Certified Coffee Demand on the Rise: Insights into Raw Coffee Beans Market

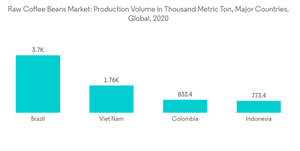

Raw Coffee Beans Market Raw Coffee Beans Market Production Volume In Thousand Metric Ton Major Countries Global 2020

Dublin, Sept. 01, 2023 (GLOBE NEWSWIRE) -- The "Raw Coffee Beans Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)" report has been added to ResearchAndMarkets.com's offering.

The Raw Coffee Beans Market size is expected to grow from USD 33.33 billion in 2023 to USD 44.60 billion by 2028, at a CAGR of 6% during the forecast period (2023-2028).

Key Highlights

Coffee beans are a global agricultural product shipped worldwide, providing livelihood for millions of coffee growers and producers. While coffee production is concentrated in developing countries, its consumption mainly occurs in developed and emerging economies. The coronavirus restrictions led to shipment delays and increased freight prices, and overland transportation became difficult for smallholder farmers who often receive low prices for their produce.

Coffee farming communities in Indonesia face overlapping crises as market volatility, climate change, and gender inequity pose critical challenges to rural communities and agricultural enterprises.

Globally, Europe is the world's largest consumer and exporter of raw coffee beans, accounting for more than 28% of global consumption. The growth of the global market for coffee beans is driven by their taste when consumed as a beverage.

Raw Coffee Beans Market Trends

Increasing Demand for Certified Coffee

Due to rising consumer concerns regarding the sourcing and quality of coffee, the demand for certified coffee is increasing globally. Certified coffee is an assurance to the consumer about the reliability of the product. These certifications offer various third-party assurances to the consumer regarding environment-friendly farming practices and the quality involved during the production of coffee.

As a result, some of the coffee certification organizations, such as Fair Trade Certification, Rainforest Alliance Certification, UTZ Certification, and USDA Organic Certification, are engaged in keeping a check on the production procedures and supply chain of coffee. These certifications help improve the quality of life of workers and help them gain adequate market access through increased trade of certified coffee.?

Many Fairtrade coffee growers also have organic certifications that ensure environmentally sustainable production. In Indonesia, around 25 Fairtrade-certified coffee cooperatives, and 98 percent of them have organic certifications. Having organic and Fairtrade certifications increase market opportunities for coffee growers and enable them to fetch higher prices from consumers willing to pay a premium for sustainable coffee.

Among all the certifications, UTZ Certification or the rainforest alliance is an important certification that allows farmers to grow coffee professionally with care for local communities and the environment. The most important aspect of the UTZ certification program is traceability, which means that consumers can know exactly where their coffee comes from and how it was produced. This makes the consumers more inclined towards purchasing certified coffee, thereby fueling the growth of the market during the forecast period.

South America Dominates the Export Market

In South America, Brazil is the world's largest coffee producer and exporter, responsible for 40% of the world's total production, with 69.9 million bags in 2021. Due to its major production and exportation role in the global coffee market, Brazil has also been recognized for its commitment to quality and social sustainability parameters based on voluntary sustainability standards (VSS) and geographic identification (GI). In 2021, Brazil held a share of 30.2% of the coffee production worldwide, followed by Vietnam and Indonesia, with 18.6% and 7.7%, respectively.

According to Food and Agriculture Organization (FAO), coffee plantations in Brazil covered about 11.3 hectares in 2021. Minas Gerais, Espirito Santo, Sao Paulo, and Parana are the main coffee-producing regions.

These regions produced 3 million metric tons of coffee in 2021, of which 2.3 million metric tons were exported. The major countries that imported raw coffee beans from Brazil as of 2021 were the United States (USD 1.12 million), Germany (USD 1.1 million), Belgium (USD 4.9 million), and Italy (USD 4.8 million), among others. Brazil is also the second-largest consumer of coffee.

Brazil's major green bean export destinations include Germany, the United States, Italy, Belgium, and Japan. Other key exporters of coffee beans include Vietnam, Colombia, Germany, Indonesia, and Honduras.

However, the existence of economic and social barriers plays salient challenges for farmers to meet the quality standards as well as GI protocols among other market compliance tools, in addition to the correct value appropriation arising for quality sustainable adopted strategies by coffee farmers in Brazil.

For more information about this report visit https://www.researchandmarkets.com/r/978wpl

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900