CFO Daniel Fleming Sells 17,500 Shares of Credo Technology Group Holding Ltd (CRDO)

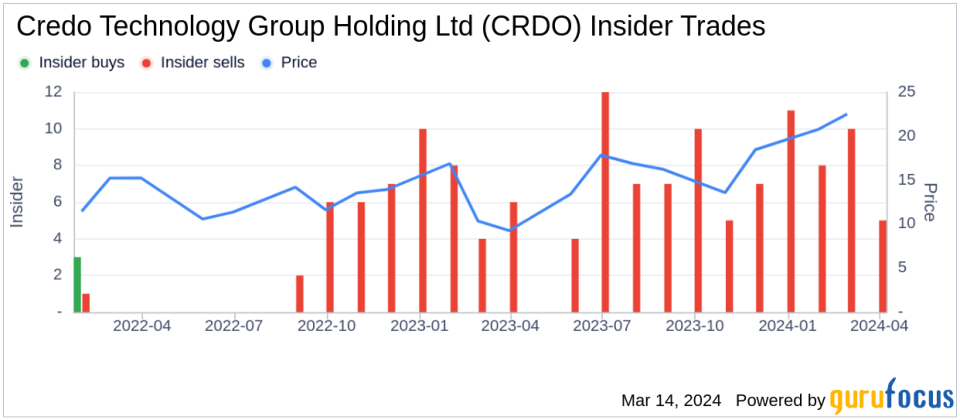

Credo Technology Group Holding Ltd (NASDAQ:CRDO), a company specializing in high-performance serial connectivity solutions, has reported an insider sale according to a recent SEC filing. Daniel Fleming, the Chief Financial Officer of the company, sold 17,500 shares of Credo Technology Group Holding Ltd on March 11, 2024. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this SEC Filing.Over the past year, the insider has sold a total of 116,200 shares of Credo Technology Group Holding Ltd and has not made any purchases of the stock. The recent sale by the insider is part of a trend observed over the past year, where there have been no insider buys but a total of 86 insider sells for the company.

On the date of the insider's most recent transaction, shares of Credo Technology Group Holding Ltd were trading at $21.45 each, valuing the company at a market cap of $3.177 billion.Credo Technology Group Holding Ltd is known for its innovative approach to delivering high-speed connectivity solutions that are integral to the infrastructure of data centers and advanced computing systems. Their products are designed to improve the efficiency and performance of data movement, which is critical in today's data-driven world.The trading activity of insiders such as Daniel Fleming is closely watched by investors as it can provide insights into the company's performance and insider perspectives on the stock's value. However, it is important to note that insider transactions are not necessarily indicative of future stock performance and may be subject to various personal financial considerations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.