CFO Nicola Allais Sells 18,462 Shares of DoubleVerify Holdings Inc (DV)

On September 14, 2023, Nicola Allais, the Chief Financial Officer of DoubleVerify Holdings Inc (NYSE:DV), sold 18,462 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 221,134 shares sold and no shares purchased.

Nicola Allais has been with DoubleVerify Holdings Inc for several years, serving in the capacity of Chief Financial Officer. His role involves overseeing the financial operations of the company, making his trading activities particularly noteworthy for investors.

DoubleVerify Holdings Inc is a leading software platform that provides measurement, data, and analytics that digital advertisers use to assess the quality and effectiveness of their online advertising campaigns. The company's mission is to build a better industry by empowering advertisers with the technology and data they need to confidently and efficiently invest in digital advertising.

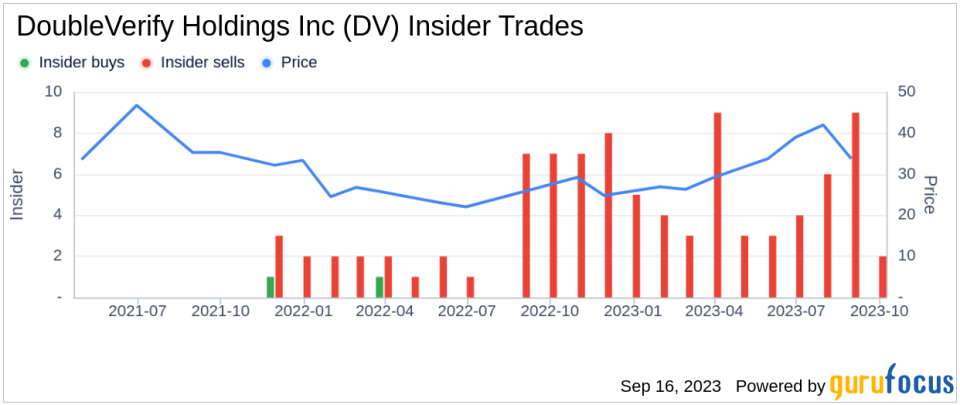

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 67 insider sells and no insider buys. This trend is illustrated in the following image:

The insider's trading activities often have a significant impact on the stock price. In this case, the shares of DoubleVerify Holdings Inc were trading for $29.24 apiece on the day of the insider's recent sell. This gives the stock a market cap of $4.841 billion.

The company's price-earnings ratio stands at 96.40, which is higher than the industry median of 27.31. However, it is lower than the companys historical median price-earnings ratio. This suggests that despite the insider's sell-off, the stock may still be undervalued compared to its historical average.

In conclusion, the insider's recent sell-off could be a signal for investors to reassess their positions in DoubleVerify Holdings Inc. However, it's also important to consider other factors such as the company's financial health, market conditions, and industry trends before making any investment decisions.

This article first appeared on GuruFocus.