CFO Todd Mcelhatton Sells 33,168 Shares of Zuora Inc

On October 10, 2023, Todd Mcelhatton, the Chief Financial Officer of Zuora Inc (NYSE:ZUO), sold 33,168 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 204,464 shares over the past year and has not made any purchases.

Zuora Inc is a technology company that provides software solutions designed to enable businesses to transition to subscription-based models. The company's cloud-based software platform, Zuora Central, is designed to be the central hub for subscription order-to-cash operations, including quoting, order, billing, collection, and revenue recognition. It serves various industries, including software, hardware, media, transportation, construction, healthcare, education, retail, and others.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To understand the implications of this move, it's essential to analyze the relationship between insider trading and the stock's price.

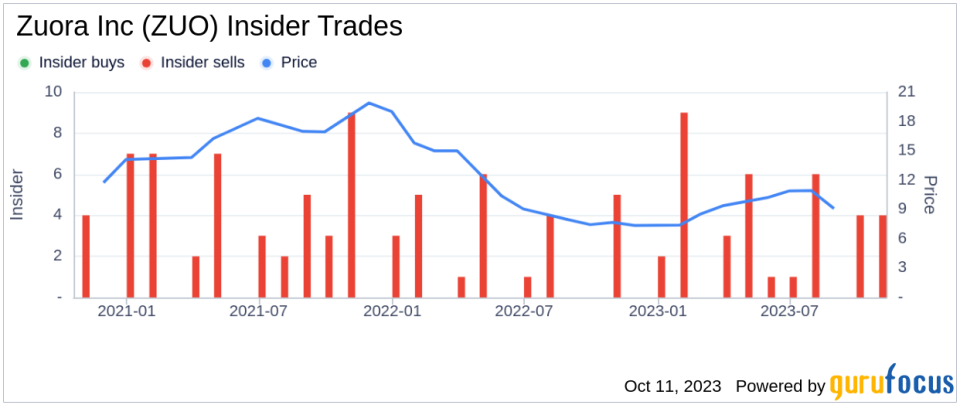

The above image shows the trend of insider trading at Zuora Inc. Over the past year, there have been 39 insider sells and no insider buys. This trend could indicate that insiders believe the stock is overvalued, leading them to sell their shares.

On the day of the insider's recent sell, shares of Zuora Inc were trading at $7.98, giving the company a market cap of $1.121 billion. However, the GuruFocus Value of the stock is $13.18, indicating a price-to-GF-Value ratio of 0.61. This suggests that the stock is a possible value trap, and investors should think twice before investing.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell-off, combined with the company's high price-to-GF-Value ratio, suggests that investors should be cautious when considering investing in Zuora Inc. While the company's subscription-based business model is innovative, the lack of insider buying and the high number of insider sells could be a red flag.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.