CF Industries (CF) Completes IPL Waggaman Facility Acquisition

CF Industries Holdings, Inc. CF successfully concluded its acquisition of Incitec Pivot Limited's (“IPL”) ammonia production complex in Waggaman, Louisiana. The purchase includes the Waggaman ammonia plant and associated assets, with CF Industries paying $1.675 billion, subject to adjustments.

Approximately $425 million of the acquisition cost is allocated to a long-term ammonia offtake agreement, wherein CF Industries will supply IPL’s Dyno Nobel subsidiary with up to 200,000 tons of ammonia annually at production economics. The remaining purchase price was financed using CF Industries' existing cash resources.

CF Industries is content with the successful expansion of its ammonia production capabilities, which was achieved through the inclusion of IPL's Waggaman facility and its skilled team. The company emphasized the strategic nature of this move, which effectively deploys capital to ensure immediate and profitable growth. By integrating one of North America's most recent ammonia production units into its existing network, CF Industries is strategically positioning itself for success. This acquisition aligns seamlessly with CF’s long-term strategic focus on low-carbon ammonia as a clean and sustainable energy source.

Apart from the offtake agreement with IPL, CF Industries will honor existing medium- and long-term offtake agreements with two customers predating the acquisition. The company expects these agreements to yield a gross margin per ton comparable to its existing ammonia segment. CF Industries also plans to optimize capacity utilization and operational logistics at the Waggaman site, enhancing overall efficiency. The company aims to expedite the implementation of carbon capture and sequestration technologies at the facility. This accelerated timeline is expected to increase the network's low-carbon ammonia production capacity, with the added benefit of qualifying for 45Q tax credits for sequestered carbon dioxide.

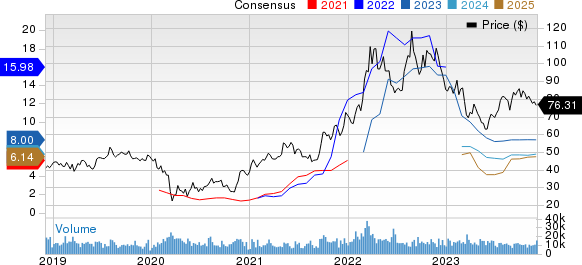

CF’s shares have fallen 26.9% in the past year compared with the industry's 33.6% decline in the same period.

Image Source: Zacks Investment Research

In the third quarter of 2023, CF Industries reported a decline in earnings to 85 cents per share from $2.18 in the year-ago quarter, falling short of the Zacks Consensus Estimate of 94 cents. The company saw a 45% year-over-year plunge in net sales, totaling $1,273 million and missing the Zacks Consensus Estimate of $1,294.3 million. The downside was caused by lower average selling prices, influenced by increased global supply availability amid lower global energy costs, leading to higher operating rates.

CF Industries expects a positive outlook for the global nitrogen supply-demand balance, citing robust demand from the agricultural sector and elevated energy costs based on forward energy curves. Consequently, the company envisions substantial margin opportunities for low-cost North American producers in line with the global nitrogen cost curve. The company predicts solid demand through the end of the current year and into 2024, particularly driven by growth in India and Brazil.

CF Industries Holdings, Inc. Price and Consensus

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

Zacks Rank & Key Picks

CF currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and The Andersons Inc. ANDE and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have rallied 19.3% in the past year.

The Zacks Consensus Estimate for ANDE’s current-year earnings has been revised upward by 5.1% in the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.8% on average. ANDE’s shares have rallied around 39.6% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents, indicating year-over-year growth of 89.3%. AGI beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 48.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report