Charles Brandes Amplifies Stake in Willis Towers Watson PLC by 201.27%

Insights from the Latest 13F Filing Reveal Strategic Portfolio Adjustments

Charles Brandes (Trades, Portfolio), a seasoned investor and founder of Brandes Investment Partners, has made notable changes to his investment portfolio in the third quarter of 2023. Brandes, who retired in 2018, is renowned for his adherence to value investing principles, a strategy pioneered by Benjamin Graham. His firm, established in 1974, has a long-standing reputation for seeking undervalued securities and holding them until their true value is recognized by the market. This approach has been a cornerstone of the firm's global equity and fixed-income asset management.

New Additions to the Portfolio

During the third quarter, Charles Brandes (Trades, Portfolio) diversified his holdings with six new stocks. Noteworthy additions include:

CRH PLC (NYSE:CRH), purchasing 100,513 shares, which now represent 0.11% of the portfolio, valued at $5.57 million.

American Outdoor Brands Inc (NASDAQ:AOUT), acquiring 214,801 shares, making up approximately 0.04% of the portfolio, with a total value of $2.1 million.

Avista Corp (NYSE:AVA), with 58,310 shares, accounting for 0.04% of the portfolio and a total value of $1.89 million.

Significant Position Increases

Brandes has also strategically increased his stakes in 98 stocks. Key increases include:

Willis Towers Watson PLC (NASDAQ:WTW), with an additional 404,530 shares, bringing the total to 605,519 shares. This represents a substantial 201.27% increase in share count and a 1.65% impact on the current portfolio, valued at $126.53 million.

Fortrea Holdings Inc (NASDAQ:FTRE), adding 1,131,114 shares, for a new total of 1,365,068 shares. This adjustment marks a 483.48% increase in share count, with a total value of $39.03 million.

Exiting Positions

Brandes has also decided to exit six holdings entirely in the third quarter of 2023:

TechnipFMC PLC (NYSE:FTI), selling all 1,951,169 shares, which had a -0.65% impact on the portfolio.

POSCO Holdings Inc (NYSE:PKX), liquidating 97,065 shares, causing a -0.14% impact on the portfolio.

Reduced Holdings

Furthermore, Brandes reduced positions in 45 stocks. The most significant reductions include:

Cemex SAB de CV (NYSE:CX), cutting 7,442,264 shares, resulting in a -28.34% decrease in shares and a -1.06% impact on the portfolio. The stock traded at an average price of $7.42 during the quarter and has seen a -11.76% return over the past three months and a 69.51% year-to-date return.

Applied Materials Inc (NASDAQ:AMAT), reducing by 176,450 shares, leading to a -30.92% reduction in shares and a -0.51% impact on the portfolio. The stock's average trading price was $143.4 during the quarter, with an 8.32% return over the past three months and a 55.19% year-to-date return.

Portfolio Overview

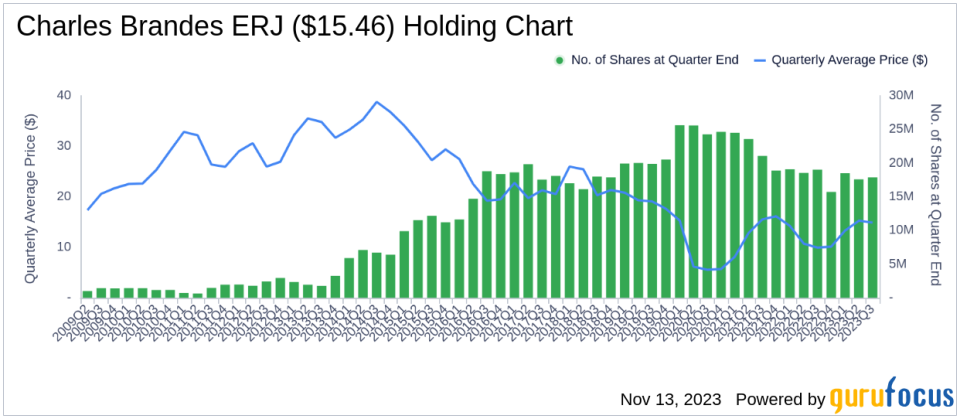

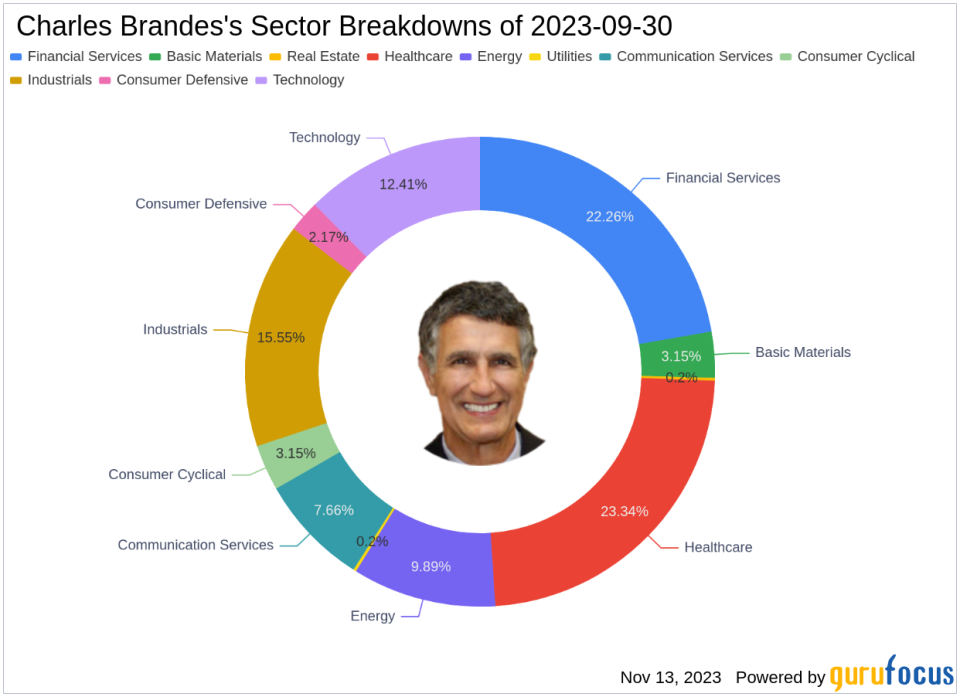

As of the third quarter of 2023, Charles Brandes (Trades, Portfolio)'s portfolio encompasses 152 stocks. The top holdings include 4.8% in Embraer SA (NYSE:ERJ), 3.05% in Wells Fargo & Co (NYSE:WFC), 2.66% in Comcast Corp (NASDAQ:CMCSA), 2.64% in Halliburton Co (NYSE:HAL), and 2.48% in McKesson Corp (NYSE:MCK). The investments are primarily concentrated across 11 industries, reflecting a diverse approach to value investing.

The strategic moves made by Charles Brandes (Trades, Portfolio) in the third quarter, particularly the significant increase in Willis Towers Watson PLC, reflect his firm's commitment to value investing and the ongoing search for undervalued opportunities in the market. Investors and followers of Brandes's investment strategies will be watching closely to see how these adjustments play out in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.