Charles Brandes Adjusts Position in Netgear Inc

Overview of Charles Brandes (Trades, Portfolio)'s Recent Stock Transaction

Charles Brandes (Trades, Portfolio), through Brandes Investment Partners, has recently made a notable adjustment in its investment portfolio by reducing its stake in Netgear Inc (NASDAQ:NTGR). On December 31, 2023, the firm sold 58,919 shares of Netgear at a price of $14.58 per share. Following this transaction, Brandes Investment Partners now holds a total of 3,406,889 shares in the company, which represents a 0.97% position in the firm's portfolio and an 11.51% ownership of the traded stock.

Profile of Charles Brandes (Trades, Portfolio)

Charles Brandes (Trades, Portfolio) is a renowned figure in the investment world, having founded Brandes Investment Partners in 1974. Before retiring in 2018, Brandes managed various portfolios, including U.S. Equity and Global Equity Funds, and authored the book Value Investing Today. The firm is recognized for its global investment strategies and adherence to value investing principles, seeking undervalued securities and holding them until their true value is realized. Brandes Investment Partners manages a diverse range of assets, with a portfolio equity of $5.11 billion, and has significant holdings in companies such as Comcast Corp (NASDAQ:CMCSA), Embraer SA (NYSE:ERJ), and Wells Fargo & Co (NYSE:WFC).

Details of Netgear Inc

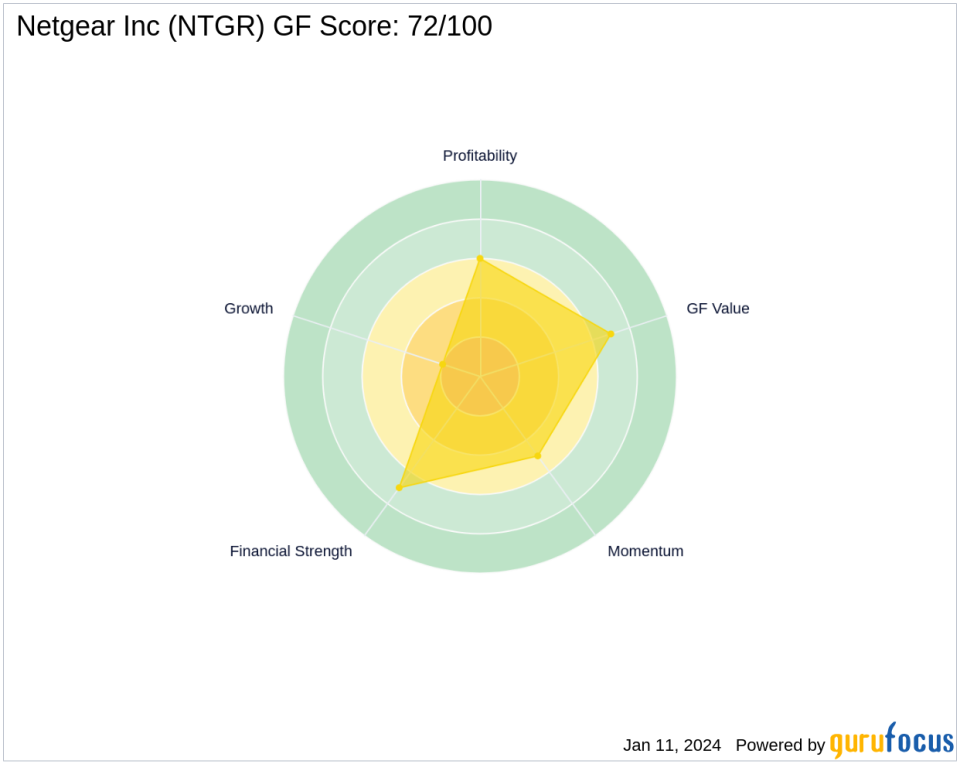

Netgear Inc, a provider of networking solutions, operates through two segments: Connected Home and Small and Medium Businesses (SMB). The company has been a player in the market since its IPO on July 31, 2003, and currently holds a market capitalization of $417.775 million. Despite a PE Ratio of 0.00 indicating a lack of profitability, Netgear is considered modestly undervalued with a GF Value of $16.30. The stock is currently trading at $14.11, reflecting a price to GF Value ratio of 0.87. Netgear's GF Score stands at 72/100, suggesting a potential for average performance in the future.

Analysis of the Trade Impact

The recent sale by Charles Brandes (Trades, Portfolio) has had a minimal impact on the firm's portfolio, with a trade impact of just -0.02%. However, the transaction is significant in terms of the firm's holdings in Netgear, as it still maintains a substantial 11.51% stake in the company. This move by Brandes could be interpreted as a strategic adjustment rather than a shift in conviction about the company's prospects.

Netgear's Financial Health and Market Valuation

Netgear's financial health is assessed through various key ratios and ranks. The company has a Financial Strength rank of 7/10 and a Profitability Rank of 6/10, indicating a stable financial position and moderate profitability. However, its Growth Rank is low at 2/10, reflecting limited growth prospects. The GF Value Rank stands at 7/10, suggesting that the stock is reasonably valued in the market. Netgear's Cash to Debt ratio is strong at 5.22, but its ROE and ROA are negative, at -18.14% and -11.41%, respectively.

Sector and Industry Context

Within the Hardware industry, Netgear's performance and valuation must be considered in the context of sector trends and industry dynamics. The company's current market position and financial metrics suggest that it faces challenges in growth and profitability, which are critical factors for investors to monitor.

Other Notable Investors in Netgear

Brandes Investment Partners is not the only notable firm with a stake in Netgear. Donald Smith & Co also holds a position in the company, highlighting the interest of value-oriented investors in this stock. As the largest guru shareholder, Brandes Investment continues to play a significant role in the company's investor landscape.

Market Reaction and Future Outlook

Following the transaction, Netgear's stock price has experienced a slight decline of -3.22%. The future performance potential of Netgear will be closely watched, with indicators such as the GF Score and other financial metrics providing insights into the company's prospects. Investors will be keen to see if Brandes Investment Partners' recent trade aligns with the long-term trajectory of Netgear's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.