CF Industries Holdings Inc Reports Full Year 2023 Earnings Amidst Global Energy Shifts

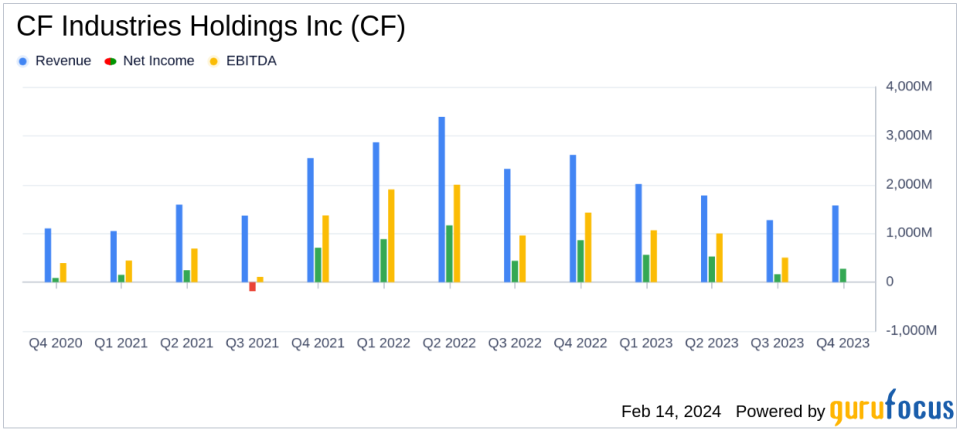

Net Earnings: $1.53 billion for the full year 2023, a decrease from $3.35 billion in 2022.

Adjusted EBITDA: $2.76 billion for the full year, down from $5.88 billion in the previous year.

Net Sales: Decreased to $6.63 billion in 2023 from $11.19 billion in 2022.

Free Cash Flow: Reported at $1.80 billion for the full year 2023.

Dividend: Quarterly dividend increased by 25% to $0.50 per common share.

Share Repurchase: Approximately 7.9 million shares repurchased for $580 million during 2023.

Green Initiatives: Progress on green ammonia project and carbon capture at Donaldsonville Complex.

On February 14, 2024, CF Industries Holdings Inc (NYSE:CF) released its 8-K filing, detailing its financial performance for the full year and fourth quarter ended December 31, 2023. CF Industries, a global leader in hydrogen and nitrogen products, reported a full year net earnings of $1.53 billion, or $7.87 per diluted share, and adjusted EBITDA of $2.76 billion. These figures represent a decline from the previous year's net earnings of $3.35 billion and adjusted EBITDA of $5.88 billion, reflecting the impact of lower global energy costs on selling prices.

CF Industries operates nitrogen manufacturing plants primarily in North America and is known for using low-cost U.S. natural gas as a feedstock, positioning it as one of the lowest-cost nitrogen producers globally. The company's strategic focus includes investing in carbon-free blue and green ammonia, contributing to the transition to clean energy.

Operational Highlights and Financial Overview

The company's operational performance remained strong, with gross ammonia production for the full year at approximately 9.5 million tons. The acquisition of the Waggaman ammonia production facility and the advancement of clean energy strategies were among the key highlights of the year.

Despite the decrease in net earnings and adjusted EBITDA, CF Industries achieved a net cash from operating activities of $2.76 billion and a robust free cash flow of $1.80 billion. The company also made significant progress on its green ammonia project at the Donaldsonville Complex and is on track to produce approximately 20,000 tons of green ammonia per year.

The company's financial results reflect the challenges posed by lower global energy costs, which have reduced the global market clearing price required to meet demand. However, CF Industries' North American-based production network presents attractive margin opportunities due to positive energy spreads.

Strategic Growth and Shareholder Returns

CF Industries' strategic initiatives, including the acquisition of the Waggaman facility and investments in low-carbon ammonia production, demonstrate its commitment to growth and sustainability. The company's capital management strategy also included the repurchase of 7.9 million shares for $580 million during 2023, underscoring its focus on creating shareholder value.

The Board of Directors declared a quarterly dividend of $0.50 per common share, representing a 25% increase from the prior dividend, reflecting confidence in the company's cash generation capabilities. Additionally, CF Industries made a semi-annual distribution payment to CHS Inc. of $144 million for the distribution period ended December 31, 2023.

Market Outlook and Future Prospects

Looking ahead, CF Industries anticipates a constructive global nitrogen supply-demand balance in the near term and a tightening balance in the medium term. The company expects resilient global nitrogen demand driven by strong agricultural applications and recovering industrial demand.

CF Industries' strategic initiatives, including the proposed greenfield low-carbon ammonia plant at the Blue Point Complex and the Donaldsonville Complex green ammonia project, position the company to capitalize on the growing demand for low-carbon ammonia and contribute to the global transition to clean energy.

The company's focus on operational efficiency, strategic growth, and shareholder returns, combined with its commitment to sustainability, positions CF Industries well for the future in a changing global energy landscape.

For more detailed financial information and the full earnings report, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from CF Industries Holdings Inc for further details.

This article first appeared on GuruFocus.