6.6%. O currently carries a Zacks Rank of 3.

The Zacks Consensus Estimate for Federal Realty’s third-quarter 2022 FFO per share stands at $1.54, indicating a year-over-year increase of nearly 2%. FRT currently has a Zacks Rank #2 (Buy).

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research