Charles Brandes Bolsters Portfolio with a Strategic Emphasis on Corteva Inc

Insight into the Investment Moves of a Value Investing Stalwart

Charles Brandes (Trades, Portfolio), a seasoned value investor and founder of Brandes Investment Partners, has made notable changes to his investment portfolio in the fourth quarter of 2023. Brandes, who retired in 2018, has built a legacy on the principles of Benjamin Graham, focusing on undervalued securities with the potential for significant market reevaluation. His firm's latest 13F filing reveals a strategic approach to global equity and fixed-income assets, reflecting a deep commitment to value investing.

Summary of New Buys

Charles Brandes (Trades, Portfolio) expanded his portfolio with 36 new stocks. Noteworthy additions include:

Smith & Nephew PLC (NYSE:SNN), with 1,095,449 shares, making up 0.45% of the portfolio and valued at $29.88 million.

Spirit AeroSystems Holdings Inc (NYSE:SPR), comprising 327,005 shares, or 0.16% of the portfolio, valued at $10.39 million.

International Flavors & Fragrances Inc (NYSE:IFF), with 40,799 shares, accounting for 0.05% of the portfolio and valued at $3.3 million.

Key Position Increases

Brandes also significantly increased his stakes in 121 stocks, including:

Corteva Inc (NYSE:CTVA), with an additional 1,352,208 shares, bringing the total to 1,932,836 shares. This represents a 232.89% increase in share count and a 0.99% impact on the current portfolio, valued at $92.62 million.

Pfizer Inc (NYSE:PFE), with an additional 1,377,426 shares, bringing the total to 4,334,849 shares. This adjustment marks a 46.58% increase in share count, valued at $124.8 million.

Summary of Sold Out Positions

Exiting certain positions, Charles Brandes (Trades, Portfolio) sold out of 2 holdings in the fourth quarter of 2023:

Toyota Motor Corp (NYSE:TM), where all 15,842 shares were sold, impacting the portfolio by -0.06%.

Key Position Reductions

Brandes also reduced his position in 26 stocks, with significant reductions in:

National Western Life Group Inc (NASDAQ:NWLI), by 61,766 shares, resulting in an 88.33% decrease and a -0.53% portfolio impact. The stock traded at an average price of $475.72 during the quarter and returned 1.50% over the past 3 months and 0.29% year-to-date.

Moog Inc (NYSE:MOG.A), by 99,032 shares, leading to a 26.86% reduction and a -0.22% portfolio impact. The stock traded at an average price of $129.36 during the quarter and returned 11.20% over the past 3 months and 0.42% year-to-date.

Portfolio Overview

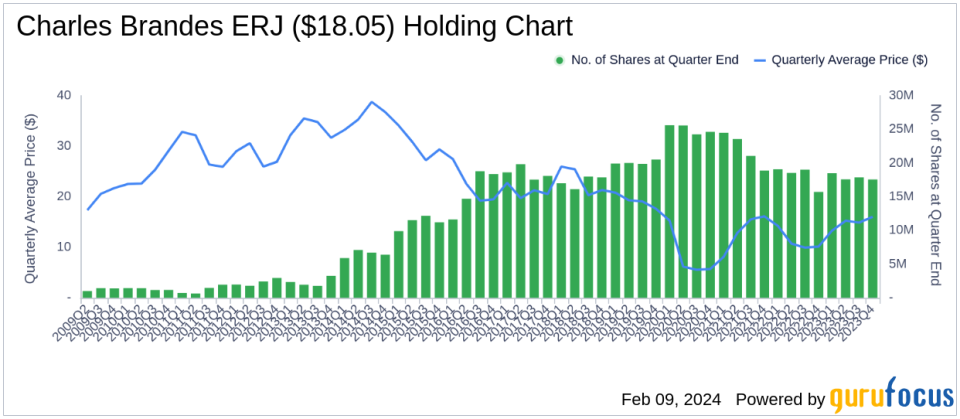

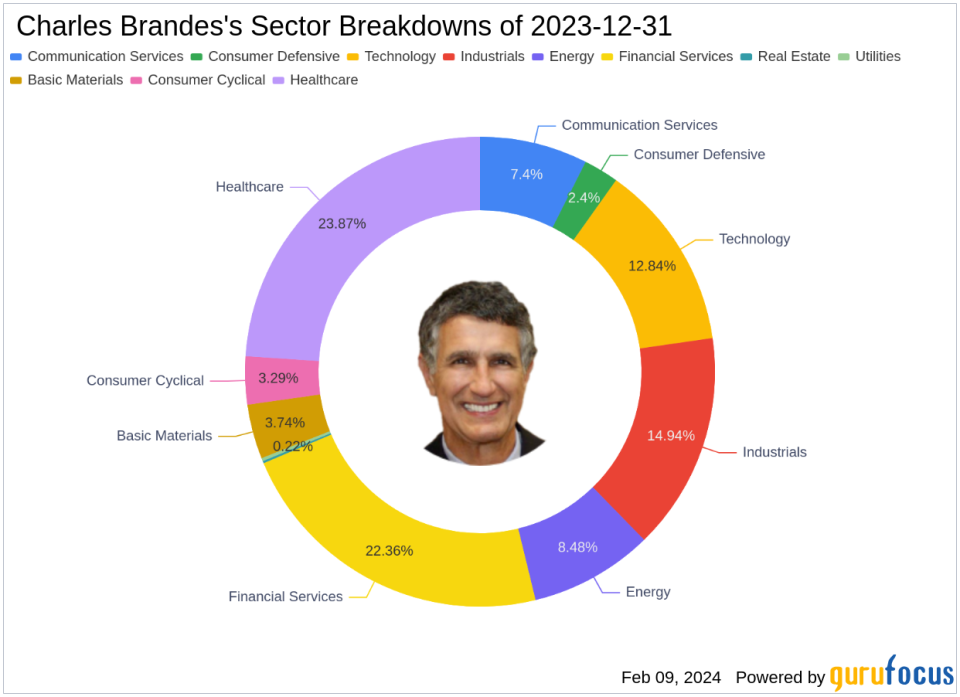

As of the fourth quarter of 2023, Charles Brandes (Trades, Portfolio)'s portfolio comprised 187 stocks. The top holdings included 4.93% in Embraer SA (NYSE:ERJ), 3.15% in Wells Fargo & Co (NYSE:WFC), 2.38% in Grifols SA (NASDAQ:GRFS), 2.35% in Bank of America Corp (NYSE:BAC), and 2.31% in Comcast Corp (NASDAQ:CMCSA). The investments span across all 11 industries, with a focus on Healthcare, Financial Services, Industrials, Technology, Energy, Communication Services, Basic Materials, Consumer Cyclical, Consumer Defensive, Utilities, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.