CEO Christopher Comparato Sells 6,873 Shares of Toast Inc (TOST)

On October 3, 2023, Christopher Comparato, the CEO of Toast Inc (NYSE:TOST), sold 6,873 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Christopher Comparato is a seasoned executive with a wealth of experience in the technology and hospitality sectors. As the CEO of Toast Inc, he has been instrumental in guiding the company's strategic direction and growth. Under his leadership, Toast Inc has grown into a leading provider of restaurant management software, offering a comprehensive suite of products that streamline operations, increase revenue, and improve customer experiences.

Toast Inc is a cloud-based restaurant software company. The company provides an all-in-one point-of-sale (POS) system that helps restaurants improve operations, increase sales, and create a better guest experience. The platform includes POS, front-of-house, back-of-house, and guest-facing technology, built specifically for restaurants. The company's mission is to empower the restaurant community to delight guests, do what they love, and thrive.

Over the past year, the insider has sold a total of 1,553,059 shares and purchased 0 shares. This recent sale of 6,873 shares is part of this larger trend. The insider's transactions can provide valuable insights into the company's financial health and future prospects.

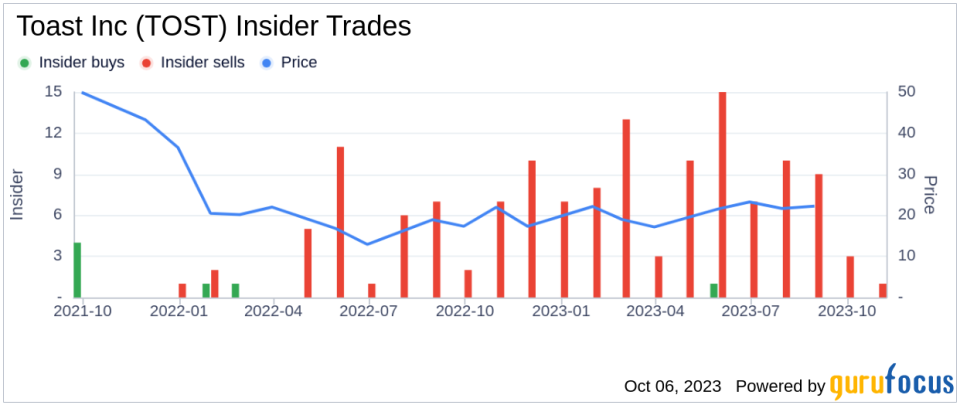

The insider transaction history for Toast Inc shows a trend of more sells than buys over the past year. There have been 1 insider buys in total, compared to 103 insider sells. This could indicate that insiders believe the company's stock is currently overvalued, leading them to sell their shares.

On the day of the insider's recent sale, shares of Toast Inc were trading for $17.51 apiece. This gives the company a market cap of $9.28 billion. The relationship between insider transactions and the stock price can be complex. While insider selling can sometimes be a bearish signal, it's important to consider the reasons behind the sale and the overall financial health of the company.

In conclusion, the recent sale of shares by CEO Christopher Comparato is part of a larger trend of insider selling at Toast Inc. While this could be a sign of overvaluation, it's crucial to consider the broader context and the company's overall financial performance. As always, potential investors should conduct their own thorough research before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.