Some ChannelAdvisor (NYSE:ECOM) Shareholders Have Taken A Painful 70% Share Price Drop

While not a mind-blowing move, it is good to see that the ChannelAdvisor Corporation (NYSE:ECOM) share price has gained 22% in the last three months. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 70% lower after that period. The recent bounce might mean the long decline is over, but we are not confident. The million dollar question is whether the company can justify a long term recovery.

Check out our latest analysis for ChannelAdvisor

ChannelAdvisor isn’t a profitable company, so it is unlikely we’ll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, ChannelAdvisor saw its revenue increase by 12% per year. That’s a fairly respectable growth rate. So the stock price fall of 21% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

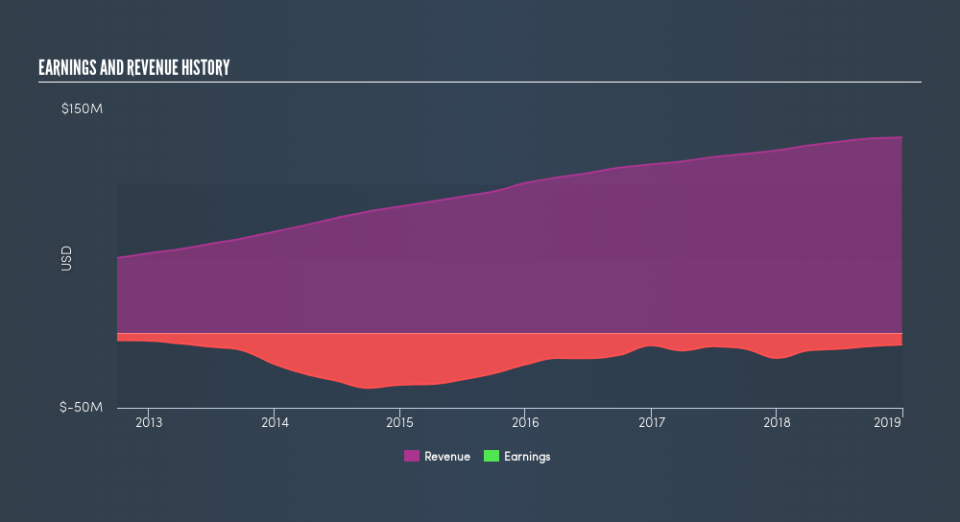

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It’s good to see that ChannelAdvisor has rewarded shareholders with a total shareholder return of 38% in the last twelve months. That certainly beats the loss of about 21% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.