CFO Dylan Smith Sells 13,000 Shares of Box Inc

On September 11, 2023, Dylan Smith, the Chief Financial Officer of Box Inc (NYSE:BOX), sold 13,000 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 156,000 shares and purchased none.

Dylan Smith is a co-founder of Box Inc and has served as the company's CFO since its inception in 2005. He has played a crucial role in the company's financial strategy and growth, overseeing its successful transition from a startup to a publicly-traded company with a market cap of $3.63 billion.

Box Inc is a leading cloud content management platform that enables organizations of all sizes to securely manage and share their content. The company's platform integrates with the leading enterprise business applications, and its open API enables customers to integrate Box services into their own custom applications.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. The insider transaction history for Box Inc shows no insider buys over the past year, but 25 insider sells. This trend suggests that insiders may see the stock as overvalued or anticipate a downturn.

On the day of the insider's recent sell, Box Inc shares were trading at $25.88, giving the company a market cap of $3.63 billion. The price-earnings ratio was 132.55, higher than the industry median of 27.3 but lower than the company's historical median price-earnings ratio.

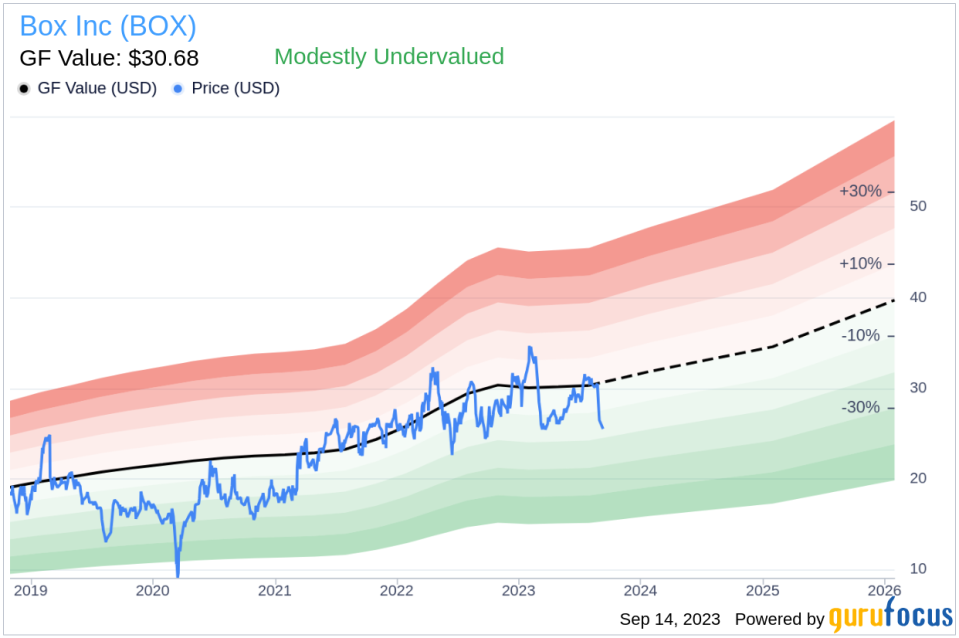

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Box Inc is modestly undervalued. The stock's price-to-GF-Value ratio is 0.84, with a GF Value of $30.68 compared to the current price of $25.88.

While the insider's sell-off may raise concerns, the company's modest undervaluation suggests potential for future growth. However, investors should keep a close eye on further insider transactions and the company's financial performance to make informed investment decisions.

As always, insider transactions should not be used in isolation to make investment decisions. Instead, they should be used as a tool to better understand the company's financial health and the sentiment of those closest to it.

This article first appeared on GuruFocus.