Charles Brandes Adjusts Position in Grifols SA

Overview of the Recent Trade by Charles Brandes (Trades, Portfolio)

Brandes Investment Partners, led by founder Charles Brandes (Trades, Portfolio), has recently made a notable adjustment in its investment portfolio. On January 31, 2024, the firm reduced its stake in Grifols SA (NASDAQ:GRFS), a leading company in the pharmaceutical industry. The transaction involved the sale of 35,837 shares at a price of $8.04 each, which altered the firm's holding to a total of 13,480,174 shares. Despite this reduction, Grifols SA still represents a significant 1.65% of Brandes' portfolio and 10.53% of the firm's holdings in the traded stock.

Investment Approach of Charles Brandes (Trades, Portfolio)

Charles Brandes (Trades, Portfolio), a renowned value investor, established Brandes Investment Partners in 1974. The firm has a long-standing reputation for applying Benjamin Graham's classic value investing principles, focusing on undervalued securities and maintaining positions until their market value is fully recognized. With a diverse global portfolio, Brandes Investment Partners has a strong presence in the Healthcare and Financial Services sectors. Among its top holdings are Comcast Corp (NASDAQ:CMCSA), Grifols SA (NASDAQ:GRFS), Bank of America Corp (NYSE:BAC), Embraer SA (NYSE:ERJ), and Wells Fargo & Co (NYSE:WFC), with an equity value of $6.58 billion.

Grifols SA at a Glance

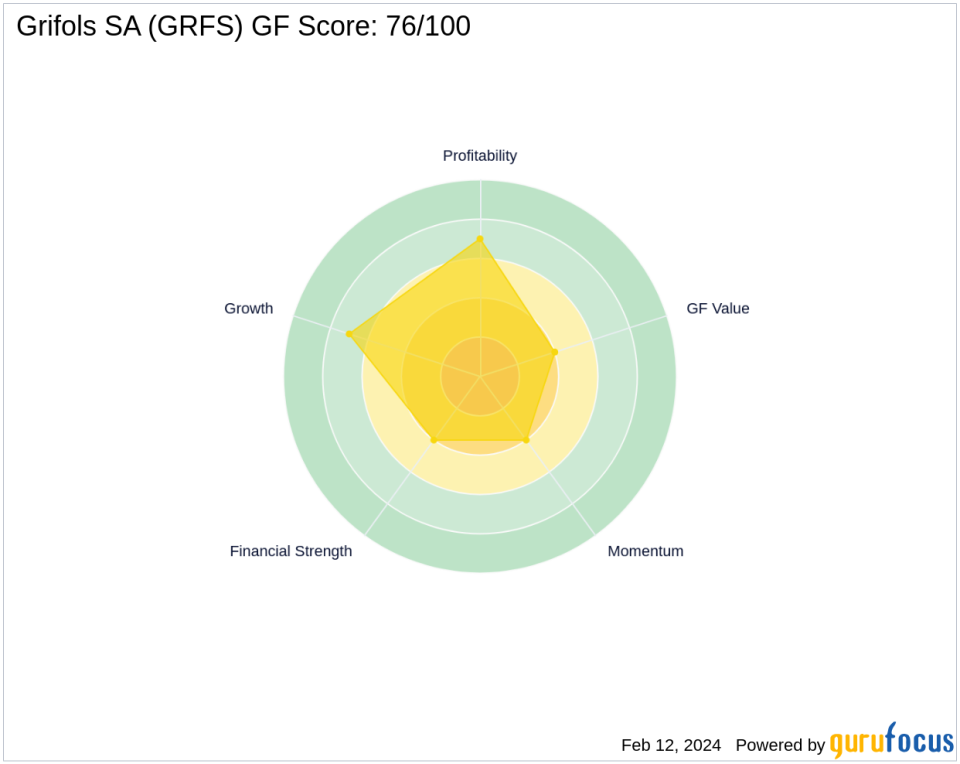

Grifols SA, headquartered in Spain, is a prominent player in the Drug Manufacturers industry. The company specializes in the production of plasma-derived products, with a significant expansion following the acquisition of Talecris in 2011. Grifols' diverse portfolio includes Bio Supplies, Biopharma, Diagnostic, and other segments. As of 2022, the biopharma business accounted for 83% of its sales. With a market capitalization of $5.62 billion and a stock price of $8.28, Grifols faces challenges reflected in its GF Value Rank of 4/10 and a GF Score of 76/100, indicating potential for future performance.

Brandes' Trade Impact and Rationale

The recent trade by Brandes Investment Partners has not had a significant impact on the firm's overall portfolio, given the 0% trade impact. However, the timing and potential rationale behind the sale could be linked to Grifols SA's current market valuation and performance metrics. With a stock price to GF Value ratio of 0.41 and a designation as a possible value trap, Brandes may have deemed it prudent to reduce exposure to Grifols SA at this time.

Grifols SA's Market Valuation and Performance

Grifols SA's current market valuation presents a complex picture. The stock's PE Ratio stands at 45.25, indicating a premium compared to earnings. The GF Valuation suggests caution, labeling the stock as a possible value trap. Despite a recent price gain of 2.99% since the transaction, the year-to-date performance shows a decline of 25.07%. These mixed signals could have influenced Brandes' decision to adjust its position in Grifols SA.

Healthcare Sector and Industry Dynamics

Brandes Investment Partners maintains a significant exposure to the Healthcare sector, with Grifols SA being a key component. Within the Drug Manufacturers industry, Grifols SA's financial health and growth prospects are critical for investors. The company's Financial Strength and Profitability Rank stand at 4/10 and 7/10, respectively, while its Growth Rank is also at 7/10. These rankings provide insights into the company's stability and potential for expansion.

Insights from Other Gurus

While Charles Brandes (Trades, Portfolio)' firm has adjusted its stake in Grifols SA, other notable investors like Mario Gabelli (Trades, Portfolio) continue to hold positions in the company. Comparing Brandes' holdings to other gurus provides a broader perspective on investor sentiment towards Grifols SA within the investment community.

Evaluating Grifols SA's Financial Health

An analysis of Grifols SA's financials reveals a mixed bag of strengths and weaknesses. The company's balance sheet, profitability, and growth ranks suggest moderate financial health, but concerns arise from its Operating Margin contraction and negative earnings growth over the past three years. Additionally, the Piotroski F-Score of 3 and an Altman Z-Score of 0.84 raise flags about the company's financial stability and risk profile.

In conclusion, Charles Brandes (Trades, Portfolio)' recent reduction in Grifols SA shares reflects a strategic move that aligns with the firm's value investing philosophy. The decision takes into account the company's current valuation, industry position, and financial health, underscoring the importance of thorough analysis in portfolio management.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.