Charles Brandes Bolsters Position in Grifols SA

Introduction to the Transaction

Brandes Investment Partners, led by founder Charles Brandes (Trades, Portfolio), has recently increased its stake in the Spain-based pharmaceutical company Grifols SA (NASDAQ:GRFS). On December 31, 2023, the firm added 1,218,787 shares to its holdings, marking an 11.02% change in shares held. This transaction impacted the portfolio by 0.27% and was executed at a trade price of $11.56. Following the acquisition, Brandes Investment Partners now owns a total of 12,280,068 shares in Grifols SA, representing 2.77% of the portfolio and 9.87% of the company's stock.

Profile of Charles Brandes (Trades, Portfolio)

Charles Brandes (Trades, Portfolio), a renowned value investor and disciple of Benjamin Graham, established Brandes Investment Partners in 1974. The firm has a long-standing reputation for applying classic value investing principles, focusing on undervalued securities and holding them until their market value is fully recognized. With a diverse global equity and fixed-income asset management portfolio, Brandes Investment Partners has become a prominent name in the investment community. The firm's top holdings include Comcast Corp (NASDAQ:CMCSA), Grifols SA (NASDAQ:GRFS), Bank of America Corp (NYSE:BAC), Embraer SA (NYSE:ERJ), and Wells Fargo & Co (NYSE:WFC), with a total equity of $6.58 billion and a strong presence in the Healthcare and Financial Services sectors.

Overview of Grifols SA

Grifols SA, headquartered in Spain, operates in the drug manufacturing industry with a focus on plasma-derived products. Since its IPO on June 2, 2011, the company has expanded its global reach, particularly after acquiring Talecris in 2011. Grifols SA's business is segmented into Bio Supplies, Biopharma, Diagnostic, Others & Intersegments, and One-offs. The firm's biopharma segment is the most significant, contributing 83% of its sales in 2022.

Financial and Market Analysis of Grifols SA

Grifols SA currently holds a market capitalization of $5.62 billion, with a stock price of $8.28. The stock's PE ratio stands at 45.25, indicating a valuation that may raise concerns for potential investors. The GF Value of the stock is $20.35, with a price to GF Value ratio of 0.41, suggesting that the stock might be a possible value trap and warrants caution. Since the transaction, the stock has experienced a -28.37% change in price, with a year-to-date performance of -25.07%. The stock's performance since its IPO has seen a 19.48% increase.

Charles Brandes (Trades, Portfolio)' Investment in Grifols SA

The addition of Grifols SA shares by Charles Brandes (Trades, Portfolio)' firm underscores the significance of the pharmaceutical company within its investment portfolio. Grifols SA now stands as one of the firm's top holdings, reflecting Brandes' confidence in the stock's value and potential for growth.

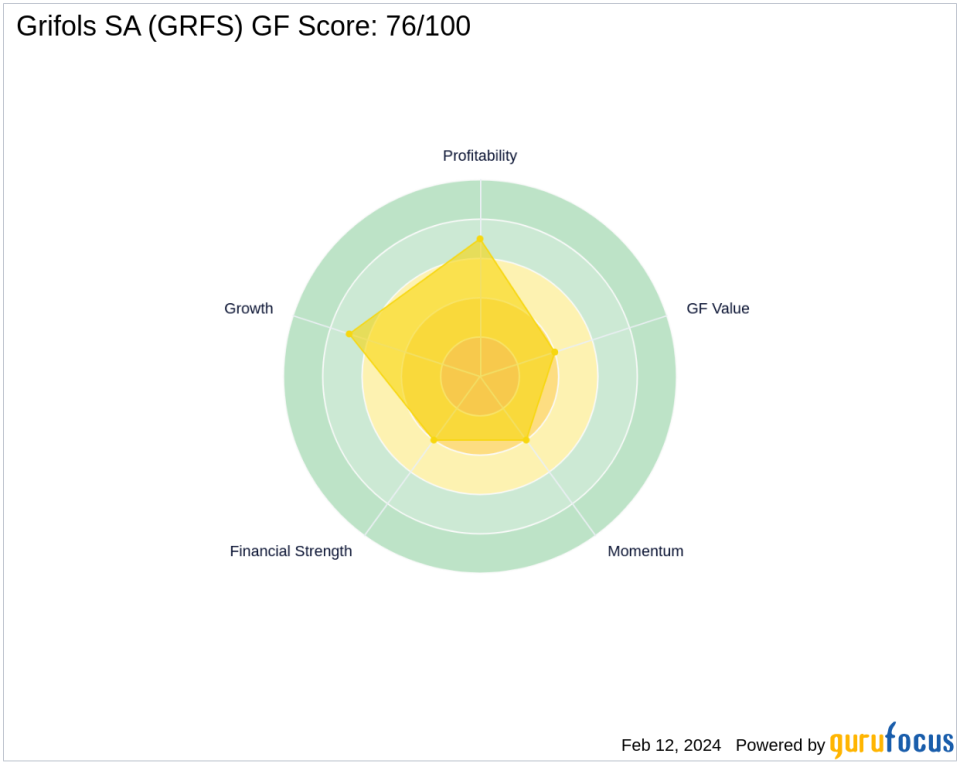

Grifols SA's Financial Health and Performance Metrics

Grifols SA's financial health and performance metrics present a mixed picture. The company's Financial Strength is rated 4/10, while its Profitability Rank and Growth Rank both stand at 7/10. However, the Piotroski F-Score is a low 3, and the Altman Z score is 0.84, which could indicate financial distress. The company's cash to debt ratio is 0.05, with a rank of 953, and its interest coverage ratio is 1.73, ranked at 585. These figures suggest that Grifols SA may face challenges in its financial stability and ability to cover interest payments.

Market Sentiment and Other Gurus' Positions

Brandes Investment Partners is currently the largest guru shareholder of Grifols SA, with a significant share percentage. Other notable investors include Mario Gabelli (Trades, Portfolio), indicating a level of confidence in the stock among seasoned investors.

Conclusion

The recent acquisition by Charles Brandes (Trades, Portfolio)' firm has the potential to positively influence its portfolio, given Grifols SA's position as a top holding. However, the current valuation and market outlook for Grifols SA suggest caution, as indicated by the GF Value and other financial metrics. Investors should consider these factors when evaluating the stock's future performance potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.