Central Pacific Financial Corp (CPF) Reports Mixed Results for Q4 and Full Year 2023

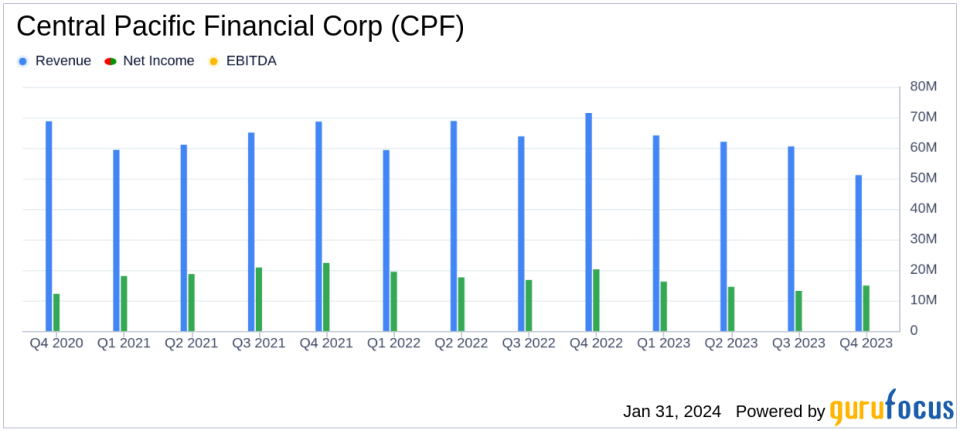

Net Income: Q4 net income of $14.9 million, down from $20.2 million in the year-ago quarter.

Earnings Per Share (EPS): Full-year EPS at $2.17, compared to $2.68 in the previous year.

Net Interest Margin (NIM): NIM decreased to 2.84% in Q4, a drop from 3.17% in the same quarter last year.

Provision for Credit Losses: Q4 saw a provision of $4.7 million, significantly higher than $0.6 million in the year-ago quarter.

Balance Sheet: Total assets remained flat quarter-over-quarter but increased 2.8% year-over-year to $7.64 billion.

Dividends and Share Repurchases: Quarterly cash dividend declared at $0.26 per share; new share repurchase program authorized for up to $20 million in 2024.

On January 31, 2024, Central Pacific Financial Corp (NYSE:CPF) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. CPF, a prominent financial services provider in the United States, operates as a full-service commercial bank in Hawaii, offering a range of banking products and services. The bank's deposits are FDIC-insured, and it is known for its diverse loan portfolio, including commercial, construction, mortgage, and consumer loans.

Financial Performance Overview

CPF reported a net income of $14.9 million for Q4 2023, translating to $0.55 per diluted share. This represents a decrease from the $20.2 million net income, or $0.74 EPS, reported in the same quarter of the previous year. The full-year net income for 2023 stood at $58.7 million, or $2.17 EPS, compared to $73.9 million, or $2.68 EPS, in the prior year. The bank's return on assets (ROA) and return on equity (ROE) for the fourth quarter were 0.79% and 12.55%, respectively.

CPF's net interest income for Q4 was $51.1 million, a 9.1% decrease from the year-ago quarter, with a net interest margin (NIM) of 2.84%. The bank completed a balance sheet repositioning, including the sale of an office property and investment securities portfolio restructuring, which is expected to positively impact future pre-tax income by an estimated $2.0 million annually.

Challenges and Strategic Moves

The bank faced challenges in the form of increased provisions for credit losses, which totaled $4.7 million in Q4, a substantial increase from the $0.6 million provision in the year-ago quarter. CPF also reported a decrease in net interest income and NIM, primarily due to higher rates paid on interest-bearing deposits and increased average balances.

Despite these challenges, CPF's strategic balance sheet repositioning and cost-saving measures, such as branch lease terminations, are expected to yield future savings and enhance financial performance. The bank's efficiency ratio for Q4 was 64.12%, reflecting higher operating expenses compared to the previous year.

Balance Sheet and Asset Quality

CPF's total assets as of December 31, 2023, were $7.64 billion, showing stability from the previous quarter and a 2.8% increase year-over-year. Total loans decreased slightly by 1.3% from the previous quarter, while total deposits saw a marginal decrease of 0.4%. The bank's asset quality remained solid, with nonperforming assets representing only 0.09% of total assets.

Capital and Liquidity

The bank's capital position remained robust, with total shareholders' equity increasing to $503.8 million at the end of 2023. CPF's regulatory capital ratios, including leverage and tier 1 risk-based capital, showed slight improvements from the previous quarter. The bank also declared a quarterly cash dividend of $0.26 per share and authorized a new share repurchase program for 2024.

Outlook and Management Commentary

CPF's management expressed confidence in the bank's positioning for 2024, citing a strategic, relationship-focused approach and solid liquidity, capital, and asset quality. President and CEO Arnold Martines highlighted CPF's inclusion in Newsweeks 2024 list of Americas Best Regional Banks and the bank's commitment to the Hawaii marketplace.

"Our solid 2023 results reflect our consistent business approach, strong credit culture and commitment to the Hawaii marketplace. We believe we are positioned to deliver a strong financial performance in 2024, highlighted by our strategic relationship focused approach and our solid liquidity, capital and asset quality." - Arnold Martines, President and CEO.

Investors and analysts are encouraged to review the detailed financial results and listen to the live webcast of the earnings conference call for further insights into CPF's performance and strategic initiatives.

For a comprehensive understanding of Central Pacific Financial Corp's financial results, stakeholders are encouraged to review the full 8-K filing and attend the earnings conference call.

Explore the complete 8-K earnings release (here) from Central Pacific Financial Corp for further details.

This article first appeared on GuruFocus.