Chairman James Wirth Acquires 2,000 Shares of InnSuites Hospitality Trust (IHT)

James Wirth, Chairman of InnSuites Hospitality Trust (IHT), has increased his stake in the company by purchasing 2,000 shares on December 19, 2023, according to a recent SEC Filing. This transaction has expanded the insider's holdings, contributing to a pattern of insider purchases over the past year.

InnSuites Hospitality Trust is a real estate investment trust (REIT) that focuses on the ownership and management of hotel properties. The trust operates through its subsidiary, InnSuites Hotels, Inc., which provides hospitality services and manages hotel operations. The company's portfolio includes hotels with a range of amenities designed to cater to both business and leisure travelers.

Insider buying and selling activities are closely watched by investors as they can provide insights into a company's internal perspective. Insider buying may suggest that the insiders are confident about the company's future prospects and consider the stock undervalued. Conversely, insider selling might indicate that insiders believe the stock is fully valued or overvalued, or they may simply be diversifying their investments.

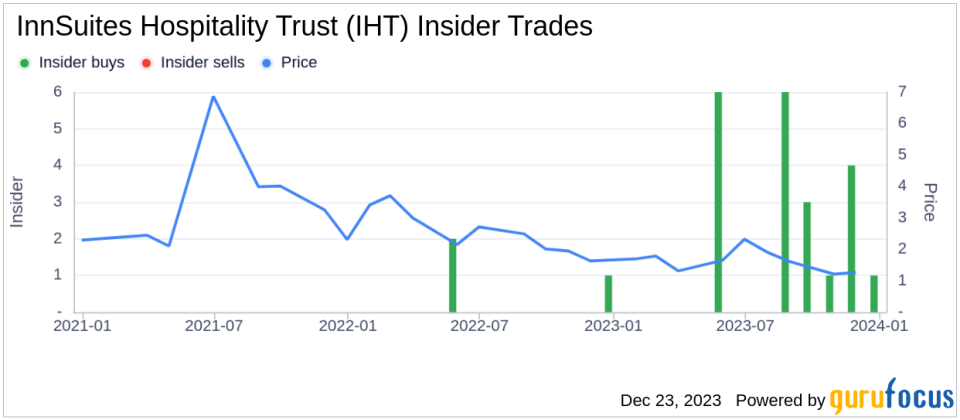

Over the past year, James Wirth has been actively increasing his position in InnSuites Hospitality Trust, with a total of 21,623 shares purchased and no shares sold. The insider transaction history for the company shows a significant inclination towards buying, with 22 insider buys and no insider sells over the same timeframe.

On the day of the insider's recent acquisition, shares of InnSuites Hospitality Trust were trading at $2,809.35, resulting in a market cap of $12.878 million.

The stock's price-earnings ratio stands at 23.06, surpassing both the industry median of 17.695 and the company's historical median price-earnings ratio. This indicates that the stock is trading at a higher valuation compared to its peers and its own historical standards.

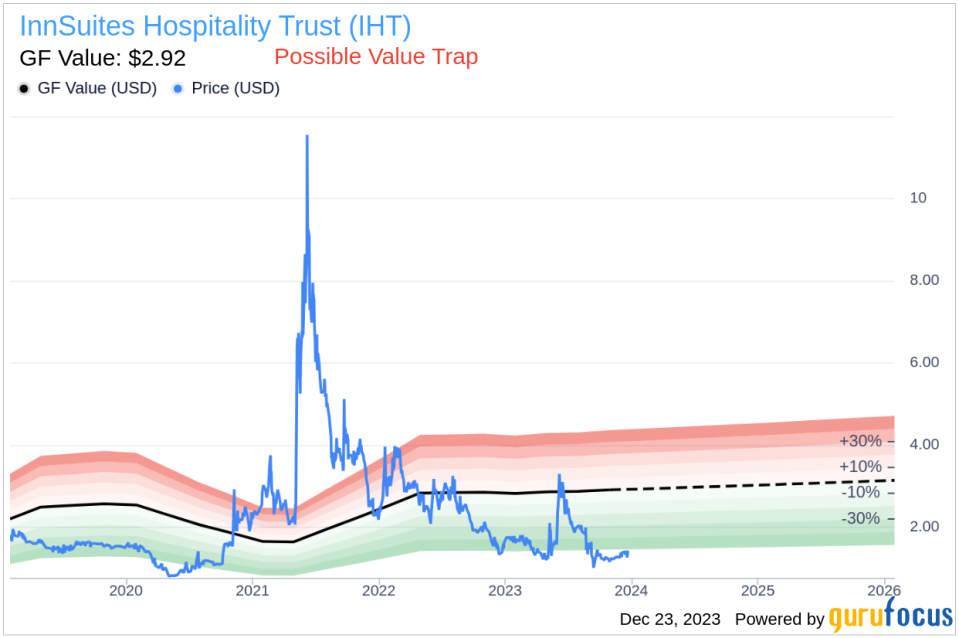

With the current share price and a GuruFocus Value of $2.92, InnSuites Hospitality Trust has a price-to-GF-Value ratio of 962.11. This positions the stock as a "Possible Value Trap, Think Twice" according to its GF Value, suggesting that investors should be cautious with the stock's current valuation.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is calculated based on historical trading multiples, a GuruFocus adjustment factor related to past performance, and future business performance estimates from Morningstar analysts.

The insider trend image above reflects the recent insider buying pattern at InnSuites Hospitality Trust, reinforcing the notion of insider confidence in the company's value.

The GF Value image provides a visual representation of the stock's valuation in relation to its intrinsic value, highlighting the current price-to-GF-Value ratio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.