Centrus Energy Corp (LEU) Reports Strong Year-Over-Year Net Income Growth for Full Year 2023

Net Income: $84.4 million for 2023, a significant increase from $52.2 million in 2022.

Revenue: Increased to $320.2 million in 2023 from $293.8 million in 2022.

Gross Profit: Reported at $112.1 million for 2023, slightly down from $117.9 million in 2022.

Unrestricted Cash: Strong liquidity with an unrestricted cash balance of $201.2 million as of December 31, 2023.

New Contracts: Originated $189 million of new sales contracts, maintaining a $1 billion long-term order book.

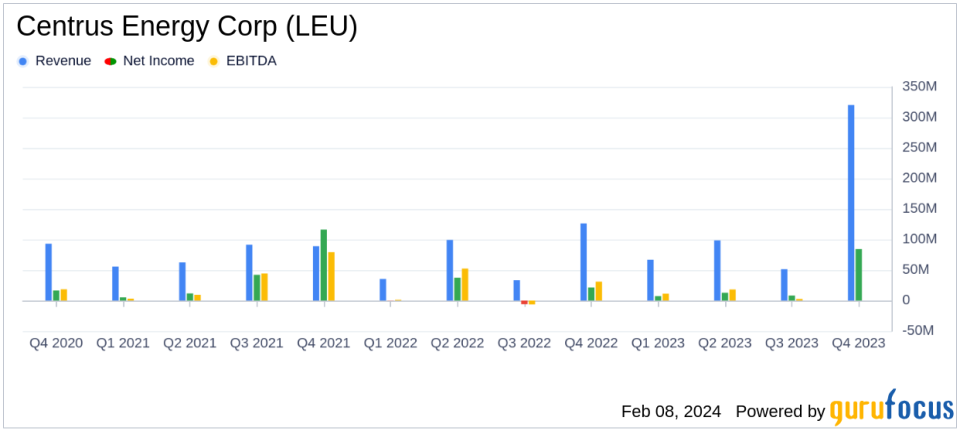

On February 8, 2024, Centrus Energy Corp (LEU) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a key player in the nuclear fuel and services industry, operates primarily through its Low-Enriched Uranium (LEU) segment, which saw a revenue increase due to higher volume and average price of SWU and uranium sold. Despite a decrease in revenue from the Technical Solutions segment, the company's overall financial performance showed resilience and growth.

Centrus Energy Corp (LEU) reported a robust net income of $84.4 million for the year ended December 31, 2023, marking a substantial increase from the $52.2 million reported in the previous year. This growth in net income is particularly noteworthy given the $21.3 million estimated loss related to the HALEU Operation Contract in the previous year. The company's revenue also saw an uptick, reaching $320.2 million in 2023, up from $293.8 million in 2022. The LEU segment contributed significantly to this increase, with $269.0 million in revenue, compared to $235.6 million in the prior year.

Despite the positive revenue growth, the company's gross profit experienced a slight decline to $112.1 million in 2023 from $117.9 million in 2022. This was primarily due to a change in the composition of contracts within the LEU segment, which included legacy contracts at historically higher prices in the previous year. The company's unrestricted cash balance stood strong at $201.2 million as of December 31, 2023.

Centrus Energy Corp (LEU) also reported the origination of $189 million in new sales contracts, maintaining a robust $1 billion long-term order book. This demonstrates the company's continued ability to secure new business and maintain a steady revenue stream.

Financial Statements Highlights

The company's financial achievements are reflected in the detailed financial statements. The Consolidated Statements of Operations and Comprehensive Income show a strong operating income of $52.4 million for 2023. The Consolidated Statements of Cash Flows indicate a healthy cash flow from operations, amounting to $9.1 million for the year. Additionally, the Consolidated Balance Sheets reveal a solid financial position with total assets of $796.2 million and total liabilities of $763.9 million as of December 31, 2023.

Centrus Energy Corp (LEU) has demonstrated a strong financial performance in 2023, with significant net income growth and sustained revenue increases. The company's ability to navigate the challenges within the Technical Solutions segment and maintain a strong order book positions it well for future growth. Investors and potential members of GuruFocus.com will find Centrus Energy Corp (LEU) to be a company worth watching as it continues to play a crucial role in the nuclear power industry.

For more detailed information and analysis on Centrus Energy Corp (LEU)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Centrus Energy Corp for further details.

This article first appeared on GuruFocus.