SITE Centers (SITC) Stock Up on Q4 OFFO & Revenue Beat

SITE Centers Corp. SITC reported fourth-quarter 2022 operating funds from operations (OFFO) per share of 29 cents, beating the Zacks Consensus Estimate by a penny. However, the figure was lower than the prior-year quarter’s 30 cents.

Results reflect healthy leasing activity and a year-over-year improvement in annualized base rent. Reflecting positive sentiments, shares of the company gained marginally in the Feb 8 regular trading session on the NYSE.

SITE Centers generated revenues of $136.4 million in the reported quarter, outpacing the Zacks Consensus Estimate of $135.3 million. Moreover, the top line improved 9.5% year over year.

Per David R. Lukes, president and CEO of SITC, “SITE Centers had a very productive fourth quarter with results ahead of plan as we continued to execute on our leasing and operational goals. In the last two years, we have executed over 2.0 million square feet of new leases increasing the Company’s leased rate over 380 bp to 95.4% highlighting the quality and strength of our focused portfolio of assets concentrated in the top sub-markets of the country.”

Quarter in Detail

SITC reported a leased rate of 95.4% on a pro-rata basis as of Dec 31, 2022, which compared favorably with the prior-year quarter’s 92.7%. The rise was driven by healthy small-shop (less than 10,000 square feet) leasing activity.

The annualized base rent per occupied square foot was $19.52 on a pro-rata basis as of Dec 31, 2022, compared with $18.33 a year ago.

SITE Centers, on a pro-rata basis, generated cash new and cash renewal leasing spreads of 55.2% and 7.6%, respectively, in the fourth quarter.

Moreover, the same-store net operating income (NOI) improved 1.8% on a pro-rata basis in the reported quarter, inclusive of redevelopment, from the prior-year quarter.

SITE Centers exited the fourth quarter with $20.3 million of cash, down from $20.9 million as of Sep 30, 2022.

Portfolio Activity

In the December quarter, SITC acquired one convenience shopping center — Shops on Montview in Denver, CO — for $5.8 million.

SITE Centers disposed of four shopping centers land parcels for $166.7 million ($158.2 million at company share).

The company repurchased 2.2 million of its common shares in open market transactions for a total cost of $28.8 million or an average cost of $13.33 per share. This was carried out with the proceeds generated from the sale of wholly-owned properties.

2023 Outlook

SITE Centers issued guidance for 2023.

It expects OFFO per share in the range of $1.10-$1.16. The Zacks Consensus Estimate for the same is currently pegged at $1.15, which lies within the guided range.

Growth in same-store NOI (adjusted for 2022 uncollectible revenue impact) is expected in the band of 0-3.5%.

SITE Centers currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

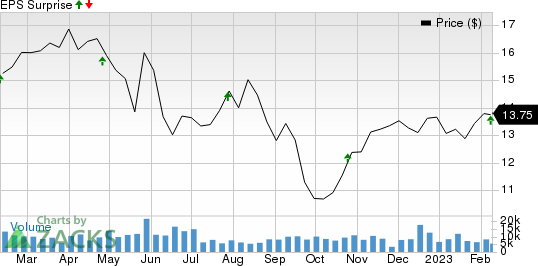

SITE CENTERS CORP. Price and EPS Surprise

SITE CENTERS CORP. price-eps-surprise | SITE CENTERS CORP. Quote

Performance of Other REITs

Simon Property Group, Inc.’s SPG fourth-quarter 2022 comparable FFO per share of $3.15 exceeded the Zacks Consensus Estimate of $3.14. The figure compares favorably with the year-ago quarter’s $3.11.

This performance was backed by a better-than-expected top line. SPG’s results reflected a healthy operating performance and growth in occupancy levels. However, the retail REIT behemoth’s 2023 comparable FFO per share projection was lower than expected.

Alexandria Real Estate Equities, Inc. ARE reported fourth-quarter 2022 AFFO per share of $2.14, surpassing the Zacks Consensus Estimate by a cent. The reported figure also compared favorably with the year-ago quarter’s $1.97.

ARE’s results reflected decent leasing activity and rental rate growth during the quarter.

Boston Properties Inc.’s BXP fourth-quarter 2022 FFO per share of $1.86 outpaced the Zacks Consensus Estimate of $1.84. The figure increased 18.7% year over year.

The quarterly figure also exceeded the mid-point of the company’s fourth-quarter guidance by a cent, reflecting portfolio outperformance. In addition, BXP experienced solid leasing activity in the quarter. The company revised its 2023 outlook for FFO per share.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report