Charles River (CRL) Gains on Price & Volume Growth Amid FX Woe

Charles River CRL continues to gain from strong organic growth on robust demand from biotech and pharmaceutical clients. The Research Models and Services (RMS) arm continues to gain from the Charles River Accelerator and Development Labs (CRADL) initiative. However, the global Discovery and Safety Assessment (DSA) business environment continues to be challenging. The stock carries a Zacks Rank #3 (Hold).

At present, Charles River is the largest provider of outsourced drug discovery, non-clinical development and regulated safety testing services worldwide. The company is gaining from its extensive expertise in the discovery of preclinical candidates and the design, execution and reporting of safety assessment studies for numerous types of compounds, including cell and gene therapies and small- and large-molecule pharmaceuticals.

The demand for these services is driven by the needs of large global pharmaceutical companies that continue to transition to an outsourced drug development model, in addition to mid-size and emerging biotechnology companies, industrial and agrochemical companies and non-governmental organizations that rely on outsourcing.

In the third quarter, organic revenue growth of 5.3% was mainly driven by broad-based strength in the Safety Assessment business on contributions from base pricing and study volume. The DSA backlog decreased to $2.6 billion in the third quarter from $2.8 billion at the end of the second quarter.

The company’s RMS business line is in high demand among clients in the field of basic research and screening of non-clinical drug candidates. These service offerings provide greater flexibility for clients’ research and also support increased scientific complexity. The RMS segment continues to benefit from broad-based growth in all geographic regions for small research models.

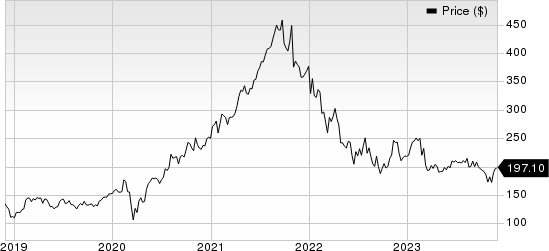

Charles River Laboratories International, Inc. Price

Charles River Laboratories International, Inc. price | Charles River Laboratories International, Inc. Quote

In 2023, the company has witnessed strong growth within the insourcing solutions business led by the CRADL initiative. These days, clients are increasingly adopting CRADL’s flexible model to access laboratory space without having to invest in internal infrastructure. To support client demand, Charles River is consistently expanding CRADL’s footprint organically and through the acquisition of Explora BioLabs (done in 2022), a provider of contract vivarium research services. According to Charles River, in the third quarter, the CRADL sites, or the flexible vivarium rental space, remained well utilized overall and continued to generate significant year-over-over revenue growth.

Over the past year, shares of Charles River have lost 13.7% compared with the industry’s 14.7% decline.

On the flip side, since the beginning of 2023, although Discovery Services revenues demonstrated steady growth, the rate of growth remained at a moderate level, which is reflective of the current market environment and the shorter-term nature of both discovery projects and business backlog. Impacted by a more cautious spending environment from biopharmaceutical clients, the DSA backlog consistently declined on a sequential basis through the quarters of 2023.

Meanwhile, the current Cambodian NHP supply constraints and the corresponding impact on its Safety Assessment business are expected to reduce consolidated revenue growth by approximately 200 basis points to 400 basis points in 2023.

Foreign exchange is a major headwind for Charles River, as a considerable percentage of its revenues comes from outside the United States. The strengthening of the euro and some other developed market currencies has constantly been hampering the company’s performance in the international markets. Going by our model, the impact of foreign currency translation is projected to reduce reported revenue growth by 0.5% in 2023.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an earnings surprise of 77.4%.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 for 2023 and from $4.07 to $4.11 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it came up with an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report