CEO Eddie Lampert's Latest Bid for Sears Holdings' Assets Is Bad News

Hedge fund manager and Sears Holdings (NASDAQ: SHLD) CEO Eddie Lampert has put a lot of effort into keeping the storied retail giant alive over the past few years. Unfortunately, the company has needed massive cash infusions, as declining mall traffic and Lampert's strategic missteps have led to years of massive losses at Sears Holdings.

Today, Sears Holdings faces a looming liquidity crisis. Most of its debt matures within the next two years while its cash cushion and asset base are both dwindling rapidly. As a result, barring a stunning turnaround, bankruptcy is likely within the next year or two.

Sears is steadily becoming more desperate to raise cash. Image source: Sears Holdings.

Yet Lampert isn't done making moves. On Tuesday, ESL Investments (his hedge fund) offered to buy SHIP -- Sears' home-improvement subsidiary -- and the company's Kenmore appliance brand. But while these deals (if consummated) could buy some time for Sears, they won't come close to saving it.

A new offer

In April, ESL made a non-binding proposal to buy SHIP and Sears' Parts Direct subsidiary for a total of $500 million. The hedge fund also expressed interest in making an offer for Kenmore.

At the time, ESL stated, "We are prepared to move as quickly as possible to complete customary due diligence for a transaction of this nature and enter into definitive agreements." A few weeks later, Sears Holdings' board announced that it had begun a formal process to explore selling SHIP, Parts Direct, and Kenmore. Yet there was no movement toward a transaction in the following months.

On Tuesday, ESL submitted a more detailed -- but still non-binding -- proposal to acquire SHIP for $70 million (plus up to $10 million in contingent payments depending on the unit's earnings). It also offered $400 million for Kenmore. ESL has put its proposal to buy Parts Direct on the back burner due to the complexity of disentangling it from the rest of Sears' operations.

ESL hopes to sign contracts for SHIP and Kenmore by August 24 and close both deals within 60 to 90 days. Sears Holdings would have an opportunity to seek out better offers for both business units and could back out of the proposed deals with ESL without penalty.

Disappointing valuations

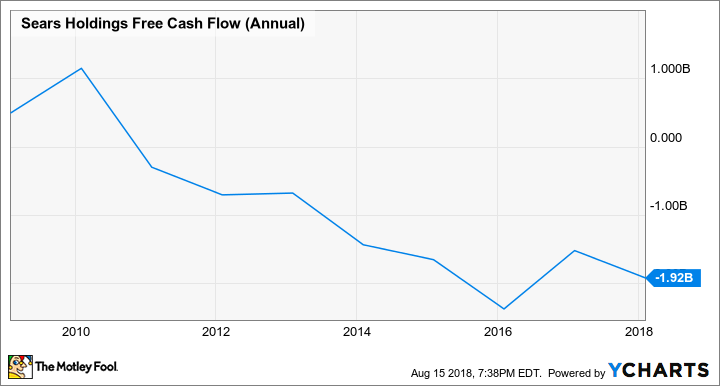

Obviously, $470 million is a substantial chunk of cash, even for a company the size of Sears Holdings. But that sum pales in comparison to the company's recent losses. Sears has burned at least $1 billion of cash in each of the last five years, and 2018 is on track to be no different.

Sears Holdings Free Cash Flow (Annual), data by YCharts.

Furthermore, the few remaining Sears bulls were probably hoping that ESL would offer more money for these assets. ESL's earlier tentative offer of $500 million for SHIP and Parts Direct clearly put most of the value on the latter business, which is now likely to stay attached to Sears Holdings at least through the end of 2018.

Meanwhile, Kenmore had been expected to "fetch at least $500 million in a sale," according to an April article in The Wall Street Journal. It's still possible that another buyer will emerge to top ESL's $400 million offer -- but it's not likely. Kenmore has been on the auction block for years and hasn't received any serious interest from other potential buyers.

Real estate is Sears Holdings' only hope

In the recent letter from ESL to the special committee of Sears' board that's evaluating asset sales, Lampert's hedge fund said it would consider buying virtually all of Sears' remaining owned real estate. Lampert had previously raised this possibility back in April, but the new letter was more forceful in recommending this course of action.

Lampert, on behalf of ESL, highlighted that selling the remaining real estate in bulk would speed up the process of monetizing it and provide greater certainty as to the sale price. Given Sears Holdings' dire financial straits, it's hard to argue with that logic.

However, Sears Holdings only owned 307 of its stores as of the beginning of this year, and 138 of those properties were appraised at an average of $7.1 million each. If that figure is roughly accurate for the company's other stores, it would imply a total value of slightly more than $2 billion for Sears-owned stores. Furthermore, Sears has sold hundreds of millions of dollars of real estate since the beginning of the year to raise cash.

Including the value of below-market leases, distribution centers, and the corporate headquarters, Sears still might have as much as $3 billion of real estate, offset by more than $1 billion of real estate debt. Yet even if Sears Holdings could raise $1.5 billion (net of debt) from selling the rest of its property, it might only delay the company's demise by a year or two.

At this point, the possibility of a big real estate-related windfall is one of the last sources of hope for Sears bulls. Depending on what ESL offers for the remaining real estate, that final hope could disappear quickly, making a bankruptcy filing even more inevitable.

More From The Motley Fool

Adam Levine-Weinberg has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.