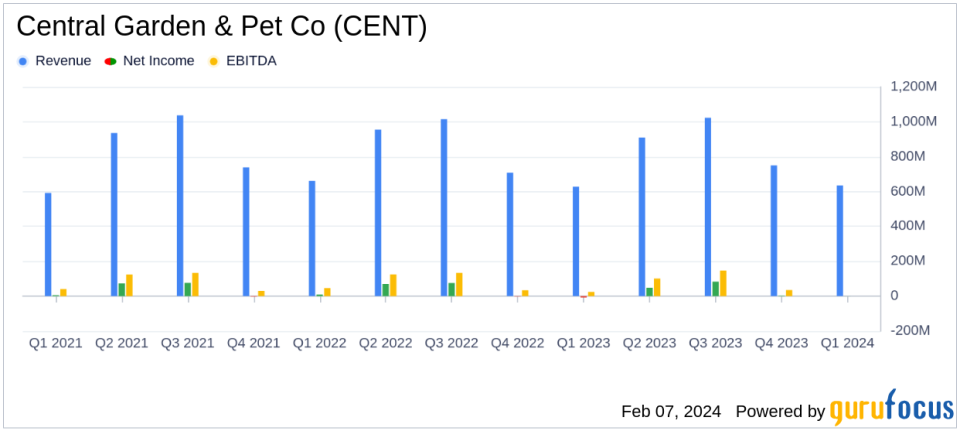

Central Garden & Pet Co (CENT) Q1 Fiscal 2024 Earnings: Margins Improve Amidst Modest Sales ...

Net Sales: Reported a slight increase to $635 million, up 1% year-over-year.

Earnings Per Share (EPS): Achieved $0.01 EPS, a significant improvement from a loss per share of $0.16 in the prior year.

Gross Margin: Improved by 80 basis points to 28.2%, reflecting effective cost management.

Operating Income: Increased to $8 million from $0.4 million, with operating margin expanding by 120 basis points.

Adjusted EBITDA: Grew to $37 million from $29 million in the previous year.

Cash Position: Ended the quarter with a strong cash balance of $341 million, driven by inventory conversion to cash.

Fiscal 2024 Guidance: Reaffirmed non-GAAP EPS expectation of $2.50 or better.

On February 7, 2024, Central Garden & Pet Co (NASDAQ:CENT) released its 8-K filing, announcing financial results for the first quarter of fiscal 2024. The company, a market leader in the Pet and Garden industries, reported a modest increase in net sales to $635 million, a 1% rise compared to the same period last year. This growth was driven by early season shipments and improved gross margin, which saw an 80 basis point increase to 28.2%.

Central Garden & Pet Co, with over forty years of experience, operates through two segments: the pet segment and the garden segment. The company boasts a portfolio of more than sixty-five brands, including Pennington, Nylabone, and Kaytee, and is known for its commitment to nurturing happy and healthy homes through its products.

Despite a challenging external environment, the company managed to turn around last year's net loss of $8 million to a net income of $0.4 million. This was largely attributed to effective cost management and moderating inflation, which contributed to the improved gross margin. Earnings per share stood at $0.01, a significant improvement from the prior year's loss per share of $0.16.

The Pet segment experienced a slight decrease in net sales, down 2% to $409 million, mainly due to lower sales of durable pet products. However, operating income in this segment increased by 10% to $43 million, reflecting the benefits of Central's Cost and Simplicity program and lower commercial spend.

The Garden segment, on the other hand, saw a 6% increase in net sales to $225 million, bolstered by early season shipments. The segment's operating loss improved by 18%, with a reduced operating margin loss of 3.9%.

Central Garden & Pet Co's cash balance at the end of the quarter was a robust $341 million, a significant increase from $88 million a year ago. This improvement was primarily due to a reduction in inventory levels over the last 12 months. The company also reported a leverage ratio of 3.0x, a slight decrease from 3.1x at the end of the previous year's quarter.

Looking ahead, Central Garden & Pet Co maintains its fiscal 2024 guidance, expecting non-GAAP EPS to be $2.50 or better. This outlook takes into account the current macroeconomic and geopolitical uncertainties, including deflationary pressures and unpredictable consumer demand.

The company's financial stability is further underscored by its planned stock dividend, which aims to enhance liquidity in its Class A Common Stock. The dividend will be distributed on February 8, 2024, to stockholders of record as of January 8, 2024.

Central Garden & Pet Co's first-quarter results demonstrate resilience in the face of market headwinds, with improved margins and a solid cash position. The company's commitment to executing its long-term Central to Home strategy and maintaining cost discipline bodes well for its future performance, making it a potentially attractive option for value investors.

"The fiscal year is off to a solid start as we successfully navigated the challenging external environment. We delivered earnings per share of $0.01 as a result of improved gross margin and early season shipments," said Beth Springer, Interim CEO of Central Garden & Pet.

For a detailed analysis of Central Garden & Pet Co's financials and future prospects, investors and potential GuruFocus.com members are encouraged to visit GuruFocus.com for comprehensive investment insights.

Explore the complete 8-K earnings release (here) from Central Garden & Pet Co for further details.

This article first appeared on GuruFocus.