CF Industries Holdings Inc's Meteoric Rise: Unpacking the 30% Surge in Just 3 Months

CF Industries Holdings Inc (NYSE:CF), a leading player in the agriculture industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $15.98 billion and a stock price of $82.83, the company's stock has gained 7.71% over the past week and a remarkable 29.61% over the past three months. This article aims to provide an in-depth analysis of the factors contributing to this impressive performance.

Stock Performance and Valuation

One of the key metrics to consider when evaluating a stock's performance is the GF Value. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, CF's GF Value stands at $89.07, compared to $105.53 three months ago. This indicates that the stock, which was significantly undervalued three months ago, is now fairly valued. This shift in valuation is a testament to the company's strong performance and growth prospects.

Company Overview

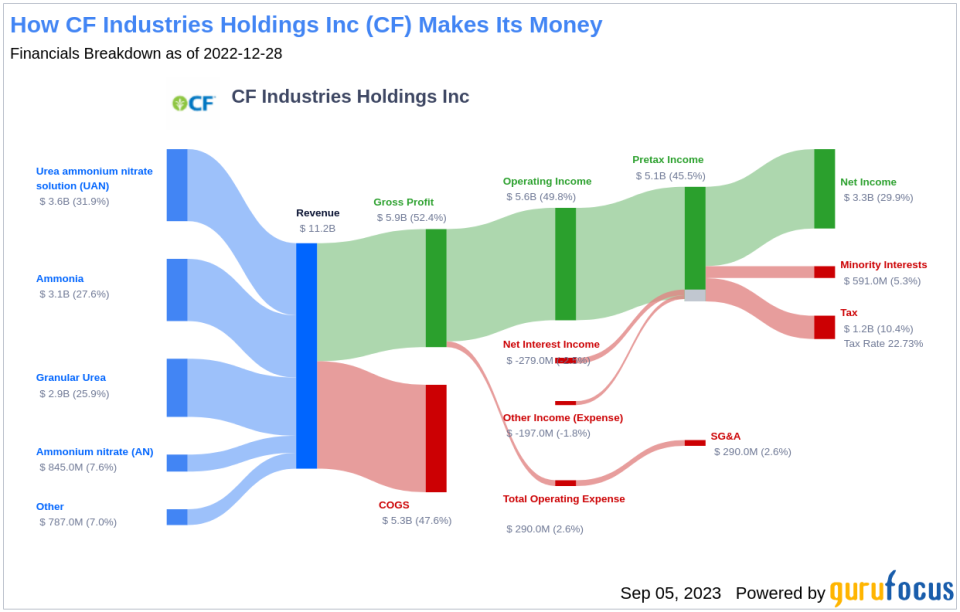

CF Industries is a leading producer and distributor of nitrogen fertilizers. The company operates seven nitrogen facilities in North America and holds joint venture interests in further production capacity in the United Kingdom and Trinidad and Tobago. CF makes nitrogen primarily using low-cost U.S. natural gas as its feedstock, making CF one of the lowest-cost nitrogen producers globally. The company is also investing in carbon-free blue and green ammonia, which can be used an alternative fuel to hydrogen or as a means to transport hydrogen.

Profitability Analysis

CF Industries boasts a high Profitability Rank of 9/10, indicating a high level of profitability. The company's Operating Margin stands at 41.09%, better than 95.63% of 229 companies in the industry. Its ROE and ROA are 47.06% and 17.81% respectively, both outperforming a majority of companies in the industry. The company's ROIC of 28.16% is also impressive, better than 92.56% of 242 companies. Over the past 10 years, CF Industries has been profitable for 9 years, better than 57.73% of 220 companies.

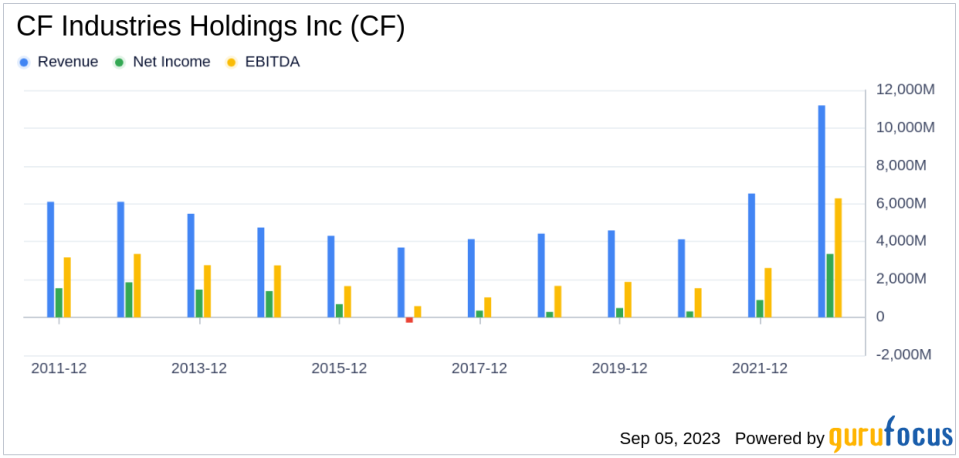

Growth Prospects

CF Industries has a Growth Rank of 10/10, indicating strong growth. The company's 3-Year and 5-Year Revenue Growth Rate per Share are 38.30% and 22.10% respectively, outperforming a majority of companies in the industry. However, the company's future total revenue growth rate is estimated to be -18.10%, which is still better than 0% of 19 companies. The company's 3-Year and 5-Year EPS without NRI Growth Rate are 94.40% and 54.10% respectively, both outperforming a majority of companies in the industry. The future EPS without NRI Growth Rate is estimated to be -13.68%, which is still better than 20% of 5 companies.

Major Stock Holders

The top three holders of CF Industries Holdings Inc's stock are T Rowe Price Equity Income Fund (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Ray Dalio (Trades, Portfolio), holding 2.04%, 0.82%, and 0.17% of the company's stock respectively.

Competitive Landscape

CF Industries operates in a competitive landscape with major competitors including The Mosaic Co (NYSE:MOS) with a market cap of $13.27 billion, FMC Corp (NYSE:FMC) with a market cap of $10.49 billion, and The Scotts Miracle Gro Co (NYSE:SMG) with a market cap of $3.03 billion.

Conclusion

In conclusion, CF Industries Holdings Inc's impressive stock performance, high profitability, strong growth prospects, and strategic investments make it a compelling option for investors. Despite the competitive landscape, the company's strong fundamentals and future growth prospects position it well for continued success.

This article first appeared on GuruFocus.