Centrus Energy (LEU) to Start HALEU Production at Piketon Site

Centrus Energy LEU is set to start production of High-Assay Low-Enriched Uranium (HALEU) at its American Centrifuge Plant in Piketon, OH in October 2023. It will be the first new U.S.-owned uranium enrichment plant to begin production since 1954.

Centrus began the construction of a cascade of centrifuges in 2019 under a contract with the U.S. Department of Energy. In November 2022, the company secured a cost-share contract from the U.S. Department of Energy to finish the construction, complete the final regulatory steps and bring the cascade into operation. The scheduled date for providing the first-ever domestic production of HALEU as per the contract was by Dec 31, 2023.

In June 2023, Centrus successfully completed its operational readiness reviews with the U.S. Nuclear Regulatory Commission (NRC) and received NRC’s approval to possess uranium at Piketon. It was the first facility to be licensed by the U.S. Nuclear Regulatory Commission for HALEU production. With this, the company cleared the final regulatory hurdle prior to production. Centrus is now conducting final system tests and other preparations to ensure that it can start producing in October, which is two months before the deadline.

The 16-centrifuge cascade will produce about 900 kg of HALEU annually. However, it is expected that with sufficient funding and offtake contracts, Centrus could scale up production. It is estimated that within about 42 months of securing the necessary funding, Centrus will be able to bring online a full-scale HALEU cascade, consisting of 120 centrifuge machines, with an annual production capacity of around 6,000 kg of HALEU. The company could add an additional HALEU cascade every six months after that.

Centrus Energy is pioneering the development of a HALEU, which is a high-performance nuclear fuel component. HALEU demand is expected to surge in the coming years as it will be used to power both existing reactors and a new generation of advanced reactors. These new HALEU-based fuels bring improved economics and inherent safety features, while also increasing the amount of carbon-free electricity that can be generated.

The lack of a domestic HALEU supply is widely regarded as critical to the successful commercialization of U.S. advanced reactor technologies, since potential reactor customers need the assurance that fuel will be available for the life of the reactor. Ensuring domestic HALEU production will pave the way for America toward large-scale deployment of carbon-free advanced nuclear plants.

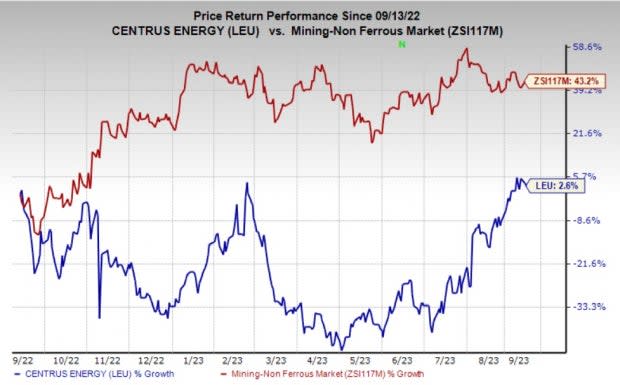

Price Performance

Shares of Centrus Energy have gained 2.6% in the past year compared with the industry’s 43.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Centrus Energy currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Hawkins, Inc. HWKN and Alamos Gold Inc. AGI. CRS and HWKN each sport a Zacks Rank of 1 at present, while Alamos Gold carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48 per share, indicating year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 71% in the past year.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares have gained 47% in the last year.

The Zacks Consensus Estimate for AGI's current-year earnings has been revised 13.2% upward over the past 60 days. The Zacks Consensus Estimate for current fiscal-year earnings for Alamos Gold is currently pegged at 43 cents per share, implying year-over-year growth of 53.6%. AGI shares have gained around 59% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report