CFO Mitch Hill Sells 6,500 Shares of Inari Medical Inc

On September 12, 2023, Mitch Hill, the Chief Financial Officer of Inari Medical Inc (NASDAQ:NARI), sold 6,500 shares of the company. This move is part of a broader trend of insider selling at Inari Medical Inc, which we will explore in more detail.

Mitch Hill is a seasoned executive with a wealth of experience in the medical device industry. As CFO of Inari Medical Inc, he plays a crucial role in the company's financial strategy and operations. His decision to sell shares is therefore noteworthy and may signal his views on the company's future prospects.

Inari Medical Inc is a medical device company focused on developing products to treat and transform the lives of patients suffering from venous diseases. The company's innovative solutions have made it a leader in its field, but the recent insider selling raises questions about its future growth.

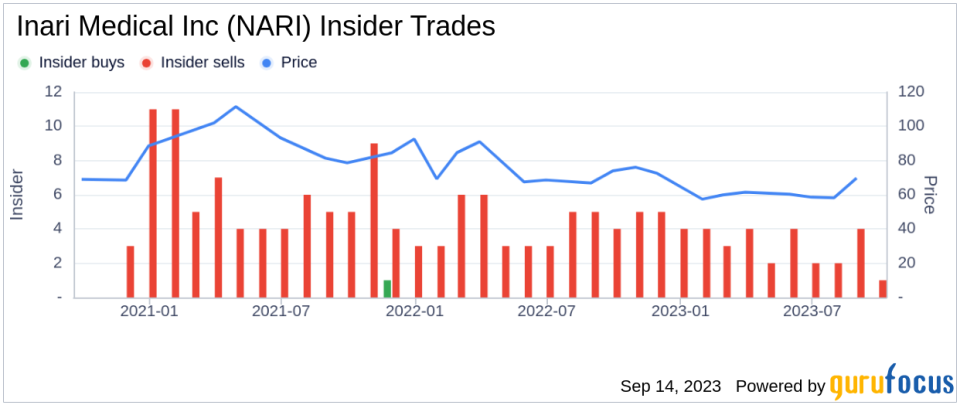

Over the past year, the insider has sold a total of 128,000 shares and purchased 0 shares. This trend is mirrored in the broader insider transaction history for Inari Medical Inc, which shows 0 insider buys and 41 insider sells over the past year.

The relationship between insider selling and stock price is complex. While insider selling can sometimes be a bearish signal, it's important to consider the context. In this case, the insider's selling has not led to a significant drop in the stock price. On the day of the insider's recent sale, shares of Inari Medical Inc were trading for $67.85 apiece, giving the stock a market cap of $3.86 billion.

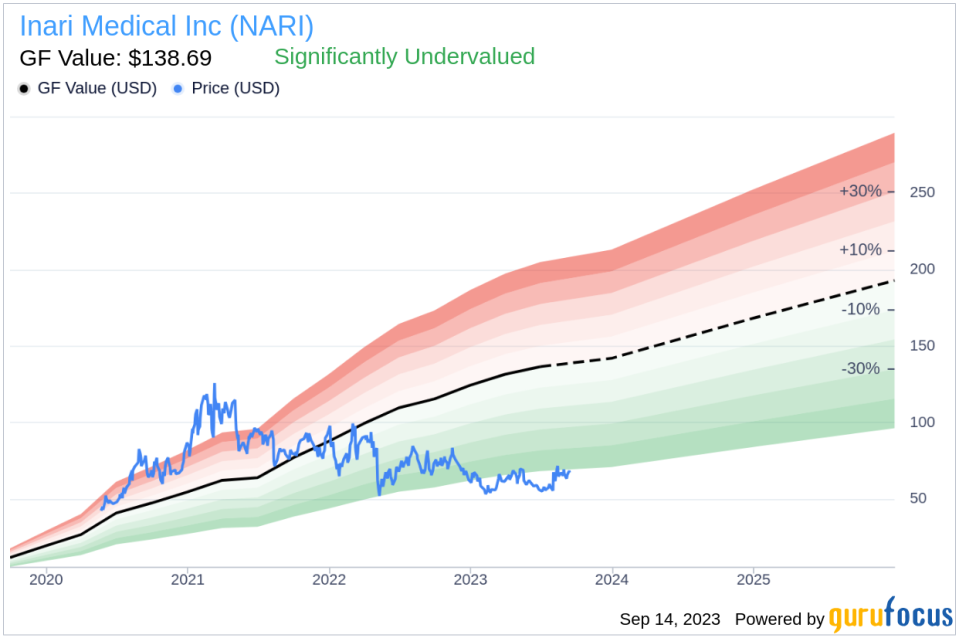

Despite the insider selling, Inari Medical Inc appears to be significantly undervalued based on its GF Value. With a price of $67.85 and a GuruFocus Value of $138.69, the stock has a price-to-GF-Value ratio of 0.49.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent selling activity may raise some eyebrows, the stock's current valuation suggests that Inari Medical Inc may still be a good investment opportunity. As always, investors should conduct their own due diligence and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.