Charles River (CRAI) Stock Surges Despite Q3 Earnings Miss

CRA International, Inc., which conducts business as Charles River Associates CRAI, reported lower-than-expected third-quarter 2023 results.

Non-GAAP EPS came in at $1.13, which missed the Zacks Consensus Estimate by 18.1% and decreased 31.1% year over year. Revenues of $147.6 million lagged the consensus mark by 6.6% and declined slightly year over year.

The lower-than-expected results did not seem to worry investors as the stock gained 6.4% since the earnings release on Nov 2. Charles River’s shares have declined 25.8% over the past year against the 10.8% rally of the industry it belongs to.

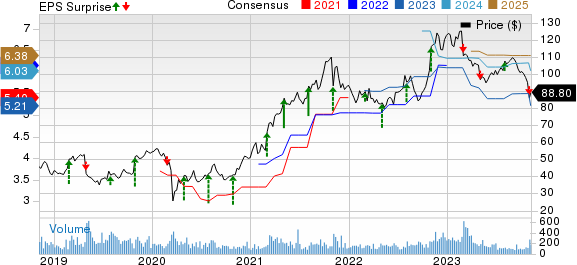

Charles River Associates Price, Consensus and EPS Surprise

Charles River Associates price-consensus-eps-surprise-chart | Charles River Associates Quote

Other Quarterly Details

The company delivered 66% utilization while headcount was up by 11.3% year over year. Non-GAAP EBITDA decreased 23.4% year over year to $13.8 million. This compares with our expectation of a non-GAAP EBITDA of $17.7 million, down 10% year over year.

Non-GAAP EBITDA margin contracted 280 basis points (bps) year over year to 9.3%. This compares with our expectation of a non-GAAP EBITDA margin of 11.2%, down 200 bps year over.

The company exited the quarter with a cash and cash equivalents balance of $27.6 million compared with $14.3 million witnessed at the end of the prior quarter. It generated $65 million of cash from operating activities and capex was $726 million. In the quarter, Charles River paid out $2.5 million in dividends.

Lowered 2023 Guidance

For 2023, on a constant currency basis relative to 2022, Charles River now anticipates revenues between $610 million and $620 million compared with the previous expectation of $625-$640 million. Non-GAAP EBITDA margin is currently expected in the range of 10.3-10.7% compared with the previous expectation of 11% to 11.7%.

Currently, Charles River carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Snapshots

The Interpublic Group of Companies, Inc. IPG posted third-quarter 2023 results, wherein both earnings and revenues missed the Zacks Consensus Estimate.

IPG’s adjusted earnings were 70 cents per share, which lagged the consensus estimate by 6.7%. The bottom line, however, climbed 11.1% on a year-over-year basis.

Net revenues of $2.31 billion fell short of the consensus estimate by 3.3%. In the year-ago quarter, IPG’s net revenues were $2.3 billion. Total revenues of $2.68 billion increased 1.5% year over year.

Equifax Inc. EFX reported lower-than-expected third-quarter 2023 results. Adjusted earnings (excluding 45 cents from non-recurring items) were $1.76 per share, missing the Zacks Consensus Estimate by 1.1%. Yet, the metric rose 1.7% from the year-ago figure.

EFX’s total revenues of $1.32 billion missed the consensus estimate by 0.7%. Nonetheless, the figure gained 6% from the year-ago figure on a reported basis and 6.5% on a local-currency basis.

Fiserv, Inc. FI reported impressive third-quarter 2023 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate. Adjusted earnings per share of $1.96 exceeded the consensus mark by 1% and increased 20% year over year. Adjusted revenues of $4.62 billion surpassed the consensus estimate by 0.53% and jumped 8.2% year over year.

FI’s organic revenue growth was 12% in the quarter. This was driven by 20% and 6% growth in the Acceptance and Payments segments, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report