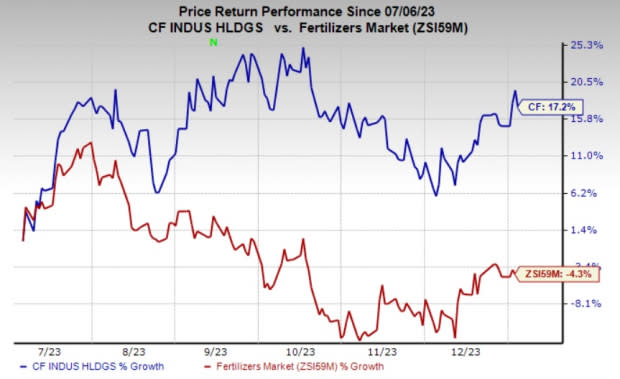

CF Industries (CF) Up 17% in 6 Months: What's Driving the Stock?

CF Industries Holdings, Inc.’s CF shares have gained 17.2% over the past six months. The fertilizer maker has also outperformed its industry’s decline of 4.3% over the same time frame. Moreover, it has topped the S&P 500’s 5.6% rise over the same period.

Let’s take a look at the factors behind this Zacks Rank #3 (Hold) stock’s price appreciation.

Image Source: Zacks Investment Research

Higher Nitrogen Demand, Lower Gas Costs Aid CF

CF Industries is gaining from healthy nitrogen fertilizer demand in major markets and lower natural gas costs amid headwinds from lower nitrogen prices. It is well-placed to capitalize on rising nitrogen fertilizer demand in major markets. Higher crop commodity prices are contributing to healthy demand globally.

Demand for nitrogen is expected to be driven, in North America, by high levels of corn planted acres in the United States, low channel inventories and favorable farm economics. Increased planted corn acres and healthy farm economics are also likely to support urea demand in Brazil. Urea demand in India is also being supported by strong agricultural production.

Lower natural gas prices are also acting in the company’s favor. CF Industries saw a significant decline in natural gas costs in the third quarter of 2023. Average cost of natural gas fell to $2.54 per MMBtu in the third quarter from $8.35 per MMBtu in the year-ago quarter. Lower natural gas costs led to a decline in the company's cost of sales. The benefits of reduced gas costs are expected to continue in the fourth quarter.

CF Industries also remains committed to boosting shareholders’ value by leveraging strong cash flows. During the first nine months of 2023, the company repurchased 5 million shares for $355 million, which included the purchase of 1.9 million shares for $150 million in the third quarter.

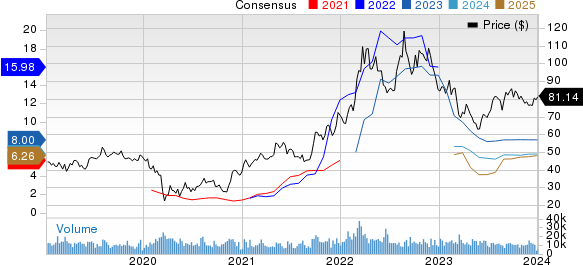

CF Industries Holdings, Inc. Price and Consensus

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include, Cameco Corporation CCJ, Axalta Coating Systems Ltd. AXTA and Quaker Chemical Corporation KWR.

Cameco has a projected earnings growth rate of 156% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 20.8% over the past 60 days. The stock is up around 75% in a year. CCJ currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the consensus estimate for Axalta Coating Systems’ current-year earnings has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #2 (Buy), beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained around 23% in the past year.

Quaker Chemical, currently carrying a Zacks Rank #2, has a projected earnings growth rate of 28.3% for the current year. KWR has a trailing four-quarter earnings surprise of roughly 16.7%, on average. KWR shares have gained 14% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Quaker Houghton (KWR) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report