CEO Dale Andres Buys 25,000 Shares of Gatos Silver Inc

On September 28, 2023, Dale Andres, the CEO of Gatos Silver Inc (NYSE:GATO), purchased 25,000 shares of the company. This move is significant as it indicates the insider's confidence in the company's future prospects.

Who is Dale Andres?

Dale Andres is the CEO of Gatos Silver Inc. He has a long history in the mining industry and has held various executive positions in several mining companies. His extensive experience and knowledge in the industry make him a valuable asset to Gatos Silver Inc.

About Gatos Silver Inc

Gatos Silver Inc is a mining company that specializes in the exploration, development, and extraction of silver. The company operates primarily in Mexico and has a strong commitment to sustainable mining practices. Gatos Silver Inc is known for its innovative approach to mining and its focus on creating value for its shareholders.

Insider Buying Analysis

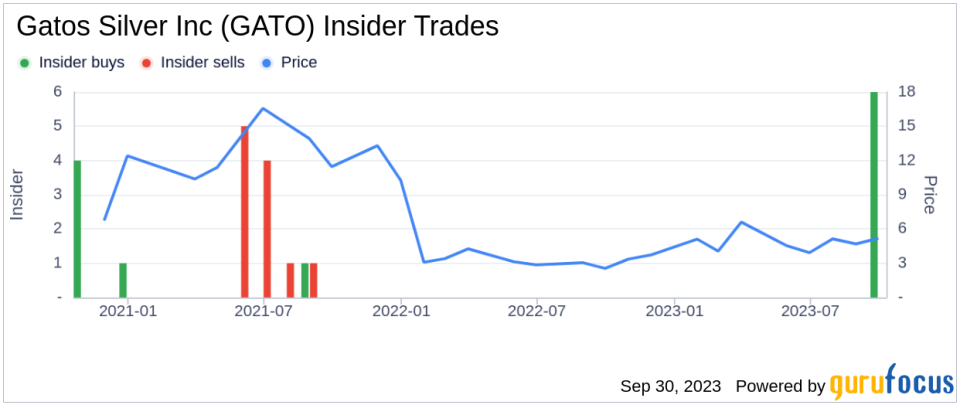

Over the past year, Dale Andres has purchased a total of 125,000 shares and has not sold any shares. This indicates a strong belief in the company's potential and a commitment to its success. The insider's recent purchase of 25,000 shares further strengthens this belief.

The insider transaction history for Gatos Silver Inc shows a total of 8 insider buys over the past year, with no insider sells. This trend suggests that insiders are confident in the company's future and are willing to invest their own money in it.

The relationship between insider buying and selling and the stock price is often seen as a strong indicator of a company's future performance. In this case, the consistent insider buying could be a positive sign for Gatos Silver Inc's stock price.

Valuation

On the day of the insider's recent buy, shares of Gatos Silver Inc were trading at $5.15 each, giving the company a market cap of $358.26 million. The price-earnings ratio is 64.75, which is higher than both the industry median of 15 and the company's historical median price-earnings ratio. This suggests that the stock is currently overvalued compared to its earnings.

However, the insider's decision to buy shares despite the high price-earnings ratio could indicate that they believe the company's future earnings will justify the current stock price. This could be a sign that the company has strong growth prospects.

In conclusion, the insider's recent purchase of Gatos Silver Inc shares, along with the consistent insider buying over the past year, could be a positive sign for the company's future stock price. However, investors should also consider the company's high price-earnings ratio when making investment decisions.

This article first appeared on GuruFocus.