Charles Brandes Adjusts Position in Graham Corp

Recent Transaction Overview

On December 31, 2023, Charles Brandes (Trades, Portfolio), through Brandes Investment Partners, made a notable adjustment to their investment portfolio by reducing their stake in Graham Corporation (NYSE:GHM). The transaction involved the sale of 13,540 shares at a price of $18.97 per share. Following this trade, Brandes Investment Partners now holds a total of 1,176,806 shares in the company, which represents a 0.44% position in their portfolio and an 11.00% ownership of the traded stock.

Investor Profile: Charles Brandes (Trades, Portfolio)

Charles Brandes (Trades, Portfolio) is a renowned figure in the investment world, having established Brandes Investment Partners in 1974. The firm, which he led until his retirement in 2018, is known for its global equity and fixed-income asset management services. Brandes, a disciple of Benjamin Graham, has authored "Value Investing Today," where he shares his insights on value investing. The firm's investment philosophy is grounded in purchasing undervalued securities and holding them until their true value is recognized by the market. With a diverse portfolio of 152 stocks, Brandes Investment Partners has significant holdings in companies like Comcast Corp (NASDAQ:CMCSA), Embraer SA (NYSE:ERJ), and Wells Fargo & Co (NYSE:WFC), with an equity value of $5.11 billion, primarily in the Healthcare and Financial Services sectors.

Graham Corp: An Industrial Products Leader

Graham Corporation, with its stock symbol GHM, operates within the USA and has been publicly traded since March 17, 1992. The company specializes in manufacturing critical equipment for the energy, defense, and chemical/petrochemical industries. Its product range includes ejectors, condensers, and pumps, with a significant portion of its revenue generated from heat transfer equipment sales. Graham Corp has a market capitalization of $203.352 million and a current stock price of $19, with a price-to-earnings (PE) ratio of 70.37, indicating profitability challenges. The stock is considered modestly overvalued with a GF Value of $16.14 and a price to GF Value ratio of 1.18. Despite a year-to-date price decrease of 1.4%, the stock has seen a substantial increase of 2217.07% since its IPO.

Impact of the Trade on Brandes' Portfolio

The recent reduction in GHM shares by Brandes Investment Partners has a minimal impact on the overall portfolio, with a trade impact of just -0.01%. However, the decision to decrease the position size in Graham Corp reflects the firm's ongoing portfolio strategy adjustments and their assessment of the stock's current valuation and future prospects.

Market Valuation and Stock Performance

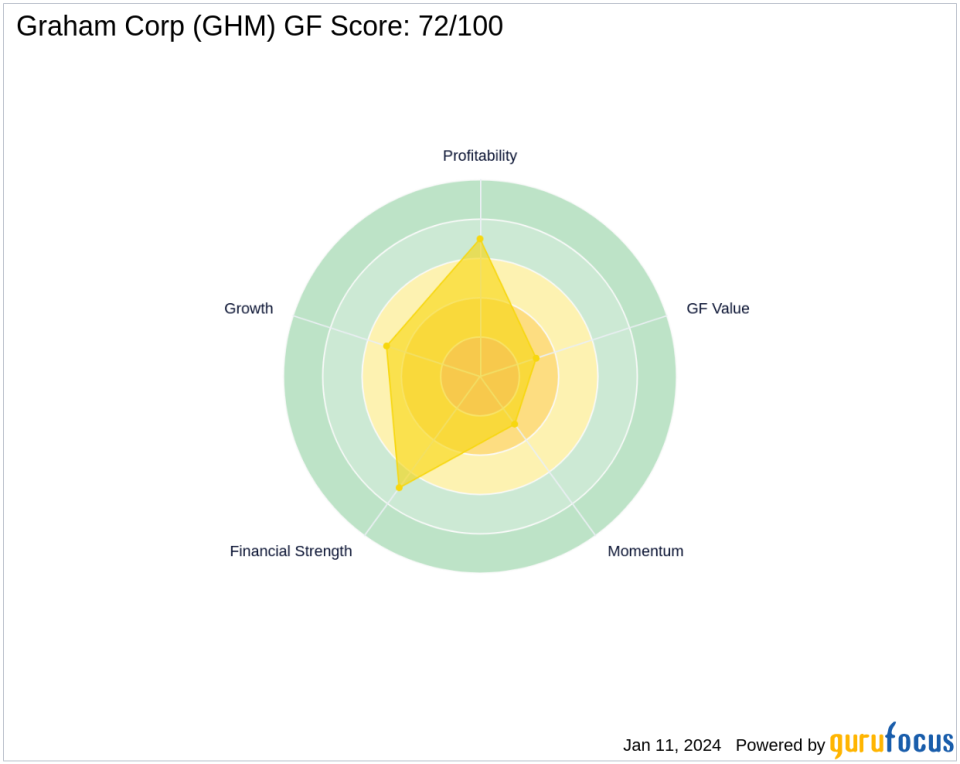

Graham Corp's stock currently holds a GF Score of 72 out of 100, suggesting a potential for average performance. The company's financial strength is solid, with a Financial Strength rank of 7 out of 10 and an interest coverage ratio of 5.50. The Altman Z score of 2.64, along with a Piotroski F-Score of 7, indicates a relatively stable financial position. However, the stock's Profitability Rank and Growth Rank are both at 7 out of 10, suggesting that there may be challenges in maintaining profitability and growth.

Industry Perspective and Other Investors' Positions

In the Industrial Products sector, Graham Corp competes with a focus on specialized equipment for critical industries. Other notable investors with positions in GHM include Mario Gabelli (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), and Robert Olstein (Trades, Portfolio). Comparing Brandes' trade actions with these other gurus can provide additional insights into the stock's attractiveness and potential investment strategies.

Conclusion

In summary, Charles Brandes (Trades, Portfolio)' recent transaction involving Graham Corp shares represents a strategic adjustment within Brandes Investment Partners' portfolio. While the trade has a minor impact on the portfolio's composition, it underscores the firm's value investing approach and careful stock valuation. Investors will continue to monitor the performance of GHM in the context of the broader market and the Industrial Products industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.