CFO Baird William D III Sells 7,031 Shares of 2seventy bio Inc (TSVT)

On August 22, 2023, Baird William D III, the Chief Financial Officer of 2seventy bio Inc, sold 7,031 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 18,873 shares sold and no shares purchased.

2seventy bio Inc is a biotechnology company focused on the development and commercialization of novel treatments for cancer. The company's innovative approach leverages the body's immune system to fight cancer, with a particular focus on hematologic malignancies and solid tumors. The company's shares were trading at $5.49 each on the day of the insider's recent sale, giving the company a market cap of $276.041 million.

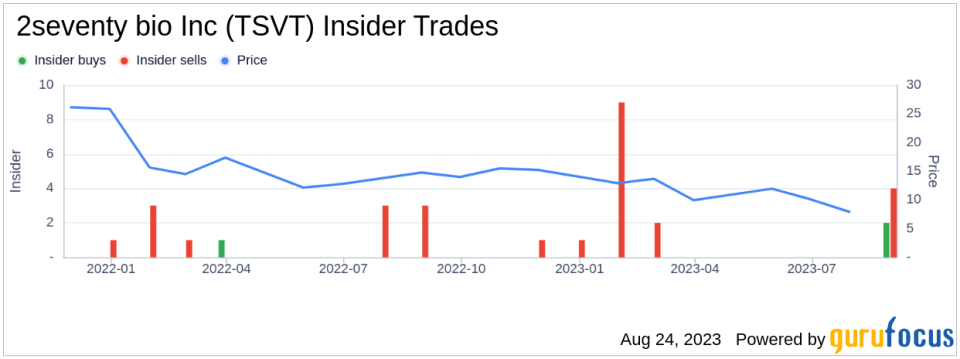

The insider's recent sale is part of a broader trend within the company. Over the past year, there have been 19 insider sells and 2 insider buys. This trend is illustrated in the following image:

The relationship between insider transactions and stock price is complex and multifaceted. In general, insider selling can be seen as a bearish signal, suggesting that those with the most knowledge about the company's prospects are choosing to reduce their holdings. However, it's important to note that insiders may sell shares for a variety of reasons, not all of which are related to their expectations for the company's future performance.

In the case of 2seventy bio Inc, the insider's recent sale comes at a time when the company's stock price is relatively low, which could suggest that the insider believes the stock's price may not increase significantly in the near future. However, without more information about the insider's motivations, it's difficult to draw definitive conclusions.

It's also worth noting that the insider's recent sale represents a relatively small portion of the total shares sold by insiders over the past year. This could suggest that the insider's sale is not indicative of a broader trend within the company.

In conclusion, while the insider's recent sale of 2seventy bio Inc shares is noteworthy, it's important to consider this transaction in the context of the broader trends within the company and the potential motivations behind the insider's decision to sell.

This article first appeared on GuruFocus.