Central Garden & Pet (NASDAQ:CENT) Q1: Beats On Revenue

Pet company Central Garden & Pet (NASDAQGS:CENT) reported results ahead of analysts' expectations in Q1 FY2024, with revenue up 1.1% year on year to $634.5 million. It made a GAAP profit of $0.01 per share, improving from its loss of $0.16 per share in the same quarter last year.

Is now the time to buy Central Garden & Pet? Find out by accessing our full research report, it's free.

Central Garden & Pet (CENT) Q1 FY2024 Highlights:

Revenue: $634.5 million vs analyst estimates of $617 million (2.8% beat)

EPS: $0.01 vs analyst estimates of -$0.18 ($0.19 beat)

Free Cash Flow was -$79.91 million, down from $141 million in the previous quarter

Gross Margin (GAAP): 28.2%, up from 27.4% in the same quarter last year

Organic Revenue was up 1% year on year

Market Capitalization: $2.30 billion

“The fiscal year is off to a solid start as we successfully navigated the challenging external environment. We delivered earnings per share of $0.01 as a result of improved gross margin and early season shipments,” said Beth Springer, Interim CEO of Central Garden & Pet.

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

Central Garden & Pet is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

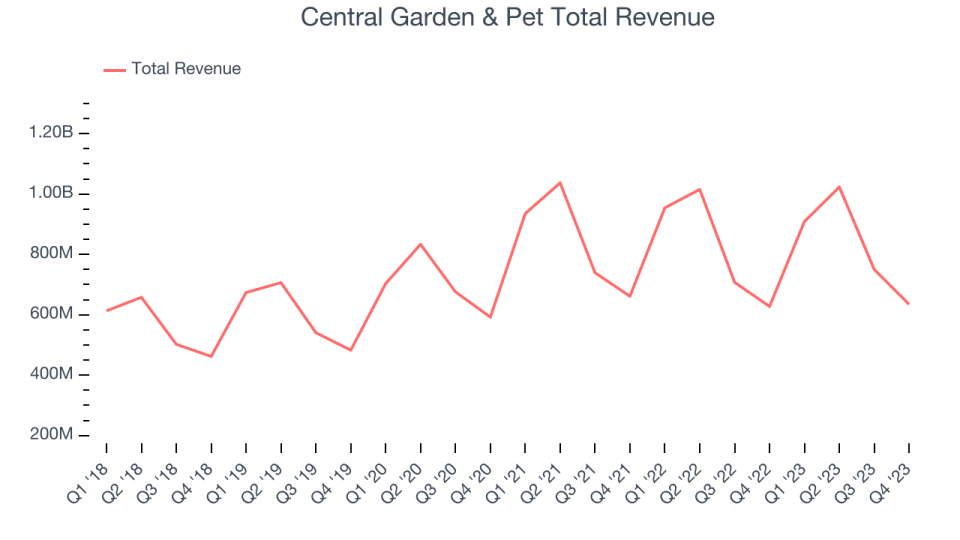

As you can see below, the company's annualized revenue growth rate of 5.7% over the last three years was mediocre for a consumer staples business.

This quarter, Central Garden & Pet reported decent year-on-year revenue growth of 1.1%, and its $634.5 million in revenue topped Wall Street's estimates by 2.8%. Looking ahead, Wall Street expects revenue to decline 2.3% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

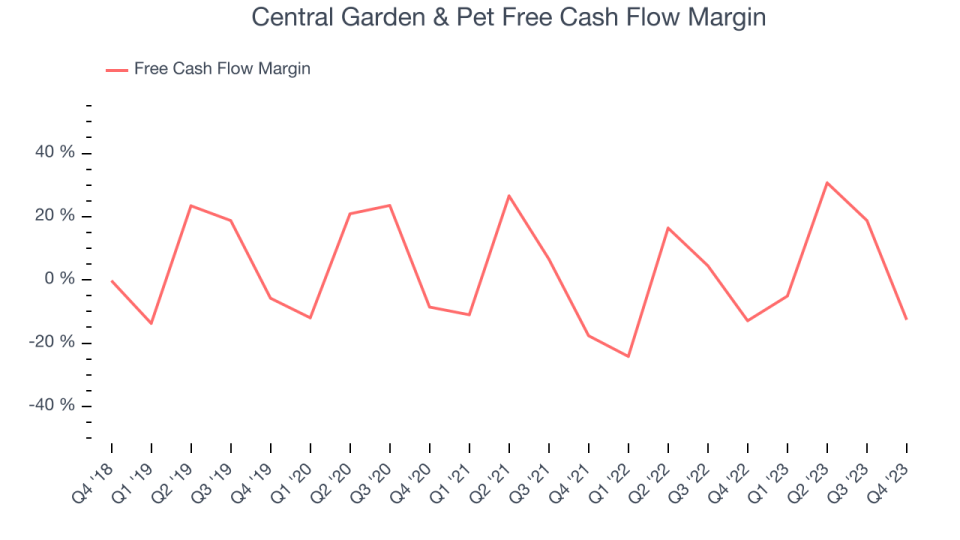

Central Garden & Pet burned through $79.91 million of cash in Q1, in line with its cash burn last year. This result represents a negative 12.6% free cash flow margin.

Over the last eight quarters, Central Garden & Pet has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.9%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 13.3 percentage points over the last 12 months. Shareholders should be excited as this will certainly help Central Garden & Pet reach the next level of profitability.

Key Takeaways from Central Garden & Pet's Q1 Results

We liked how revenue beat on slightly positive organic revenue growth. Operating income beat convincingly, leading to an impressive EPS beat. Zooming out, we think this was a very solid quarter that should please shareholders. The stock is flat after reporting and currently trades at $46.94 per share.

Central Garden & Pet may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.