Charles River's (CRL) New Launch to Boost Gene Therapy Programs

Charles River Laboratories International, Inc. CRL recently announced the launch of its off-the-shelf Rep/Cap plasmid offering. Per the company, it has been designed to streamline adeno-associated virus (AAV)-based gene therapy programs.

Charles River is expected to officially launch the off-the-shelf Rep/Cap plasmid offering during the ongoing Advanced Therapies Week, which concludes on Jan 19.

The latest product offering is expected to significantly solidify Charles River’s foothold in the niche space.

Significance of the Launch

Charles River had previously announced the launch of its lentiviral packaging and AAV Helper plasmid products. Per management, the addition of AAV Rep/Cap (RC2, 5, 6, 8, 9) will likely supplement a comprehensive range of contract development and manufacturing organization (“CDMO”) products and services and significantly reduce manufacturing efforts (by up to 66%).

Management also believes that by using standard off-the-shelf plasmids (such as Helper and Rep/Cap plasmid required for AAV production), gene therapy developers will be able to leverage the advantages of being immediately available, thus reducing development costs, risks and timelines, subsequently simplifying supply chains.

Industry Prospects

Per a report by Coherent Market Insights, the global cell and gene therapy market was valued at $22.7 billion in 2023 and is anticipated to witness a CAGR of 28.7% between 2023 and 2030. Factors like the increasing demand for innovative treatments and the developing interest in cell and gene treatments for cancer treatments are likely to drive the market.

Given the market potential, the latest launch is expected to significantly strengthen Charles River’s CDMO business.

Notable Developments

Last month, Charles River achieved an important milestone in its strategic collaboration with Vertex Pharmaceuticals to manufacture CASGEVY (exagamglogene autotemcel [exa-cel]). The company’s Memphis facility was approved to manufacture Vertex’s CASGEVY — the first-ever gene-edited therapy in the world that targets severe sickle cell disease.

The same month, Charles River entered into an agreement with German biotech company, CELLphenomics. Through the partnership, Charles River clients will have access to CELLphenomics’ proprietary 3D tumor model platform, PD3D, expanding Charles River’s 3D in vitro testing services to further optimize oncological approaches for its clients.

In November 2023, Charles River announced a collaboration with an Australian non-profit foundation, Genetic Cures for Kids Inc. (“GC4K”). Under the partnership, the company will perform plasmid DNA production in support of GC4K’s early phase trials for Hereditary Spastic Paraplegia Type 56 (SPG56).

Price Performance

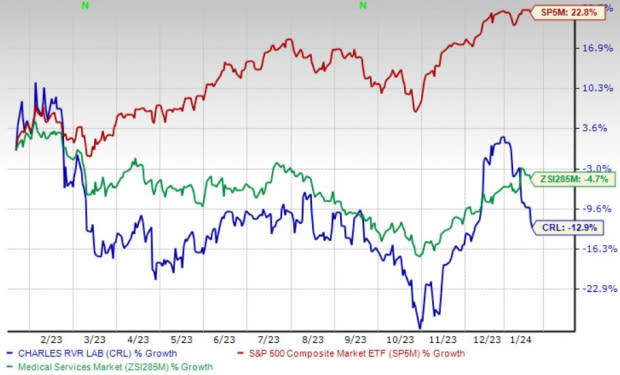

Shares of the company have lost 12.9% in the past year compared with the industry’s 4.7% decline. The S&P 500 has witnessed 22.8% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Charles River carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Merit Medical Systems, Inc. MMSI and Integer Holdings Corporation ITGR.

DaVita, presently sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 31.6% compared with the industry’s 8.4% rise in the past year.

Merit Medical, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 11.5%. MMSI’s earnings surpassed estimates in each of the trailing four quarters, with the average being 14.4%.

Merit Medical has gained 12.2% compared with the industry’s 9.9% rise in the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings’ shares have rallied 41.9% compared with the industry’s 0.5% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report