CF Industries (CF) to Report Q4 Earnings: What's in Store?

CF Industries Holdings, Inc. CF is set to release fourth-quarter 2023 results on Feb 14, after the closing bell.

CF Industries beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters while missing it once. The company delivered a trailing four-quarter earnings surprise of 7.4%, on average. CF’s fourth-quarter results are likely to reflect the impacts of softer nitrogen prices. However, it is expected to have benefited from healthy nitrogen fertilizer demand in major markets and lower natural gas costs.

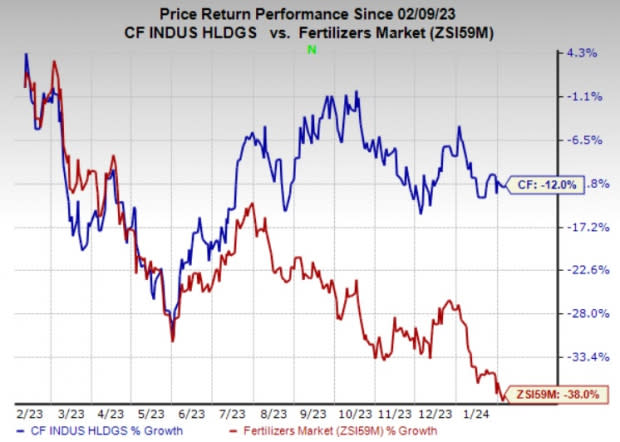

Shares of CF Industries have declined 12% in the past year compared with a 38% decline of the industry.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What Do the Estimates Indicate?

The Zacks Consensus Estimate for CF Industries' fourth-quarter total sales is currently pegged at $1,486.7 million, which indicates a 43% decline year over year.

Our estimate for total sales in the Ammonia segment is currently pegged at $368.4 million, indicating a 54.2% decline on a year-over-year basis. The same for the Granular Urea segment is $417.5 million, which suggests a decrease of 31%.

Our estimate for sales of the Urea Ammonium Nitrate Solution segment currently stands at $469.6 million, which suggests a decline of 44.4% year over year.

Our estimate for total sales of the Ammonium Nitrate segment is $116.7 million, which indicates a decline of 38.3% year over year.

Factors at Play in Q4

CF Industries is expected to have benefited from higher global demand for nitrogen fertilizers, being driven by strong agricultural demand. Demand for nitrogen is likely to have remained healthy in the fourth quarter on the back of higher crop commodity prices, high levels of corn planted acres and favorable farm economics. Additionally, lower natural gas prices are expected to have led to a decline in the company's cost of sales in the quarter to be reported.

However, softer nitrogen prices are likely to have been a challenge for CF Industries. Global nitrogen prices have declined since the beginning of 2023. Higher global supply availability driven by higher global operating rates due to lower global energy costs has resulted in a decline in prices. Lower average selling prices weighed on CF's top line in the third quarter. The weak pricing environment is likely to have persisted in the fourth quarter as well. Lower pricing is expected to have hurt CF’s sales and profitability.

CF Industries Holdings, Inc. Price and EPS Surprise

CF Industries Holdings, Inc. price-eps-surprise | CF Industries Holdings, Inc. Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for CF Industries this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for CF Industries is -1.49%. The Zacks Consensus Estimate for the fourth quarter is currently pegged at $1.56. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: CF Industries currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Nutrien Ltd. NTR, scheduled to release earnings on Feb 21, has an Earnings ESP of +8.52% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for NTR’s earnings for the fourth quarter is currently pegged at 72 cents.

Agnico Eagle Mines Limited AEM, slated to release earnings on Feb 15, has an Earnings ESP of +6.14% and carries a Zacks Rank #3 at present.

The consensus mark for AEM’s fourth-quarter earnings is currently pegged at 46 cents.

Kinross Gold Corporation KGC, scheduled to release fourth-quarter earnings on Feb 14, has an Earnings ESP of +13.51%.

The Zacks Consensus Estimate for Kinross' earnings for the fourth quarter is currently pegged at 9 cents. KGC currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report