Cerus Corp (CERS) Posts Narrowed Q4 Net Loss and Achieves Adjusted EBITDA Breakeven

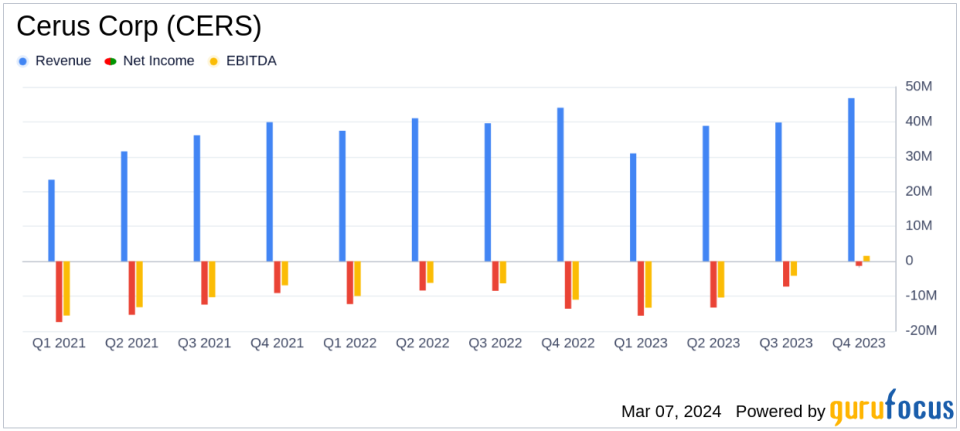

Q4 Revenue Growth: Cerus Corp (NASDAQ:CERS) reported a 6% increase in Q4 product revenue, reaching $46.8 million.

Net Loss Improvement: Q4 net loss narrowed to $1.3 million, a significant improvement from the $13.6 million loss in the same quarter last year.

Adjusted EBITDA: Achieved a positive adjusted EBITDA of $4.7 million in Q4, compared to a negative $3.7 million in Q4 of the previous year.

Full-Year Revenue Guidance: Cerus Corp reiterates its 2024 product revenue guidance range of $172-175 million.

Operating Expenses: Q4 operating expenses decreased by 24% year-over-year, reflecting the impact of the June 2023 restructuring initiative.

Cash Position: Cash and cash equivalents and short-term investments stood at $65.9 million at the end of 2023.

On March 5, 2024, Cerus Corp (NASDAQ:CERS) released its 8-K filing, detailing the financial results for the fourth quarter and the full year ended December 31, 2023. The company, known for its INTERCEPT Blood System designed to ensure blood transfusion safety, reported a sequential revenue growth in the fourth quarter, driven by sales in North America.

Financial Performance and Challenges

Cerus Corp (NASDAQ:CERS) experienced a 6% increase in product revenue during the fourth quarter of 2023, amounting to $46.8 million, compared to $44.0 million during the prior year period. This growth was primarily driven by the expansion of INTERCEPT platelet sales in North America. However, the full-year 2023 product revenue saw a 4% decline to $156.4 million from $162.1 million in the previous year, influenced by customer ordering patterns and market dynamics.

Despite the challenges, the company narrowed its GAAP net loss to $1.3 million for the fourth quarter and achieved its goal of adjusted EBITDA breakeven, indicating a significant improvement in financial health. This performance is crucial as it demonstrates Cerus Corp's ability to manage expenses and move towards profitability, a key consideration for investors in the Medical Devices & Instruments industry.

Financial Achievements and Importance

The company's financial achievements include a stable product gross margin of 55.5% for the fourth quarter and an improved full-year product gross margin of 55.3%, up from 53.7% the previous year. These margins reflect Cerus Corp's efficiency in managing production costs and its ability to maintain profitability despite revenue fluctuations.

Total operating expenses for the fourth quarter were significantly reduced by 24% year-over-year, totaling $31.6 million, which can be attributed to the company's restructuring initiatives and lower non-cash stock-based compensation. This reduction in expenses is a positive indicator of the company's commitment to optimizing its cost structure and improving its bottom line.

Key Financial Metrics and Commentary

Key financial metrics from the earnings report include:

"Our fourth quarter performance sets the stage well for what we expect will be sustainable growth, beginning in 2024," stated William Obi Greenman, Cerus president and chief executive officer. "It is encouraging to see that pathogen inactivation has secured its position as a foundational technology for blood safety and availability across the globe, and we are excited about the opportunities ahead of us for expanding its reach."

Furthermore, the company's balance sheet reflects a solid financial position with cash and cash equivalents and short-term investments totaling $65.9 million at the end of 2023. The company also reported a net cash used in operating activities of $15.2 million for the fourth quarter and $43.2 million for the full year.

Analysis and Outlook

Cerus Corp's performance in the fourth quarter of 2023 indicates a promising trajectory towards sustainable growth. The company's ability to narrow its net loss and achieve adjusted EBITDA breakeven are significant milestones. With the reiteration of its full-year 2024 product revenue guidance range, Cerus Corp demonstrates confidence in its commercial strategy and the ongoing expansion of its INTERCEPT Blood System.

As Cerus Corp continues to navigate the complexities of the blood transfusion safety market, its focus on managing operating expenses and capitalizing on growth opportunities in North America and internationally will be key to its success. Investors and potential members of GuruFocus.com should consider the company's strategic positioning and financial resilience when evaluating its potential for long-term value creation.

Explore the complete 8-K earnings release (here) from Cerus Corp for further details.

This article first appeared on GuruFocus.