Century Aluminum's (CENX) Q3 Earnings & Sales Beat Estimates

Century Aluminum Company CENX logged a loss of 45 cents per share in third-quarter 2023 compared with the year-ago quarter's earnings of 43 cents.

Barring one-time items, the adjusted loss was 13 cents per share in the reported quarter, narrower than the Zacks Consensus Estimate of a loss of 19 cents. The company benefited from lower input prices and other cost savings, somewhat countered by lower aluminum prices.

Century Aluminum Company Price, Consensus and EPS Surprise

Century Aluminum Company price-consensus-eps-surprise-chart | Century Aluminum Company Quote

Revenues and Shipments

The company generated net sales of $545.2 million in the reported quarter, down around 14% year over year. The figure, however, beat the Zacks Consensus Estimate of $542.3 million.

Primary aluminum shipments were 171,995 tons, down around 1% year over year. It lagged the consensus estimate of 174,920 tons.

Financials

At the end of the quarter, the company had cash and cash equivalents of $70.3 million, up 6.5% year over year.

Net cash used by operating activities was $39.6 million for the nine months ended Sep 30, 2023.

Outlook

The company anticipates that its Adjusted EBITDA for the fourth quarter will be in the range of $0-$10 million, primarily due to a decline in LME prices, partially mitigated by lower raw material costs.

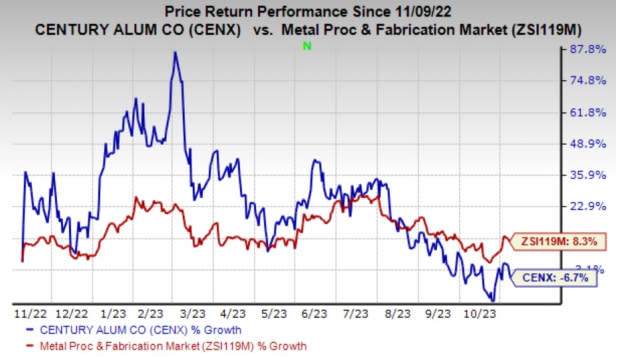

Price Performance

Shares of Century Aluminum have lost 6.7% in the past year against an 8.3% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Century Aluminum currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and The Andersons Inc. ANDE and Linde plc LIN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’s current fiscal year earnings is pegged at $3.57, indicating year-over-year growth of 213.2%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have surged 69.6% in the past year.

The Zacks Consensus Estimate for ANDE’s current-year earnings has been revised 3.3% upward in the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 30.6% in a year.

The consensus estimate for Linde’s current fiscal year earnings is pegged at $14.08, indicating a year-over-year growth of 14.6%. LIN beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 5.7%. The company’s shares have rallied 24.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Century Aluminum Company (CENX) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report