ChargePoint Holdings Inc (CHPT) Faces Revenue Decline and Widening Losses in Q4 and Full Fiscal ...

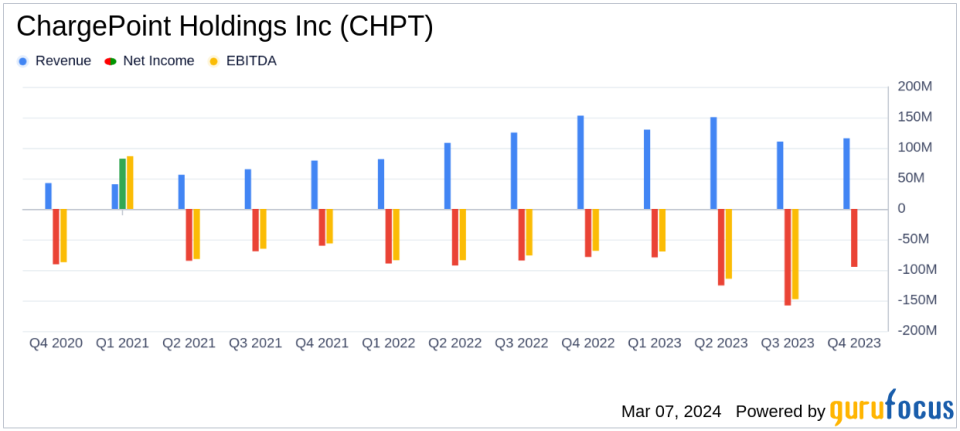

Revenue: Q4 revenue fell 24% year-over-year to $115.8 million; full-year revenue rose 8% to $506.6 million.

Gross Margin: Q4 GAAP gross margin declined to 19%; full-year GAAP gross margin dropped to 6%.

Net Loss: Q4 GAAP net loss widened to $94.7 million; full-year GAAP net loss increased to $457.6 million.

Subscription Growth: Subscription revenue surged 41% to $120 million for the full fiscal year.

Liquidity: Ended the year with $357.8 million in cash, cash equivalents, and restricted cash.

Outlook: Q1 FY2025 revenue projected between $100 million to $110 million; reaffirms goal for positive non-GAAP Adjusted EBITDA by Q4 FY2025.

On March 5, 2024, ChargePoint Holdings Inc (NYSE:CHPT), a leader in electric vehicle (EV) charging solutions, released its 8-K filing, detailing its financial results for the fourth quarter and full fiscal year ended January 31, 2024. The company, which designs and markets networked EV charging infrastructure, experienced a decline in revenue and widening losses in the fourth quarter, although it saw an overall revenue increase for the fiscal year.

Financial Performance and Challenges

ChargePoint's Q4 revenue decreased by 24% to $115.8 million from $152.8 million in the same quarter of the previous year. The full fiscal year revenue, however, increased by 8% to $506.6 million. The GAAP gross margin for Q4 was 19%, a decrease from 22% in the prior year's same quarter, and the full fiscal year GAAP gross margin was significantly lower at 6%. The company's net loss for Q4 expanded to $94.7 million from $78.7 million year-over-year, and the full fiscal year net loss grew to $457.6 million from $345.1 million.

The decline in gross margin and the increased net loss highlight the challenges ChargePoint faces, including the competitive landscape, supply chain disruptions, and the need for continued investment in technology and market expansion. These challenges are critical as they impact the company's profitability and long-term growth prospects.

Financial Achievements and Industry Significance

Despite the setbacks, ChargePoint achieved a notable 41% year-over-year growth in subscription revenue, reaching $120 million for the full fiscal year. This growth is significant as it underscores the company's successful expansion of its recurring revenue streams, which are vital for stability and predictability in the cyclical retail industry.

Key Financial Metrics

Important metrics from the financial statements include:

Financial Metrics | Q4 FY2024 | Full Year FY2024 |

|---|---|---|

Revenue | $115.8 million | $506.6 million |

GAAP Gross Margin | 19% | 6% |

Net Loss | $94.7 million | $457.6 million |

Subscription Revenue | $33.5 million | $120.4 million |

Cash and Equivalents | $357.8 million | N/A |

These metrics are crucial as they provide insights into the company's sales performance, cost management, profitability, and liquidity position. The increase in subscription revenue is particularly important as it indicates growing market acceptance of ChargePoint's services and a strengthening recurring revenue base.

Management Commentary

"In the fourth quarter, ChargePoint continued to focus on operational execution, delivering sequential revenue growth, normalization in gross margin, reduction of operating expenses, and a significant decrease in cash usage," said Rick Wilmer, CEO of ChargePoint.

Analysis of Company Performance

ChargePoint's performance in the fourth quarter and full fiscal year reflects a mixed picture. While the company managed to grow its subscription revenue significantly, it faced headwinds that led to a decrease in overall revenue and gross margins in the fourth quarter. The widening net loss indicates that despite growth in some areas, profitability remains a challenge.

The company's focus on operational excellence and innovation, as well as its goal to achieve positive non-GAAP Adjusted EBITDA by the fourth quarter of fiscal year 2025, suggests that management is taking steps to improve financial health and position the company for sustainable growth.

For investors, ChargePoint's commitment to expanding its charging network and enhancing its software platform, combined with the growth in subscription revenue, may offer long-term value despite the current challenges. However, the widening losses and declining gross margins warrant careful monitoring.

For more detailed information and analysis, readers are encouraged to visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from ChargePoint Holdings Inc for further details.

This article first appeared on GuruFocus.