Charles River (CRAI) Rides on Global Presence & Diversification

CRA International, Inc., which conducts business as Charles River Associates CRAI, is currently benefiting from a strong global presence, business diversification, an excellent professional team and shareholder-friendly steps.

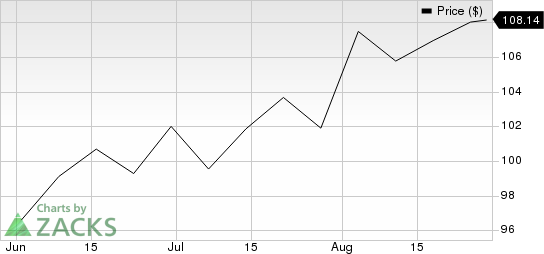

The stock has gained 15.1% over the past three months, significantly outperforming the 4.4% rise of the industry it belongs to, as well as the Zacks S&P 500 composite.

Charles River Associates Price

Charles River Associates price | Charles River Associates Quote

How CRAI is Faring

Charles River has a diversified business with service offerings across areas of functional expertise, client base and geographical regions. Being proficient in multiple industries helps the company meet varying client needs and offer other innovative services. Further, it gets to know about business strategies adopted across the world.

A multidisciplinary setup enables it to bring experts from all fields under one platform. Diversification in business helps reduce its dependence on any specific market, industry or geographic area. It also increases the company’s ability to adapt to changing conditions.

Charles River's professional team has helped it to achieve and maintain a solid reputation for providing high-quality consulting services. Almost three-fourths of the company’s senior consultants are highly educated, with a doctorate or other advanced degrees and are recognized experts in their respective fields. In 2022, the company had 939 consulting staff, which includes 149 officers, 496 other senior staff and 294 junior staff.

Charles River also works with a select group of non-employee experts belonging to top educational institutes to better serve clients. These experts generate business and provide access to other leading academic and industry experts.

Charles River has a consistent record of returning value to shareholders in the form of dividends and share repurchases. In 2022, 2021, and 2020, the company repurchased shares worth $27.6 million, $44.9 million and $13.4 million, respectively. It paid $9.58 million, $8.29 million, and $7.50 million as dividends during 2022, 2021 and 2020, respectively.

Higher talent costs due to a competitive talent market are hurting consulting services companies like Charles River. The industry is labor-intensive and heavily dependent on foreign talent.

Charles River's current ratio (a measure of liquidity) at the end of second-quarter 2023 was pegged at 1.07, lower than the current ratio of 1.08 reported at the end of the year-ago quarter.

Zacks Rank & Other Key Picks

Charles River currently carries a Zacks Rank #2 (Buy).

The following stocks from the Business Services Sector are also worth consideration by investors:

DocuSign DOCU beat the Zacks Consensus Estimate in all the four trailing quarters and has an earnings surprise of 25.6%. The current year Zacks Consensus Estimate for revenues indicates an 8.1% increase from the year-ago figure. The consensus mark for earnings is pegged at $2.52 per share, suggesting 24.1% year-over-year growth. DOCU currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ABM Industries ABM beat the Zacks Consensus Estimate in all the four trailing quarters, with an earnings surprise of 2.64%. The current Zacks Consensus Estimate for revenues indicates a 3.5% increase from the year-ago figure. The consensus mark for earnings is pegged at $3.51 per share, suggesting a 4.1% year-over-year decline. ABM has a Zacks Rank of 2, at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report