Central Banks Amass Record-Breaking Gold Reserves: A Golden Opportunity for Investors?

Amidst an unprecedented landscape of geopolitical tensions, economic fluctuations, and policy uncertainties, it comes as no surprise that investor interest in gold has been reignited. The steady bid for gold by central banks has proven to be a compelling catalyst, pushing prices to new highs as well.

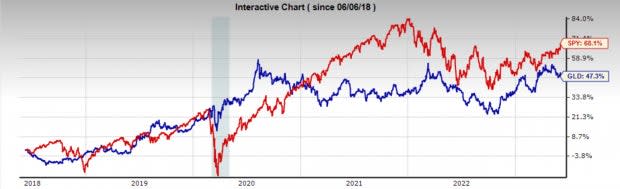

Although there have been complaints from Wall St about gold’s lackluster hedging abilities, the yellow metal has performed quite well over the last five years, compounding 8.1% annually. Additionally, there are still several bullish factors that can push gold higher. With a convincing long-term technical setup, a central bank buying spree, and upgrades in the miners, gold stocks may be ready to run.

One way for investors to get exposure to gold without directly buying the commodity is to invest in gold mining stocks. The Gold - Mining industry currently sits in the top 30% of the Zacks Industry Rank and boasts several top-ranked stocks. Newmont NEM, Sandstorm Gold SAND, and AngloGold Ashanti AU are all Zacks Rank #1 (Strong Buy) stocks, indicating upward trending earnings revisions.

Image Source: Zacks Investment Research

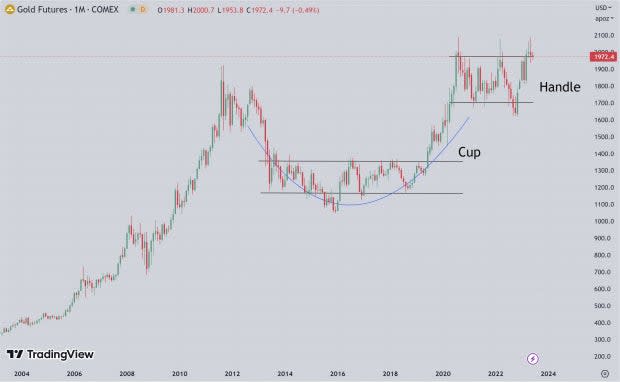

Technical Setup

Gold has been building out a prototypical cup and handle pattern for over a decade. If the price of gold can hold above the $2,000 level, it should signal the next big bull run is underway.

Admittedly, price has experienced some trouble holding above $2,000, so there may be some more sideways consolidation before it begins to steadily trend higher again. If gold can’t hold above the $1,800 level this trade setup would be challenged, and if it is below $1,700 it is invalid.

Image Source: TradingView

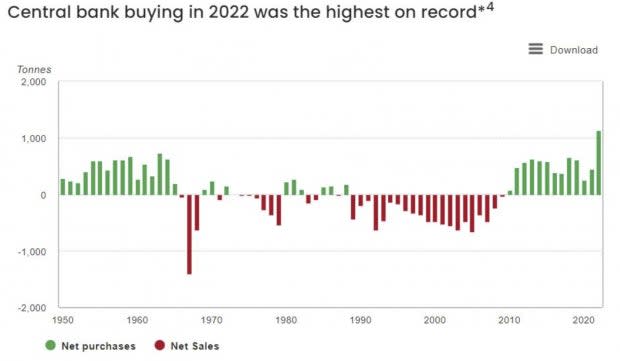

Central Banks

In 2022, central bank gold demand was the highest on record. In total, central banks purchased 1,136 tons of gold, worth ~$70 billion. Demand in 2023 is expected to slow with projections estimating ~$50 billion in gold purchases central banks. However, it is clear that central banks are very much focused on diversifying their holdings, especially away from the USD.

Image Source: World Gold Council

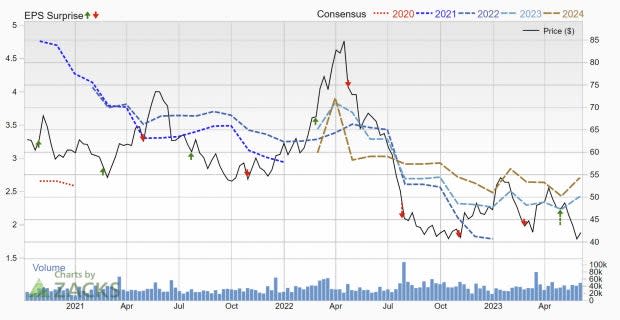

Newmont

Newmont is one of the world's largest producers of gold with several active mines in Nevada, Peru, Australia, and Ghana. As of Dec 31, 2022, Newmont had gold mineral reserves of more than 96.1 million ounces and its attributable gold production for 2022 was 6 million ounces.

NEM currently earns a Zacks Rank #1 (Strong Buy), reflecting its upward trending earnings revisions. After trending lower over the last year, earnings estimates have turned sharply higher. FY23 earnings have been upgraded by 16.4% and are expected to grow 31% YoY to $2.42 per share.

Image Source: Zacks Investment Research

Newmont is trading at a one-year forward earnings multiple of 17.4x, which is above the industry average of 9.7x, but well below its 10-year median of 24x. As one of the leading gold mining companies in the world it is no surprise that NEM has regularly traded at a significant premium to the industry. Additionally, NEM has a generous dividend yield of 3.8%.

Image Source: Zacks Investment Research

AngloGold Ashanti

Headquartered in Johannesburg, South Africa, AngloGold Ashanti is a global gold mining company with mines and exploration projects across Continental Africa, South Africa, Americas, and Australasia. It is the third-biggest gold mining company globally in terms of production.

Earnings for AU have been revised significantly higher over the last two months. FY23 earnings have been boosted by 14%, and FY24 have been revised higher by 7.7%. Additionally, FY23 earnings are expected to grow 50.4% YoY, and FY24 earnings are projected to climb by 30% YoY. Furthermore, FY23 sales are expected to 20% YoY.

Image Source: Zacks Investment Research

AU recently made some exciting strategic moves regarding its primary listing. While the company has recently shifted its focus to a set of more lucrative mines, they also require significantly more capital. In an effort to access the world largest pool of capital AngloGold Ashanti is moving its stock listing from Johannesburg to New York.

Sandstorm Gold

Sandstorm Gold is a leading royalty and streaming company in the precious metals sector. With a focus on gold, Sandstorm provides upfront financing to mining companies in exchange for future streams or royalty interests.

This unique business model allows Sandstorm to benefit from the long-term success of its partner mines without assuming the operational risks associated with mining operations. SAND’s diversified portfolio includes assets in various mining jurisdictions worldwide, providing exposure to a range of exploration and production opportunities.

After bottoming earlier this year, FY23 earnings are now clearly trending higher. FY23 earnings estimates have been upgraded by 57% over the last two months and are expected to be flat YoY. Additionally, FY23 sales are expected to 21% YoY.

Image Source: Zacks Investment Research

Because of its unique business model, SAND enjoys very wide margins. Over the last five years margins have expanded by over 500%, and the company now has 54% net margins. It also means the company is much less capital intensive and has a comfortable balance sheet. With $1.9 billion in assets, and just $510 million in liabilities, the company has $1.45 billion in shareholder equity.

Image Source: Zacks Investment Research

Bottom Line

With a 5,000-year history of storing value, gold has proven its staying power. While it may not offer the same advantages of equities, gold makes for a compelling portfolio diversifier, that performs exactly when you need it most.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report