CFO Dylan Smith Sells 13,000 Shares of Box Inc

On October 10, 2023, Dylan Smith, the Chief Financial Officer of Box Inc (NYSE:BOX), sold 13,000 shares of the company. This move is part of a trend for the insider, who has sold a total of 156,000 shares over the past year and made no purchases.

Dylan Smith is a co-founder of Box Inc and has served as the company's CFO since its inception. He has played a crucial role in the company's financial strategy and growth, overseeing its initial public offering in 2015 and its financial operations since then.

Box Inc is a leading cloud content management platform that enables organizations of all sizes to securely manage and share their files and documents. The company's platform integrates with the leading enterprise business applications, and is compatible with multiple file formats and devices, providing a flexible and secure solution for managing and sharing business information.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. The stock was trading at $25.46 per share on the day of the sale, giving the company a market cap of $3.65 billion. The price-earnings ratio stands at 133.26, significantly higher than the industry median of 26.82, suggesting that the stock may be overvalued.

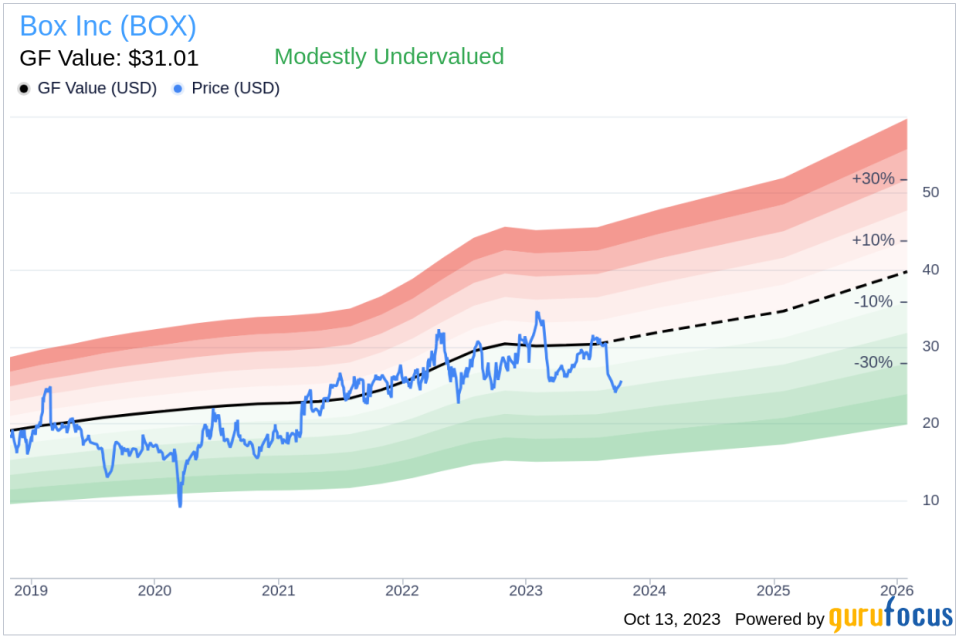

However, the GuruFocus Value of $31.01 indicates that the stock is modestly undervalued. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider's selling activity over the past year contrasts with the overall insider trend for Box Inc. There have been no insider buys over the past year, and 26 insider sells, suggesting a bearish sentiment among the company's insiders.

The relationship between insider selling and stock price is complex. While insider selling can sometimes indicate a lack of confidence in the company's future prospects, it can also be a personal financial decision unrelated to the company's performance. In the case of Dylan Smith, the insider's consistent selling activity over the past year may be a cause for concern for investors. However, the stock's modest undervaluation according to the GF Value suggests that there may still be potential for growth.

Investors should keep a close eye on the insider's future trading activity and the company's financial performance to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.