CFO Nicola Allais Sells 18,462 Shares of DoubleVerify Holdings Inc (DV)

On October 17, 2023, Nicola Allais, the Chief Financial Officer of DoubleVerify Holdings Inc (NYSE:DV), sold 18,462 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Nicola Allais has been with DoubleVerify Holdings Inc for several years, serving in the capacity of CFO. His role involves overseeing the financial operations of the company, making his trading activities of particular interest to investors and market watchers.

DoubleVerify Holdings Inc is a leading software platform that provides measurement, data, and analytics that digital advertisers use to assess the quality and effectiveness of their digital advertising. The company's mission is to build a better industry by empowering advertisers to drive more effective and efficient digital ad spend.

Over the past year, the insider has sold a total of 247,594 shares and purchased 0 shares. This recent sale of 18,462 shares is a continuation of this trend. The insider's trading activities can often provide valuable insights into the company's financial health and market outlook.

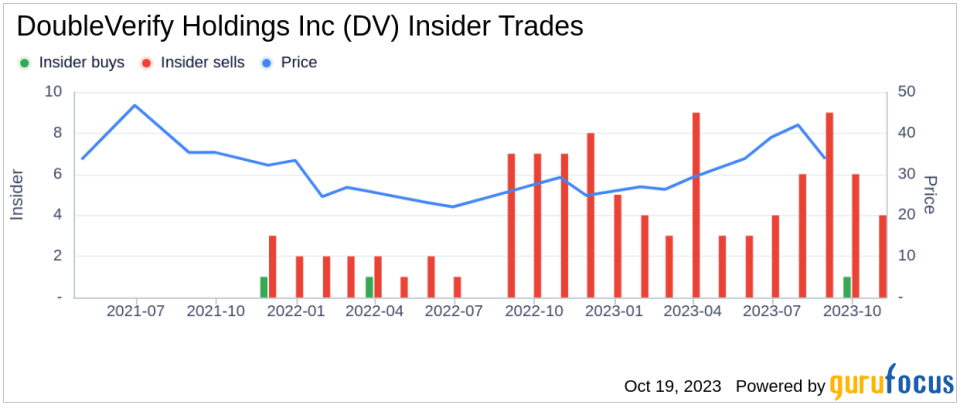

The insider transaction history for DoubleVerify Holdings Inc shows a total of 1 insider buy over the past year, compared to 65 insider sells over the same timeframe. This trend suggests that insiders may be taking profits or have a bearish outlook on the company's future performance.

On the day of the insider's recent sale, shares of DoubleVerify Holdings Inc were trading for $27.87 apiece. This gives the stock a market cap of $4.712 billion. The price-earnings ratio is 96.20, which is higher than the industry median of 26.18 and lower than the companys historical median price-earnings ratio. This valuation suggests that the stock may be overvalued compared to its peers, but undervalued based on its own historical standards.

In conclusion, the insider's recent sale of shares, along with the overall trend of insider selling over the past year, may signal a bearish outlook for DoubleVerify Holdings Inc. However, investors should also consider other factors such as the company's financial performance, industry trends, and broader market conditions before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.